Wells Fargo 2011 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

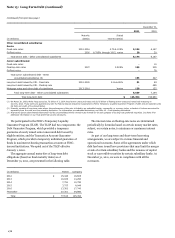

Note 16: Derivatives (continued)

of the cash flows or the value of the note in a manner similar to a

derivative instrument and therefore are considered to contain an

“embedded” derivative instrument. The indices on which the

performance of the hybrid instrument is calculated are not

clearly and closely related to the host debt instrument. The

“embedded” derivative is separated from the host contract and

accounted for as a free-standing derivative. Additionally, we may

invest in hybrid instruments that contain embedded derivatives,

such as credit derivatives, that are not clearly and closely related

to the host contract. In such instances, we either elect fair value

option for the hybrid instrument or separate the embedded

derivative from the host contract and account for the host

contract and derivative separately.

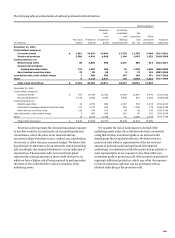

The following table shows the net gains recognized in the

income statement related to derivatives not designated as

hedging instruments.

Year ended

December 31,

(in millions)

2011

2010

Net gains (losses) recognized on free-standing derivatives (economic hedges):

Interest rate contracts

Recognized in noninterest income:

Mortgage banking (1)

$

246

1,611

Other (2)

(157)

(22)

Foreign exchange contracts (2)

70

103

Equity contracts (2)

(5)

-

Credit contracts (2)

(18)

(174)

Subtotal

136

1,518

Net gains (losses) recognized on customer accommodation, trading and other free-standing derivatives:

Interest rate contracts

Recognized in noninterest income:

Mortgage banking (3)

3,594

3,305

Other (4)

298

224

Commodity contracts (4)

124

65

Equity contracts (4)

769

441

Foreign exchange contracts (4)

698

565

Credit contracts (4)

(200)

(710)

Other (4)

(5)

10

Subtotal

5,278

3,900

Net gains recognized related to derivatives not designated as hedging instruments

$

5,414

5,418

(1) Predominantly mortgage banking noninterest income including gains (losses) on the derivatives used as economic hedges of MSRs measured at fair value, interest rate lock

commitments and mortgages held for sale.

(2) Predominantly included in other noninterest income.

(3) Predominantly mortgage banking noninterest income including gains (losses) on interest rate lock commitments.

(4) Predominantly included in net gains from trading activities in noninterest income.

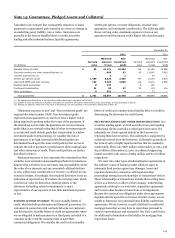

Credit Derivatives

We use credit derivatives primarily to assist customers with their

risk management objectives. We may also use credit derivatives

in structured product transactions or liquidity agreements

written to special purpose vehicles. The maximum exposure of

sold credit derivatives is managed through posted collateral,

purchased credit derivatives and similar products in order to

achieve our desired credit risk profile. This credit risk

management provides an ability to recover a significant portion

of any amounts that would be paid under the sold credit

derivatives. We would be required to perform under the noted

credit derivatives in the event of default by the referenced

obligors. Events of default include events such as bankruptcy,

capital restructuring or lack of principal and/or interest

payment. In certain cases, other triggers may exist, such as the

credit downgrade of the referenced obligors or the inability of

the special purpose vehicle for which we have provided liquidity

to obtain funding.

188