Wells Fargo 2011 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

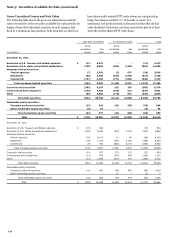

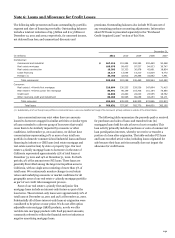

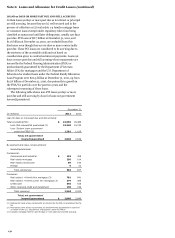

Note 6: Loans and Allowance for Credit Losses (continued)

2011

2010

(in millions)

Commercial

Consumer

Total

Commercial

Consumer

Total

Year ended December 31,

Purchases (1)

$

7,078

284

7,362

2,135

162

2,297

Sales

(4,705)

(1,018)

(5,723)

(5,930)

(553)

(6,483)

Transfers from/(to) MHFS/LHFS (1)

(164)

(75)

(239)

(1,461)

(82)

(1,543)

(1) The “Purchases” and “Transfers (from)/to MHFS/LHFS" categories exclude activity in government insured/guaranteed loans where Wells Fargo acts as servicer. On a net

basis, this activity was $10.4 billion and $7.0 billion for the year ended December 31, 2011 and 2010, respectively.

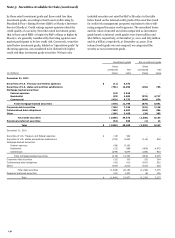

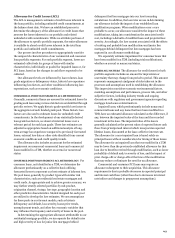

Commitments to Lend

A commitment to extend credit is a legally binding agreement to

lend funds to a customer, usually at a stated interest rate and for

a specified purpose. These commitments have fixed expiration

dates and generally require a fee. When we make such a

commitment, we have credit risk. The liquidity requirements or

credit risk will be lower than the contractual amount of

commitments to extend credit because a significant portion of

these commitments are expected to expire without being used.

Certain commitments are subject to loan agreements with

covenants regarding the financial performance of the customer

or borrowing base formulas that must be met before we are

required to fund the commitment. Also, in some cases we

participate a portion of our commitment to others in an

arrangement that reduces our contractual commitment amount.

We use the same credit policies in extending credit for unfunded

commitments and letters of credit that we use in making loans.

See Note 14 for information on standby letters of credit.

In addition, we manage the potential risk in credit

commitments by limiting the total amount of arrangements,

both by individual customer and in total, by monitoring the size

and maturity structure of these portfolios and by applying the

same credit standards for all of our credit activities.

For certain extensions of credit, we may require collateral,

based on our assessment of a customer’s credit risk. We hold

various types of collateral, including accounts receivable,

inventory, land, buildings, equipment, autos, financial

instruments, income-producing commercial properties and

residential real estate. Collateral requirements for each customer

may vary according to the specific credit underwriting, terms

and structure of loans funded immediately or under a

commitment to fund at a later date.

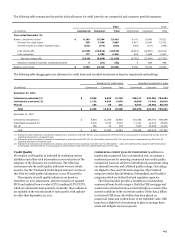

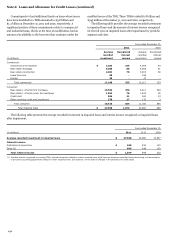

The contractual amount of our unfunded credit

commitments, net of participations and net of all standby and

commercial letters of credit issued under the terms of these

commitments, is summarized by portfolio segment and class of

financing receivable in the following table:

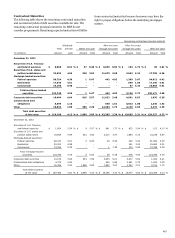

December 31,

(in millions)

2011

2010

Commercial:

Commercial and industrial

$

201,061

185,947

Real estate mortgage

5,419

4,596

Real estate construction

7,347

5,698

Foreign

6,083

7,775

Total commercial

219,910

204,016

Consumer:

Real estate 1-4 family first mortgage

37,185

36,562

Real estate 1-4 family

junior lien mortgage

55,207

58,618

Credit card

65,111

62,019

Other revolving credit and installment

17,617

18,458

Total consumer

175,120

175,657

Total unfunded

credit commitments

$

395,030

379,673

142