Wells Fargo 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

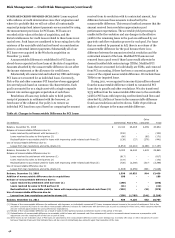

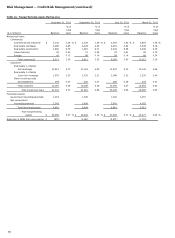

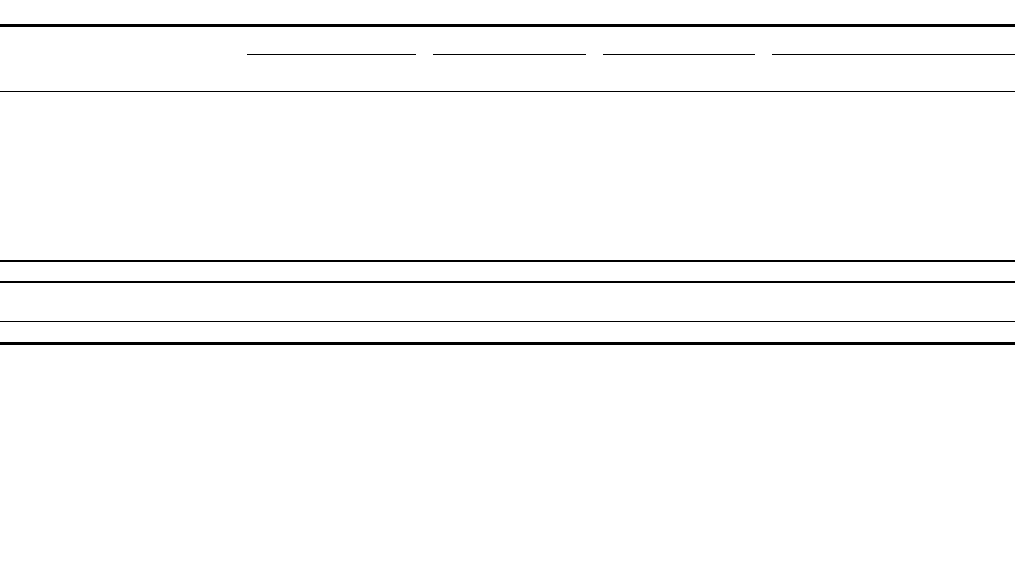

Table 22: European Exposure

Lending (1)(2)

Securities (3)

Derivatives and other (4)

Total exposure

Non-

Non-

Non-

Non-

(in millions)

Sovereign

sovereign

Sovereign

sovereign

Sovereign

sovereign

Sovereign

sovereign (5)

Total

December 31, 2011

Eurozone:

Germany

$

57

2,547

-

240

-

185

57

2,972

3,029

Netherlands

-

2,107

-

111

-

72

-

2,290

2,290

Spain

-

1,109

-

97

-

30

-

1,236

1,236

Luxembourg

-

1,010

-

123

-

2

-

1,135

1,135

France

87

517

-

302

-

165

87

984

1,071

Ireland

100

772

-

53

-

23

100

848

948

Italy

-

465

-

124

-

1

-

590

590

Austria

95

222

-

19

-

1

95

242

337

Other (6)

21

531

4

185

-

27

25

743

768

Total Eurozone exposure

360

9,280

4

1,254

-

506

364

11,040

11,404

United Kingdom

1,707

3,996

-

4,983

-

331

1,707

9,310

11,017

Other European countries

-

4,996

3

268

8

955

11

6,219

6,230

Total European exposure

$

2,067

18,272

7

6,505

8

1,792

2,082

26,569

28,651

(1)

Lending exposure includes funded loans and unfunded commitments, leveraged leases, and money market placements presented on a gross basis prior to the deduction of

impairment allowance and collateral received under the terms of the credit agreements.

(2)

Includes $1.6 billion in PCI loans, predominantly to customers in Germany and United Kingdom territories, and $3.1 billion in defeased leases secured predominantly by U.S.

Treasury and government agency securities, or government guaranteed.

(3)

Represents issuer exposure on cross-border debt and equity securities, held in trading or available-for-sale portfolio, at fair value.

