Wells Fargo 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

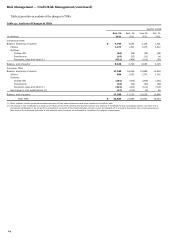

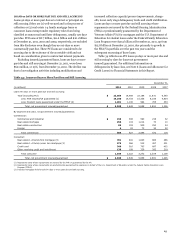

Risk Management — Credit Risk Management (continued)

alleged by attorneys general that having a mortgagee of record

that is different from the owner of the mortgage note “breaks the

chain of title” and clouds the ownership of the loan. We do not

believe that to be the case, and believe that the operative legal

principle is that the ownership of a mortgage follows the

ownership of the mortgage note, and that a securitization trust

should have good title to a mortgage loan if the note is endorsed

and delivered to it, regardless of whether MERS is the mortgagee

of record or whether an assignment of mortgage is recorded to

the trust. However, in order to foreclose on the mortgage loan, it

may be necessary for an assignment of the mortgage to be

completed by MERS to the trust, in order to comply with state

law requirements governing foreclosure. Our practice is to

obtain assignments of mortgages from MERS prior to

commencing the foreclosure process.

Consent Orders and Settlement in Principle

In April 2011, the Board of Governors of the Federal Reserve

System (FRB) and the Office of the Comptroller of the Currency

(OCC) issued Consent Orders that require us to correct

deficiencies in our residential mortgage loan servicing and

foreclosure practices that were identified by federal banking

regulators in their fourth quarter 2010 review. The Consent

Orders also require that we improve our servicing and

foreclosure practices. We have already implemented many of the

operational changes that will result from the expanded servicing

responsibilities outlined in the Consent Orders.

On February 9, 2012, the OCC and FRB announced the

imposition of civil money penalties of $83 million and

$85 million, respectively, pursuant to the Consent Orders. These

penalties will be satisfied through payments made under a

separate simultaneous federal/state settlement in principle,

announced on the same day, among the Department of Justice,

Department of Housing and Urban Development (HUD), the

Department of the Treasury, the Department of Veterans Affairs,

the Federal Trade Commission (FTC), the Executive Office of the

U.S. Trustee, the Consumer Financial Protection Bureau, a task

force of Attorneys General representing 49 states, Wells Fargo,

and four other servicers related to investigations of mortgage

industry servicing and foreclosure practices. While Oklahoma is

not participating in the larger settlement, it is settling separately

with the five servicers with a simplified agreement. Under the

settlement in principle, the terms of which do not become final

until approval of the settlement agreement by the U.S. District

Court and execution of a consent order, which will be in effect

for three and one-half years (subject to a trailing review period),

we have agreed to the following programmatic commitments,

consisting of three components totalling $5.3 billion:

Consumer Relief Program For qualified borrowers with

financial hardship and a loan owned and serviced by Wells

Fargo, a commitment to provide $3.4 billion in aggregate

consumer relief and assistance programs, including

expanded first and second mortgage modifications that

broaden the use of principal reduction to help customers

achieve affordability, an expanded short sale program that

includes waivers of deficiency balances, forgiveness of

arrearages for unemployed borrowers, cash-for-keys

payments to borrowers who voluntarily vacate properties,

and “anti-blight” provisions designed to reduce the impact on

communities of vacant properties. As of December 31, 2011,

the expected impact of the Consumer Relief Program was

covered in our allowance for credit losses and in the

nonaccretable difference relating to our purchased credit-

impaired residential mortgage portfolio.

Refinance Program For qualified borrowers with little or

negative equity in their home and a loan owned and serviced

by Wells Fargo, an expanded first-lien refinance program

commitment estimated to provide $900 million of aggregate

payment relief over the life of the refinanced loans. The

Refinance Program will not result in any current-period

charge as its impact will be recognized over a period of years

in the form of lower interest income as qualified borrowers

benefit from reduced interest rates on loans refinanced under

the program.

Foreclosure Assistance Payment $1 billion paid directly

to the federal government and the participating states for

their use to address the impact of foreclosure challenges as

they see fit and which may include direct payments to

consumers. As of December 31, 2011, we had fully accrued for

the Foreclosure Assistance Payment.

California (under a separate California Agreement) and

Florida (under a separate Florida Agreement) will receive state-

specific sub-commitments totaling $1.95 billion and $1.0 billion,

respectively, regarding the amount of Consumer Relief and

Refinance Program benefits for these two states as a part of, and

not in addition to, the overall commitment to all states for these

two programs.

The amount of credit we will receive toward fulfilling our

commitments under the Consumer Relief and Refinance

Programs will be determined based upon the nature of the

modification or other relief to the borrower, the characteristics

of the loan and the timing of the modification or relief. The

terms of the Consumer Relief and Refinance Programs as well as

other servicing matters are discussed in more detail below.

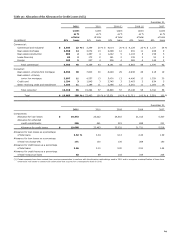

Consumer Relief Program

The Consumer Relief Program allows for selection from a menu

of various alternatives to meet the $3.4 billion overall

commitment, subject to servicer agreements, agreements with

the U.S. Treasury, investor guidelines, mortgage or bond insurer

requirements, or other applicable requirements, and is intended

to provide assistance to eligible borrowers who are experiencing

financial difficulty. Eligible borrowers include borrowers who

have a pre-modification LTV in excess of 100%. The settlement

provides for various modification and assistance programs with

varying levels of credits, minimums, and maximums that can be

used to satisfy the overall commitment amount for different

activities, primarily including:

first lien principal forgiveness for LTV less than or equal to

175%: 100% credit (must constitute at least 30% of the

Consumer Relief Program credits);

first lien principal forgiveness for LTV greater than 175%:

50% credit for portion forgiven over 175% LTV;

74