Wells Fargo 2011 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

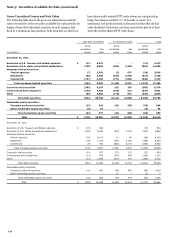

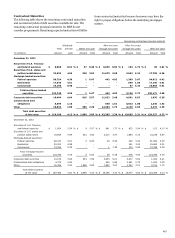

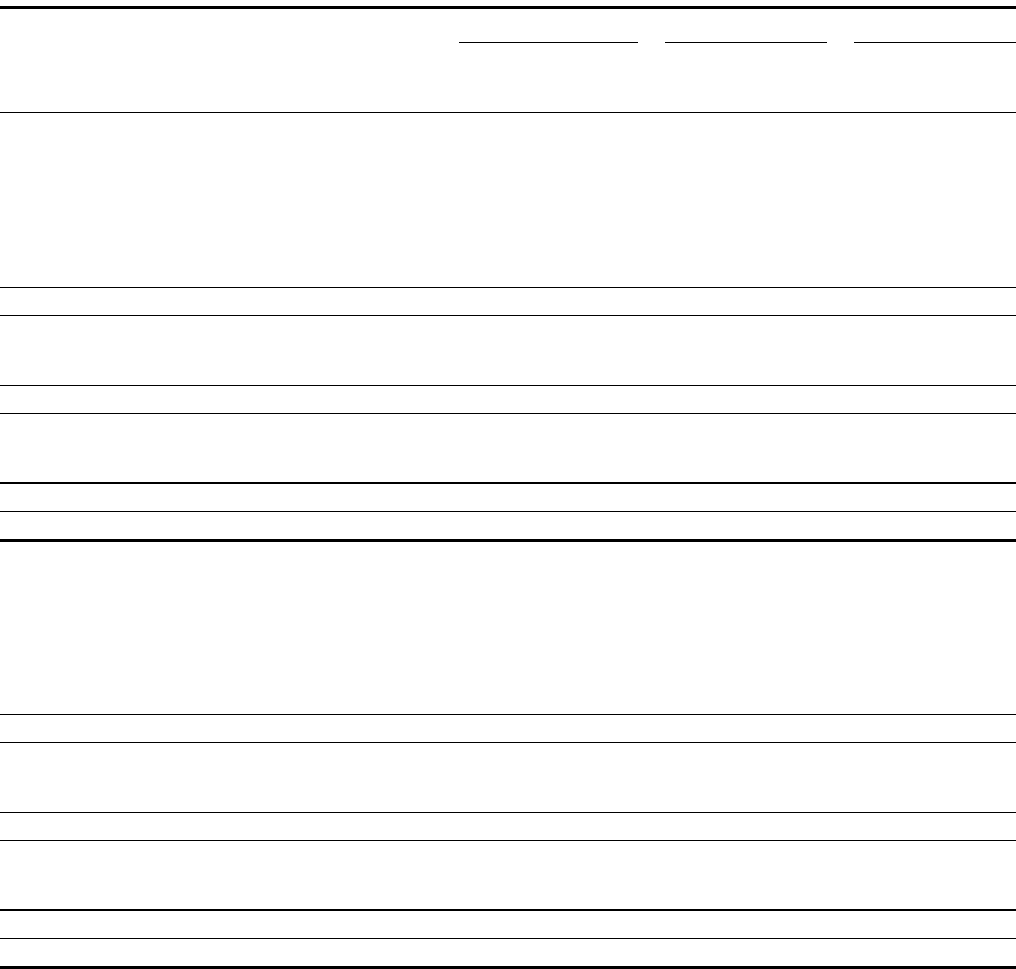

Note 5: Securities Available for Sale (continued)

Gross Unrealized Losses and Fair Value

The following table shows the gross unrealized losses and fair

value of securities in the securities available-for-sale portfolio by

length of time that individual securities in each category had

been in a continuous loss position. Debt securities on which we

have taken credit-related OTTI write-downs are categorized as

being “less than 12 months” or “12 months or more” in a

continuous loss position based on the point in time that the fair

value declined to below the cost basis and not the period of time

since the credit-related OTTI write-down.

Less than 12 months

12 months or more

Total

Gross

Gross

Gross

unrealized

Fair

unrealized

Fair

unrealized

Fair

(in millions)

losses

value

losses

value

losses

value

December 31, 2011

Securities of U.S. Treasury and federal agencies

$

(11)

5,473

-

-

(11)

5,473

Securities of U.S. states and political subdivisions

(229)

8,501

(654)

4,348

(883)

12,849

Mortgage-backed securities:

Federal agencies

(7)

2,392

(3)

627

(10)

3,019

Residential

(80)

3,780

(334)

3,440

(414)

7,220

Commercial

(157)

3,183

(771)

3,964

(928)

7,147

Total mortgage-backed securities

(244)

9,355

(1,108)

8,031

(1,352)

17,386

Corporate debt securities

(205)

8,107

(81)

167

(286)

8,274

Collateralized debt obligations

(150)

4,268

(199)

613

(349)

4,881

Other

(55)

3,002

(170)

841

(225)

3,843

Total debt securities

(894)

38,706

(2,212)

14,000

(3,106)

52,706

Marketable equity securities:

Perpetual preferred securities

(13)

316

(41)

530

(54)

846

Other marketable equity securities

(9)

61

-

-

(9)

61

Total marketable equity securities

(22)

377

(41)

530

(63)

907

Total

$

(916)

39,083

(2,253)

14,530

(3,169)

53,613

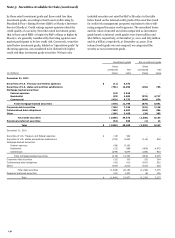

December 31, 2010

Securities of U.S. Treasury and federal agencies

$

(15)

544

-

-

(15)

544

Securities of U.S. states and political subdivisions

(322)

6,242

(515)

2,720

(837)

8,962

Mortgage-backed securities:

Federal agencies

(95)

8,103

(1)

60

(96)

8,163

Residential

(35)

1,023

(454)

4,440

(489)

5,463

Commercial

(9)

441

(626)

5,141

(635)

5,582

Total mortgage-backed securities

(139)

9,567

(1,081)

9,641

(1,220)

19,208

Corporate debt securities

(10)

477

(27)

157

(37)

634

Collateralized debt obligations

(13)

679

(216)

456

(229)

1,135

Other

(13)

1,985

(270)

757

(283)

2,742

Total debt securities

(512)

19,494

(2,109)

13,731

(2,621)

33,225

Marketable equity securities:

Perpetual preferred securities

(41)

962

(48)

467

(89)

1,429

Other marketable equity securities

-

-

(1)

7

(1)

7

Total marketable equity securities

(41)

962

(49)

474

(90)

1,436

Total

$

(553)

20,456

(2,158)

14,205

(2,711)

34,661

134