(4)

Represents counterparty exposure on foreign exchange and derivative contracts, and securities resale and lending agreements. This exposure is presented net of

counterparty netting adjustments and reduced by the amount of cash collateral. It includes credit default swaps (CDS) predomi

nantly used to manage our U.S. and London

-

based cash credit trading businesses, which sometimes results in selling and pur

chasing protection on the identical reference entity. Generally, we do not use market

instruments such as CDS to hedge the credit risk of our investment or loan positions, although we do use them to manage risk

in our trading businesses. At

December

31, 2011, the gross notional amount of our CDS sold on reference assets domiciled in Europe was substantially offset by the notional of CDS purchased from

investment-grade counterparties. Additionally, at December 31, 2011, we did not have any net exposure on sovereign CDS associated with European countries.

(5)

Total non-sovereign exposure is comprised of $12.3 billion exposure to financial institutions and $14.3 billion to non-financial corporations at December 31, 2011.

(6)

Includes non-sovereign exposure to Greece and Portugal in the amount of $9.5 million and $ 49.1 million, respectively. We had no sovereign debt exposure to these

countries at December 31, 2011.

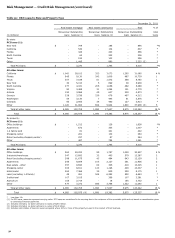

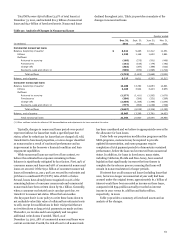

REAL ESTATE 1-4 FAMILY MORTGAGE LOANS

Our real estate 1-

4 family mortgage loans primarily include loans we have made to

customers and retained as part of our asset liability management

strategy. These loans also include the Pick-a-Pay portfolio

acquired from Wachovia and the home equity portfolio, which

are discussed later in this Report. In addition, these loans

include other purchased loans and loans included on our balance

sheet due to the adoption of consolidation accounting guidance

related to VIEs.

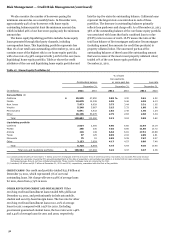

Our underwriting and periodic review of loans collateralized

by residential real property includes appraisals or estimates

from automated valuation models (AVMs) to support property

values. AVMs are computer-based tools used to estimate the

market value of homes. AVMs are a lower-cost alternative to

appraisals and support valuations of large numbers of properties

in a short period of time using market comparables and price

trends for local market areas. The primary risk associated with

the use of AVMs is that the value of an individual property may

vary significantly from the average for the market area. We have

processes to periodically validate AVMs and specific risk

management guidelines addressing the circumstances when

AVMs may be used. AVMs are generally used in underwriting to

support property values on loan originations only where the loan

amount is under $250,000. We generally require property

visitation appraisals by a qualified independent appraiser for

larger residential property loans.

Some of our real estate 1-4 family first and junior lien

mortgage loans include an interest-only feature as part of the

loan terms. These interest-only loans were approximately 21% of

total loans at December 31, 2011, and 25% at December 31, 2010.

Substantially all of these interest-only loans at origination were

considered to be prime or near prime.

We believe we have manageable adjustable-rate mortgage

(ARM) reset risk across our owned mortgage loan portfolios. We

do not offer option ARM products, nor do we offer variable-rate

mortgage products with fixed payment amounts, commonly

referred to within the financial services industry as negative

amortizing mortgage loans. Our liquidating option ARM

portfolio was acquired from Wachovia.

We continue to modify real estate 1-4 family mortgage loans

to assist homeowners and other borrowers in the current

difficult economic cycle. Loans are underwritten at the time of

the modification in accordance with underwriting guidelines

established for governmental and proprietary loan modification

programs. As a participant in the U.S. Treasury’s Making Home

Affordable (MHA) programs, we are focused on helping

customers stay in their homes. The MHA programs create a

standardization of modification terms including incentives paid

to borrowers, servicers, and investors. MHA includes the Home

Affordable Modification Program (HAMP) for first lien loans and

the Second Lien Modification Program (2MP) for junior lien

loans. Under both our proprietary programs and the MHA

programs, we may provide concessions such as interest rate

reductions, forbearance of principal, and in some cases,

principal forgiveness. These programs generally include trial

payment periods of three to four months, and after successful

completion and compliance with terms during this period, the

loan is permanently modified. During both the trial payment

period and/or permanent modification period, the loan is

accounted for as a TDR loan. See Table 32 for discussion on trial

modifications, including balances. See Note 6 (Loans and

Allowance for Credit Losses) to Financial Statements in this

Report for discussion on how we determine the allowance

attributable to our modified residential real estate portfolios.

The concentrations of real estate 1-4 family first and junior

lien mortgage loans by state are presented in Table 23. Our real

estate 1-4 family mortgage loans to borrowers in California

represented approximately 13% of total loans (3% of this amount

53