Wells Fargo 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

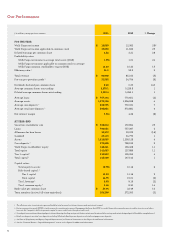

Our Performance

inmillionsexceptpershareamounts Change

FORTHEYEAR

WellsFargonetincome

WellsFargonetincomeapplicabletocommonstock

Dilutedearningspercommonshare

Profitabilityratios

WellsFargonetincometoaveragetotalassets(ROA)

WellsFargonetincomeapplicabletocommonstocktoaverage

WellsFargocommonstockholders’equity(ROE)

Eciencyratio

Totalrevenue ()

Pretaxpreprovisionprofit ()

Dividendsdeclaredpercommonshare

Averagecommonsharesoutstanding

Dilutedaveragecommonsharesoutstanding

Averageloans ()

Averageassets

Averagecoredeposits

Averageretailcoredeposits

Netinterestmargin ()

ATYEAREND

Securitiesavailableforsale

Loans

Allowanceforloanlosses ()

Goodwill

Assets

Coredeposits

WellsFargostockholders’equity

Totalequity

Tiercapital

Totalcapital

Capitalratios

Totalequitytoassets

Riskbasedcapital

Tiercapital

Totalcapital ()

Tierleverage ()

Tiercommonequity

Bookvaluepercommonshare

Teammembers(activefulltimeequivalent) ()

1 The eciency ratio is noninterest expense divided by total revenue (net interest income and noninterest income).

2 Pre-tax pre-provision profit (PTPP) is total revenue less noninterest expense. Management believes that PTPP is a useful financial measure because it enables investors and others

to assess the Company’s ability to generate capital to cover credit losses through a credit cycle.

3 Core deposits a re noninterest-bearing deposits, interest-bearing checking, savings certificates, certain market ra t e a nd other savings, an d certain foreign deposits (Eurodollar sweep balances).

4 Retail core deposits are total core deposits excluding Wholesale Banking core deposits and retail mortgage escrow deposits.

5 See Note 26 (Regulatory and Agency Capital Requirements) to Financial Statements in this Report for additional information.

6 See the “Financial Review – Capital Management” section in this Report for additional information.

• Completedmorethan728,000activetrial

• Helpedmorethan5.2millionhomeowners

• Providedmorethan$4.1billioninprincipal

1. Puttingcustomersrst

2. Growingrevenue

3. Reducingexpenses

4. LivingourVision&Values

5. Connectingwithcommunities