Wells Fargo 2011 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

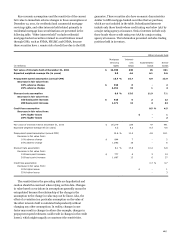

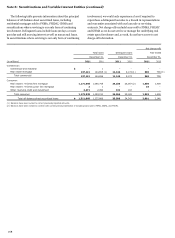

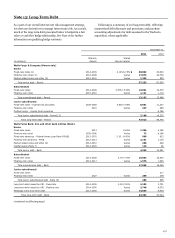

Key economic assumptions and the sensitivity of the current

fair value to immediate adverse changes in those assumptions at

December 31, 2011, for residential and commercial mortgage

servicing rights, and other interests held related primarily to

residential mortgage loan securitizations are presented in the

following table. “Other interests held” exclude residential

mortgage-backed securities retained in securitizations issued

through GSEs, such as FNMA, FHLMC and GNMA, because

these securities have a remote risk of credit loss due to the GSE

guarantee. These securities also have economic characteristics

similar to GSE mortgage-backed securities that we purchase,

which are not included in the table. Subordinated interests

include only those bonds whose credit rating was below AAA by

a major rating agency at issuance. Senior interests include only

those bonds whose credit rating was AAA by a major rating

agency at issuance. The information presented excludes trading

positions held in inventory.

Other interests held

Mortgage

Interest-

servicing

only

Subordinated

Senior

(in millions)

rights

strips

bonds

bonds

Fair value of interests held at December 31, 2011

$

14,359

230

45

321

Expected weighted-average life (in years)

5.0

4.6

6.1

5.6

Prepayment speed assumption (annual CPR)

13.7

%

10.7

6.9

13.9

Decrease in fair value from:

10% adverse change

$

913

6

-

2

25% adverse change

2,151

15

1

4

Discount rate assumption

6.9

%

15.6

11.9

7.1

Decrease in fair value from:

100 basis point increase

$

613

6

2

12

200 basis point increase

1,171

12

4

24

Credit loss assumption

0.5

%

4.5

Decrease in fair value from:

10% higher losses

$

-

1

25% higher losses

-

2

Fair value of interests held at December 31, 2010

$

16,279

226

47

441

Expected weighted-average life (in years)

5.2

5.2

8.3

4.5

Prepayment speed assumption (annual CPR)

12.6

%

11.4

4.8

18.1

Decrease in fair value from:

10% adverse change

$

844

7

-

2

25% adverse change

1,992

16

-

6

Discount rate assumption

8.1

%

17.8

10.2

6.8

Decrease in fair value from:

100 basis point increase

$

777

6

3

14

200 basis point increase

1,487

13

6

27

Credit loss assumption

0.7

%

3.7

Decrease in fair value from:

10% higher losses

$

-

1

25% higher losses

-

3

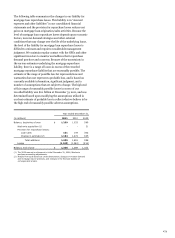

The sensitivities in the preceding table are hypothetical and

caution should be exercised when relying on this data. Changes

in value based on variations in assumptions generally cannot be

extrapolated because the relationship of the change in the

assumption to the change in value may not be linear. Also, the

effect of a variation in a particular assumption on the value of

the other interests held is calculated independently without

changing any other assumptions. In reality, changes in one

factor may result in changes in others (for example, changes in

prepayment speed estimates could result in changes in the credit

losses), which might magnify or counteract the sensitivities.

167