Wells Fargo 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

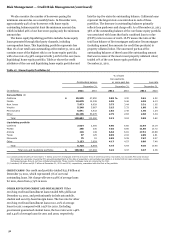

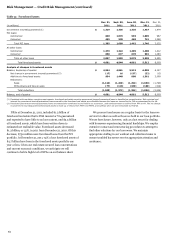

TROUBLED DEBT RESTRUCTURINGS (TDRs)

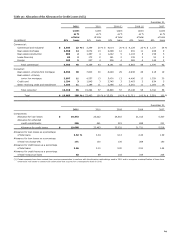

Table 32: Troubled Debt Restructurings (TDRs) (1)

Dec. 31,

Sept. 30,

June 30,

Mar. 31,

(in millions)

2011

2011

2011

2011

Commercial TDRs

Commercial and industrial

$

2,026

2,192

1,821

1,251

Real estate mortgage

2,262

1,752

1,444

1,152

Real estate construction

1,008

795

694

711

Leasing

33

51

84

25

Foreign

20

9

10

6

Total commercial TDRs

5,349

4,799

4,053

3,145

Consumer TDRs

Real estate 1-4 family first mortgage

13,799

13,512

12,938

12,261

Real estate 1-4 family junior lien mortgage

1,986

1,975

1,910

1,824

Other revolving credit and installment

872

875

838

859

Trial modifications (2)

651

668

942

944

Total consumer TDRs

17,308

17,030

16,628

15,888

Total TDRs

$

22,657

21,829

20,681

19,033

TDRs on nonaccrual status

$

6,811

6,758

6,568

6,129

TDRs on accrual status

15,846

15,071

14,113

12,904

Total TDRs

$

22,657

21,829

20,681

19,033

(1)

Amounts reported for June 30 and March 31, 2011, have been revised to reflect the retrospective adoption from the beginning of 2011 during third quarter 2011 of

ASU

2011-02, which provides guidance under what circumstances a restructured loan should be classified as a TDR. The impact of adopting ASU 2011-02 increased total

commercial TDRs by $1.5 billion and $793 million at June 30 and March 31, 2011, respectively.

(2)

Based on clarifying guidance from the Securities and Exchange Commission (SEC) received in December 2011, we classify trial modifications as TDRs at the beginning of the

trial period. For many of our consumer real estate modification programs, we may require a borrower to make trial payments ge

nerally for a period

of three to four months.

Prior to the SEC clarification, we classified trial modifications as TDRs once a borrower successfully completed the trial period in accordance with the terms.

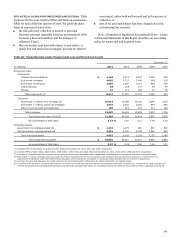

Table 32 provides information regarding the recorded

investment of loans modified in TDRs. It reflects the

retrospective adoption from the beginning of 2011 of

ASU 2011-2, which provided additional guidance for classifying

modifications as TDRs. This new guidance specifically clarifies,

among other things, the definition of a concession, including

how to evaluate modified loan terms against terms that would be

commensurate for loans with similar credit risk. For our

commercial loan modifications, we do not typically modify

principal through forgiveness or forbearance or reduce the

contractual interest rate. In fact, in many cases, we obtain higher

rates of interest, additional collateral or guarantor support, or

other improvements to the terms. Certain commercial loan

modifications are now classified as TDRs under the clarified

guidance. The allowance for loan losses for TDRs was

$5.2 billion and $3.9 billion at December 31, 2011 and 2010,

respectively. See Note 6 (Loans and Allowance for Credit Losses)

to Financial Statements in this Report for more information.

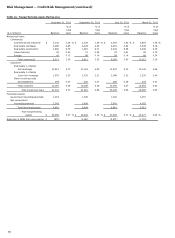

We do not forgive principal for a majority of our TDRs, but in

those situations where principal is forgiven, the entire amount of

such principal forgiveness is immediately charged off to the

extent not done so prior to the modification. We sometimes

delay the timing on the repayment of a portion of principal

(principal forbearance) and charge off the amount of

forbearance if that amount is not considered fully collectible.

Our nonaccrual policies are generally the same for all loan

types when a restructuring is involved. We underwrite loans at

the time of restructuring to determine whether there is sufficient

evidence of sustained repayment capacity based on the

borrower’s documented income, debt to income ratios, and other

factors. Loans lacking sufficient evidence of sustained repayment

capacity at the time of modification are charged down to the fair

value of the collateral, if applicable. For an accruing loan that

has been modified, if the borrower has demonstrated

performance under the previous terms and the underwriting

process shows the capacity to continue to perform under the

restructured terms, the loan will remain in accruing status.

Otherwise, the loan will be placed in nonaccrual status until the

borrower demonstrates a sustained period of performance,

generally six consecutive months of payments, or equivalent,

inclusive of consecutive payments made prior to modification.

Loans will also be placed on nonaccrual, and a corresponding

charge-off is recorded to the loan balance, if we believe that

principal and interest contractually due under the modified

agreement will not be collectible.

63