Wells Fargo 2011 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

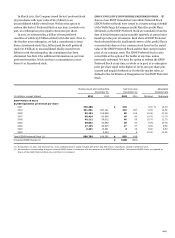

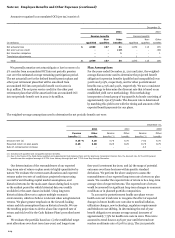

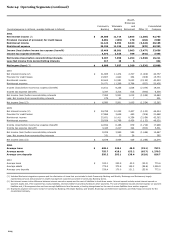

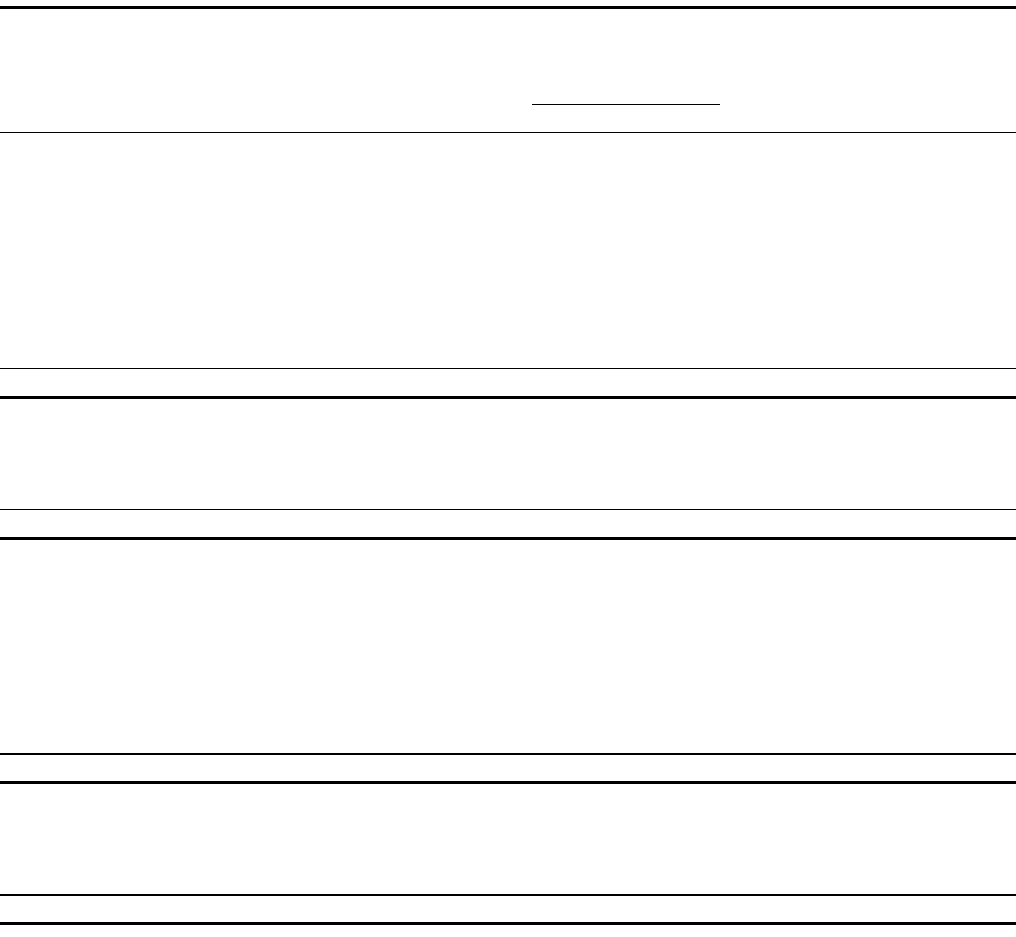

The changes in Level 3 pension plan and other benefit plan assets measured at fair value are summarized as follows:

Purchases,

sales,

Balance

issuances

Transfers

Balance

beginning

Gains (losses)

and

into

end of

(in millions)

of year

Realized

Unrealized (1)

settlements (net)

Level 3

year

Year ended December 31, 2011

Pension plan assets

Long duration fixed income

$

-

-

-

1

-

1

Intermediate (core) fixed income

10

-

1

(5)

-

6

High-yield fixed income

1

-

-

-

-

1

Domestic large-cap stocks

4

-

(1)

(1)

-

2

International stocks

6

-

(1)

(4)

-

1

Real estate/timber

360

10

22

(37)

-

355

Multi-strategy hedge funds

313

5

(3)

(64)

-

251

Private equity

112

1

16

-

-

129

Other

41

4

-

1

-

46

$

847

20

34

(109)

-

792

Other benefits plan assets

Real estate/timber

$

12

-

-

-

-

12

Multi-strategy hedge funds

10

-

-

(2)

-

8

Private equity

4

-

-

-

-

4

Other

22

-

-

1

-

23

$

48

-

-

(1)

-

47

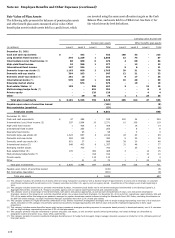

Year ended December 31, 2010

Pension plan assets

Intermediate (core) fixed income

$

9

-

2

(3)

2

10

High-yield fixed income

-

-

-

1

-

1

Domestic large-cap stocks

5

-

1

(2)

-

4

International stocks

1

-

2

3

-

6

Real estate/timber

353

(6)

8

5

-

360

Multi-strategy hedge funds

339

6

12

(44)

-

313

Private equity

83

1

10

18

-

112

Other

46

9

(1)

(13)

-

41

$

836

10

34

(35)

2

847

Other benefits plan assets

Real estate/timber

$

4

(7)

10

5

-

12

Multi-strategy hedge funds

5

(1)

(3)

9

-

10

Private equity

2

-

1

1

-

4

Other

21

(1)

-

2

-

22

$

32

(9)

8

17

-

48

(1) All unrealized gains (losses) relate to instruments held at period end.

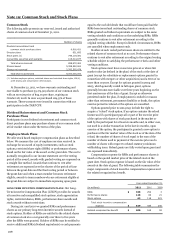

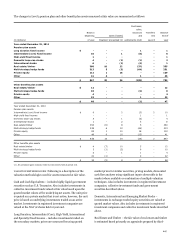

VALUATION METHODOLOGIES

Following is a description of the

valuation methodologies used for assets measured at fair value.

Cash and Cash Equivalents – includes highly liquid government

securities such as U.S. Treasuries. Also includes investments in

collective investment funds valued at fair value based upon the

quoted market values of the underlying net assets. The unit price

is quoted on a private market that is not active; however, the unit

price is based on underlying investments traded on an active

market. Investments in registered investment companies are

valued at the NAV of shares held at year end.

Long Duration, Intermediate (Core), High-Yield, International

and Specialty Fixed Income – includes investments traded on

the secondary markets; prices are measured by using quoted

market prices for similar securities, pricing models, discounted

cash flow analyses using significant inputs observable in the

market where available or combination of multiple valuation

techniques. Also includes investments in registered investment

companies, collective investment funds and government

securities described above.

Domestic, International and Emerging Market Stocks –

investments in exchange-traded equity securities are valued at

quoted market values. Also includes investments in registered

investment companies and collective investment funds described

above.

Real Estate and Timber – the fair value of real estate and timber

is estimated based primarily on appraisals prepared by third-

217