Wells Fargo 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and 2010 are included in Note 16 (Derivatives) to Financial

Statements in this Report. Open, “at risk” positions for all

trading businesses are monitored by Corporate ALCO.

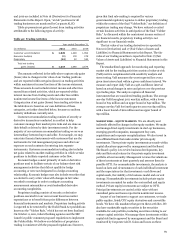

Table 40 presents net gains (losses) from trading activities

attributable to the following types of activity:

Table 40: Trading Activities

Year ended December 31,

(in millions)

2011

2010

2009

Customer accommodation

$

1,029

1,448

1,854

Economic hedging

(1)

178

278

Proprietary

(14)

22

542

Total net trading

gains (losses)

$

1,014

1,648

2,674

The amounts reflected in the table above capture only gains

(losses) due to changes in fair value of our trading positions

and are reported within net gains (losses) on trading activities

within noninterest income line item of the income statement.

These amounts do not include interest income and other fees

earned from related activities, which are reported within

interest income from trading assets and other fees within

noninterest income line items of the income statement.

Categorization of net gains (losses) from trading activities in

the table above is based on our own definition of those

categories, as further described below, because no uniform

industry definitions currently exist.

Customer accommodation trading consists of security or

derivative transactions conducted in an effort to help

customers manage their market price risks and are done on

their behalf or driven by their investment needs. For the

majority of our customer accommodation trading we serve as

intermediary between buyer and seller. For example, we may

enter into financial instruments with customers that use the

instruments for risk management purposes and offset our

exposure on such contracts by entering into separate

instruments. Customer accommodation trading also includes

net gains related to market-making activities in which we take

positions to facilitate expected customer order flow.

Economic hedges consist primarily of cash or derivative

positions used to facilitate certain of our balance sheet risk

management activities that did not qualify for hedge

accounting or were not designated in a hedge accounting

relationship. Economic hedges may also include securities that

we elected to carry at fair value with changes in fair value

recorded to earnings in order to mitigate accounting

measurement mismatches or avoid embedded derivative

accounting complexities.

Proprietary trading consists of security or derivative

positions executed for our own account based on market

expectations or to benefit from price differences between

financial instruments and markets. Proprietary trading activity

is expected to be restricted by the Dodd-Frank Act prohibitions

known as the “Volcker Rule,” which has not yet been finalized.

On October 11, 2011, federal banking agencies and the SEC

issued for public comment proposed regulations to implement

the Volcker Rule. We believe our definition of proprietary

trading is consistent with the proposed regulations. However,

given that final rule-making is required by various

governmental regulatory agencies to define proprietary trading

within the context of the final “Volcker Rule,” our definition of

proprietary trading may change. We have reduced or exited

certain business activities in anticipation of the final “Volcker

Rule.” As discussed within the noninterest income section of

our financial results, proprietary trading activity is not

significant to our financial results.

The fair value of our trading derivatives is reported in

Notes 16 (Derivatives) and 17 (Fair Values of Assets and

Liabilities) to Financial Statements in this Report. The fair

value of our trading securities is reported in Note 17 (Fair

Values of Assets and Liabilities) to Financial Statements in this

Report.

The standardized approach for monitoring and reporting

market risk for the trading activities consists of value-at-risk

(VaR) metrics complemented with sensitivity analysis and

stress testing. VaR measures the worst expected loss over a

given time interval and within a given confidence interval. We

measure and report daily VaR at a 99% confidence interval

based on actual changes in rates and prices over the previous

250 trading days. The analysis captures all financial

instruments that are considered trading positions. The average

one-day VaR throughout 2011 was $29 million, with a lower

bound of $19 million and an upper bound of $42 million. The

average one-day VaR for fourth quarter 2011 was $32 million,

with a lower bound of $22 million and an upper bound of

$42 million.

MARKET RISK – EQUITY MARKETS

We are directly and

indirectly affected by changes in the equity markets. We make

and manage direct equity investments in start-up businesses,

emerging growth companies, management buy-outs,

acquisitions and corporate recapitalizations. We also invest in

non-affiliated funds that make similar private equity

investments. These private equity investments are made within

capital allocations approved by management and the Board.

The Board’s policy is to review business developments, key

risks and historical returns for the private equity investment

portfolio at least annually. Management reviews the valuations

of these investments at least quarterly and assesses them for

possible OTTI. For nonmarketable investments, the analysis is

based on facts and circumstances of each individual investment

and the expectations for that investment’s cash flows and

capital needs, the viability of its business model and our exit

strategy. Nonmarketable investments include private equity

investments accounted for under the cost method and equity

method. Private equity investments are subject to OTTI.

Principal investments are carried at fair value with net

unrealized gains and losses reported in noninterest income.

As part of our business to support our customers, we trade

public equities, listed/OTC equity derivatives and convertible

bonds. We have risk mandates that govern these activities. We

also have marketable equity securities in the securities

available-for-sale portfolio, including securities relating to our

venture capital activities. We manage these investments within

capital risk limits approved by management and the Board and

monitored by Corporate ALCO. Gains and losses on these

81