Wells Fargo 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

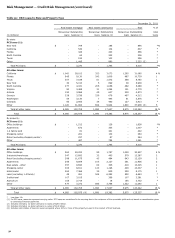

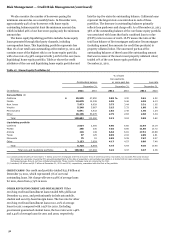

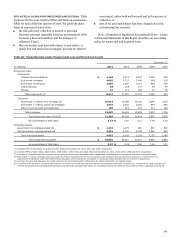

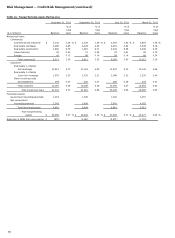

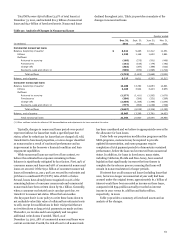

NONACCRUAL LOANS AND FORECLOSED ASSETS (NPAs)

Table

28 shows the five-year trend for NPAs and Table 29 summarizes

NPAs for each of the four quarters of 2011. We generally place

loans on nonaccrual status when:

the full and timely collection of interest or principal

becomes uncertain (generally based on an assessment of the

borrower’s financial condition and the adequacy of

collateral, if any);

they are 90 days (120 days with respect to real estate 1-4

family first and junior lien mortgages) past due for interest

or principal, unless both well-secured and in the process of

collection; or

part of the principal balance has been charged off and no

restructuring has occurred.

Note 1 (Summary of Significant Accounting Policies – Loans)

to Financial Statements in this Report describes our accounting

policy for nonaccrual and impaired loans.

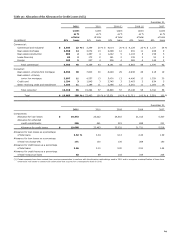

Table 28: Nonperforming Assets (Nonaccrual Loans and Foreclosed Assets)

December 31,

(in millions)

2011

2010

2009

2008

2007

Nonaccrual loans:

Commercial:

Commercial and industrial

$

2,142

3,213

4,397

1,253

432

Real estate mortgage

4,085

5,227

3,696

594

128

Real estate construction

1,890

2,676

3,313

989

293

Lease financing

53

108

171

92

45

Foreign

47

127

146

57

45

Total commercial (1)

8,217

11,351

11,723

2,985

943

Consumer:

Real estate 1-4 family first mortgage (2)

10,913

12,289

10,100

2,648

1,272

Real estate 1-4 family junior lien mortgage

1,975

2,302

2,263

894

280

Other revolving credit and installment

199

300

332

273

184

Total consumer

13,087

14,891

12,695

3,815

1,736

Total nonaccrual loans (3)(4)(5)

21,304

26,242

24,418

6,800

2,679

As a percentage of total loans

2.77

%

3.47

3.12

0.79

0.70

Foreclosed assets:

Government insured/guaranteed (6)

$

1,319

1,479

960

667

535

Non-government insured/guaranteed

3,342

4,530

2,199

1,526

649

Total foreclosed assets

4,661

6,009

3,159

2,193

1,184

Total nonperforming assets

$

25,965

32,251

27,577

8,993

3,863

As a percentage of total loans

3.37

%

4.26

3.52

1.04

1.01

(1)

Includes LHFS of $25 million, $3 million and $27 million at December 31, 2011, 2010 and 2009, respectively.

(2)

Includes MHFS of $301 million, $426 million, $339 million, $193 million and $222 million at December 31, 2011, 2010, 2009, 2008 and 2007, respectively.

(3)

Excludes PCI loans because they continue to earn interest income from accretable yield, independent of performance in accordance with their contractual terms.

(4)

Real estate 1-4 family mortgage loans insured by the FHA or guaranteed by the VA and student loans predominantly guaranteed by agencies on behalf of the U.S.

Department of Education under the Federal Family Education Loan Program are not placed on nonaccrual status because they are insured or guaranteed.

(5)

See Note 6 (Loans and Allowance for Credit Losses) to Financial Statements in this Report for further information on impaired loans.

(6)

Consistent with regulatory reporting requirements, foreclosed real estate securing government insured/guaranteed loans is classified as nonperforming. Both principal and

interest for government insured/guaranteed loans secured by the foreclosed real estate are collectible because the loans are insured by the FHA or guaranteed by the VA.

59