Wells Fargo 2011 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

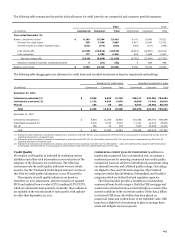

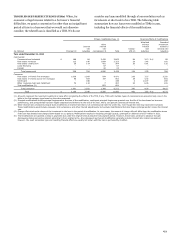

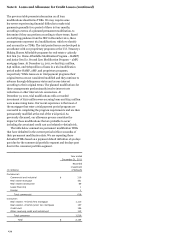

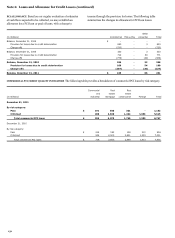

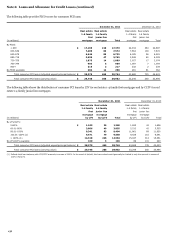

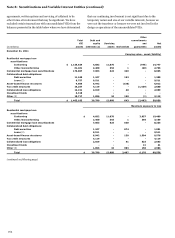

Note 6: Loans and Allowance for Credit Losses (continued)

The previous table presents information on all loan

modifications classified as TDRs. We may require some

borrowers experiencing financial difficulty to make trial

payments generally for a period of three to four months,

according to terms of a planned permanent modification, to

determine if they can perform according to those terms. Based

on clarifying guidance from the SEC in December 2011, these

arrangements represent trial modifications, which we classify

and account for as TDRs. The trial period terms are developed in

accordance with our proprietary programs or the U.S. Treasury’s

Making Homes Affordable programs for real estate 1-4 family

first lien (i.e. Home Affordable Modification Program – HAMP)

and junior lien (i.e. Second Lien Modification Program – 2MP)

mortgage loans. At December 31, 2011, we had $421 million,

$46 million, and $184 million of loans in a trial modification

period under HAMP, 2MP, and proprietary programs,

respectively. While loans are in trial payment programs their

original terms are not considered modified and they continue to

advance through delinquency status and accrue interest

according to their original terms. The planned modifications for

these arrangements predominantly involve interest rate

reductions or other interest rate concessions. At

December 31, 2011, trial modifications with a recorded

investment of $310 million were accruing loans and $341 million

were nonaccruing loans. Our recent experience is that most of

the mortgages that enter a trial payment period program are

successful in completing the program requirements and are then

permanently modified at the end of the trial period. As

previously discussed, our allowance process considers the

impact of those modifications that are probable to occur

including the associated credit cost and related re-default risk.

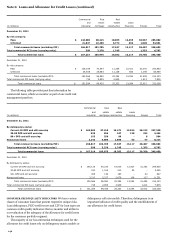

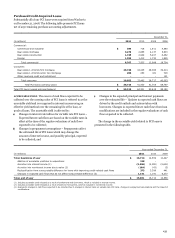

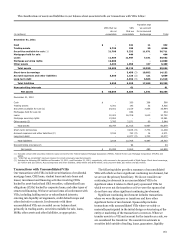

The table below summarizes permanent modification TDRs

that have defaulted in the current period within 12 months of

their permanent modification date. We are reporting these

defaulted TDRs based on a payment default definition of 90 days

past due for the commercial portfolio segment and 60 days past

due for the consumer portfolio segment.

Year ended

December 31, 2011

Recorded

investment

(in millions)

of defaults

Commercial:

Commercial and industrial

$

216

Real estate mortgage

331

Real estate construction

69

Lease financing

1

Foreign

1

Total commercial

618

Consumer:

Real estate 1-4 family first mortgage

1,110

Real estate 1-4 family junior lien mortgage

137

Credit card

156

Other revolving credit and installment

113

Total consumer

1,516

Total

$

2,134

154