Wells Fargo 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

We’re taking major steps to help our

customers avoid foreclosure. Since the beginning

of 2009 through the end of 2011, we have:

• Completedmorethan728,000activetrial

or completed mortgage modifications

to help homeowners who are struggling

financially keep their homes. That’s an

average of 665each and every day, or

28every hour.

• Helpedmorethan5.2millionhomeowners

with new low-rate loans, either to buy a

home or refinance their mortgage.

• Providedmorethan$4.1billioninprincipal

reduction when that was the best solution

for the customer and the company.

In 2011 alone, we hosted 33home preservation

workshops, where we met face-to-face with

thousands of our mortgage customers in cities

across the country and provided on-the-spot

relief to many of them. While we can’t help

every mortgage customer who falls behind on

payments, we’re proud of our progress and look

forward to helping even more customers.

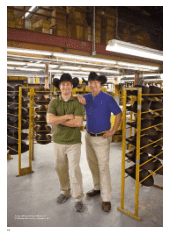

Helping small business grow

Second, no part of the economy is getting

more attention today than our nation’s small

businesses, widely viewed as the engine of

America’s job growth. As the nation’s leading

small business lender, we’ve been increasing

our small business lending, doing everything we

can to say “yes” to creditworthy borrowers. Our

new loan commitments for small businesses

grew to $13.9billion in 2011, up 8percent from

2010. We were the nation’s No.1 Small Business

Administration (SBA) lender in dollar volume

for the third consecutive year, approving a

record $1.2billion in SBA 7(a) loans.

Our five priorities

Serving customers when, where, and how they

want to be served, and helping them succeed

financially, is the foundation for everything

we do. Our success depends on staying true to

those principles and focusing on executing our

strategic priorities, including:

1. Puttingcustomersrst

2. Growingrevenue

3. Reducingexpenses

4. LivingourVision&Values

5. Connectingwithcommunities

andstakeholders

1. Putting customers first

From WellsFargo’s Vision & Values:

“We value what’s right for our customers in

everything we do.”

Our customers come first, and we focus on

helping them succeed financially. Their success

comes before ours. We never put the stagecoach

ahead of the horses.

Consider our integration of Wachovia into

WellsFargo. When most companies merge,

often the first thing they do is rush to change

signs and business cards. We did it dierently.

It took us three years to integrate Wachovia’s

operations because it was important to get

the merger right for our customers. During

those three years, we provided 490,000 hours

of training for 35,000 retail banking team

members who focused on making the transition

as easy and eortless as possible for our

customers. Our team members never lost sight

of our guiding principle: The customer is always

at the center of everything we do and every

decision we make.

This principle is more important than ever

when you consider our size and scale. In the

Community Bank alone, we touch people and

businesses at least 5billion times a year. Every

single one of those interactions is vital to each

customer. That gives us billions of chances

a year to be a customer’s hero, to put the

customer’s needs first and ensure we do things

right. We will never be perfect. No company

can be flawless billions of times a year. Smart

companies, however, learn from their mistakes.

When we make one, we want to admit it,

apologize for it, fix it fast, and try to make sure

it never happens again.

Today, seven out of every 10 of our checking

accounts are online. We’re finding new ways

to make this experience even better. This year,

we launched a new program called WellsFargo

AssistSM to help customers who are behind on

payments or face financial hardship. In the first

12months, we expect to have more than 100,000

customers visit this site, where they can connect

with product specialists who can work with

them — privately and conveniently. Rather than

having to visit dierent WellsFargo sites, the

WellsFargo Assist site is organized to reflect the

way customers think of us, as OneWellsFargo

oering many financial services and products:

mortgages, home equity lines, credit cards,

5.2 million

Since the beginning of 2009

through the end of 2011, we

helped more than 5.2million

homeowners with new low-rate

loans, either to buy a home

or refinance their mortgage.

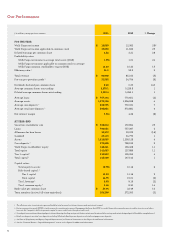

$13.9 billion

In 2011, small business new loan

commitments grew to $13.9billion

(an8percent increase from2010).

92%

92percent of our mortgage

customers remained current on

their homepayments.