Wells Fargo 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk Management — Credit Risk Management (continued)

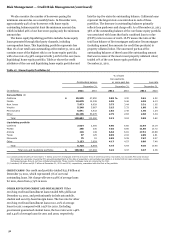

During the current credit cycle, we have experienced an

increase in loans requiring risk mitigation activities including

the restructuring of loan terms and requests for extensions of

commercial and industrial and CRE loans. All actions are based

on a re-underwriting of the loan and our assessment of the

borrower’s ability to perform under the agreed-upon terms.

Extension terms generally range from six to thirty-six months

and may require that the borrower provide additional economic

support in the form of partial repayment, or additional collateral

or guarantees. In cases where the value of collateral or financial

condition of the borrower is insufficient to repay our loan, we

may rely upon the support of an outside repayment guarantee in

providing the extension.

Our ability to seek performance under a guarantee is directly

related to the guarantor’s creditworthiness, capacity and

willingness to perform, which is evaluated on an annual basis, or

more frequently as warranted. Our evaluation is based on the

most current financial information available and is focused on

various key financial metrics, including net worth, leverage, and

current and future liquidity. We consider the guarantor’s

reputation, creditworthiness, and willingness to work with us

based on our analysis as well as other lenders’ experience with

the guarantor. Our assessment of the guarantor’s credit strength

is reflected in our loan risk ratings for such loans. The loan risk

rating and accruing status are important factors in our allowance

methodology for commercial and industrial and CRE loans.

In considering the accrual status of the loan, we evaluate the

collateral and future cash flows as well as the anticipated support

of any repayment guarantor. In many cases the strength of the

guarantor provides sufficient assurance that full repayment of

the loan is expected. When full and timely collection of the loan

becomes uncertain, including the performance of the guarantor,

we place the loan on nonaccrual status and we charge-off all or a

portion of the loan based on the fair value of the collateral

securing the loan, if any.

At the time of restructuring, we evaluate whether the loan

should be classified as a TDR, and account for it accordingly. For

more information on TDRs, see “Troubled Debt Restructurings”

later in this section and Note 6 (Loans and Allowance for Credit

Losses) to Financial Statements in this Report.

FOREIGN LOANS AND EUROPEAN EXPOSURE

Our foreign

country risk monitoring process incorporates frequent dialogue

with our foreign financial institution customers, counterparties

and regulatory agencies, enhanced by centralized monitoring of

macroeconomic and capital markets conditions. We establish

exposure limits for each country via a centralized oversight

process based on the needs of our customers, and in

consideration of relevant economic, political, social, legal, and

transfer risks. We monitor exposures closely and adjust our

limits in response to changing conditions. We conduct periodic

stress tests of our significant country risk exposures, analyzing

the potential direct and indirect impacts of various

macroeconomic and capital market scenarios.

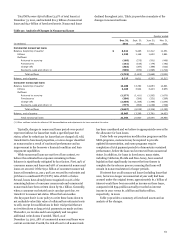

At December 31, 2011, foreign loans represented

approximately 5% of our total consolidated loans outstanding

and approximately 3% of our total assets. Our largest foreign

country exposure on an ultimate risk basis was the United

Kingdom, which amounted to approximately $11.0 billion, or

0.84%, of our consolidated assets, and included $1.7 billion of

sovereign claims. Our United Kingdom sovereign claims arise

primarily from deposits we have placed with the Bank of

England pursuant to regulatory requirements in support of our

London branch.

Several European countries have been experiencing

significant fiscal and economic deterioration in recent months.

In January 2012, Standard & Poor’s Ratings Service (S&P)

downgraded the long-term sovereign debt ratings of France,

Italy, Spain, Cyprus, Portugal, Austria, Malta, Slovakia and

Slovenia, as well as the rating of the European Financial Stability

Facility. In addition, in February 2012, Moody’s Investors

Service lowered the sovereign debt ratings of Italy, Malta,

Portugal, Slovakia, Slovenia, and Spain, and Fitch Ratings and

S&P downgraded Greece to the lowest rating above a default. At

December 31, 2011, our exposure to these downgraded countries,

including cross-border claims on an ultimate risk basis, and

foreign exchange and derivative products, aggregated

approximately $3.4 billion, including $182.3 million of sovereign

claims.

Based on our most recent stress testing activities conducted

in fourth quarter 2011, in the event of a rapid deterioration in

financial and economic conditions in Europe we believe it is

unlikely we would experience a material impact to our financial

condition, results of operations, liquidity, or capital resources as

a result of our European exposures due to the relatively small

magnitude of our exposures as well as its diversity by country,

type, and counterparty.

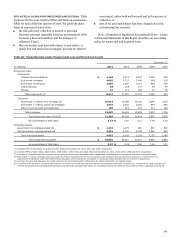

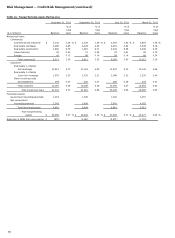

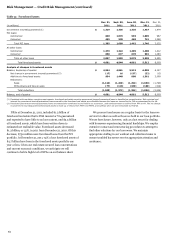

Table 22 provides information regarding our exposures to

European sovereign entities and institutions located within such

countries, including cross-border claims on an ultimate risk

basis, and foreign exchange and derivative products.

52