Wells Fargo 2011 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

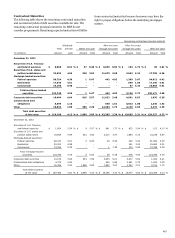

Note 5: Securities Available for Sale (continued)

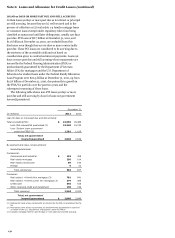

For asset-backed securities (e.g., residential MBS), we estimate

expected future cash flows of the security by estimating the

expected future cash flows of the underlying collateral and

applying those collateral cash flows, together with any credit

enhancements such as subordinated interests owned by third

parties, to the security. The expected future cash flows of the

underlying collateral are determined using the remaining

contractual cash flows adjusted for future expected credit losses

(which consider current delinquencies and nonperforming assets

(NPAs), future expected default rates and collateral value by

vintage and geographic region) and prepayments. The expected

cash flows of the security are then discounted at the security’s

current effective interest rate to arrive at a present value

amount. Total credit impairment losses on residential MBS that

we do not intend to sell are shown in the table below. The table

also presents a summary of the significant inputs considered in

determining the measurement of the credit loss component

recognized in earnings for residential MBS.

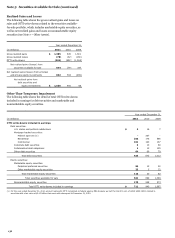

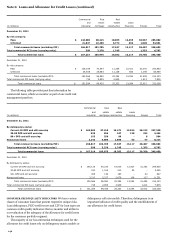

Year ended December 31,

($ in millions)

2011

2010

2009

Credit impairment losses on residential MBS

Investment grade

$

5

5

24

Non-investment grade

247

170

567

Total credit impairment losses on residential MBS

$

252

175

591

Significant inputs (non-agency – non-investment grade MBS)

Expected remaining life of loan losses (1):

Range (2)

0-48

%

1-43

0-58

Credit impairment distribution (3):

0 - 10% range

42

52

56

10 - 20% range

18

29

27

20 - 30% range

28

17

12

Greater than 30%

12

2

5

Weighted average (4)

12

9

11

Current subordination levels (5):

Range (2)

0-25

0-25

0-44

Weighted average (4)

4

7

8

Prepayment speed (annual CPR (6)):

Range (2)

3-19

2-27

5-25

Weighted average (4)

11

14

11

(1) Represents future expected credit losses on underlying pool of loans expressed as a percentage of total current outstanding loan balance.

(2) Represents the range of inputs/assumptions based upon the individual securities within each category.

(3) Represents distribution of credit impairment losses recognized in earnings categorized based on range of expected remaining life of loan losses. For example 42% of credit

impairment losses recognized in earnings for the year ended December 31, 2011, had expected remaining life of loan loss assumptions of 0 to 10%.

(4) Calculated by weighting the relevant input/assumption for each individual security by current outstanding amortized cost basis of the security.

(5) Represents current level of credit protection (subordination) for the securities, expressed as a percentage of total current underlying loan balance.

(6) Constant prepayment rate.

140