Wells Fargo 2011 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

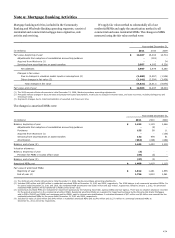

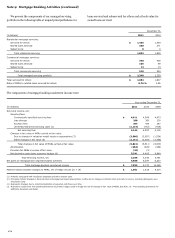

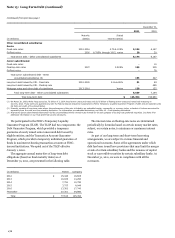

Note 9: Mortgage Banking Activities (continued)

We present the components of our managed servicing

portfolio in the following table at unpaid principal balance for

loans serviced and subserviced for others and at book value for

owned loans serviced.

December 31,

(in billions)

2011

2010

Residential mortgage servicing:

Serviced for others

$

1,456

1,429

Owned loans serviced

358

371

Subservicing

8

9

Total residential servicing

1,822

1,809

Commercial mortgage servicing:

Serviced for others

398

408

Owned loans serviced

106

99

Subservicing

14

13

Total commercial servicing

518

520

Total managed servicing portfolio

$

2,340

2,329

Total serviced for others

$

1,854

1,837

Ratio of MSRs to related loans serviced for others

0.76

%

0.86

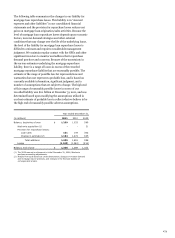

The components of mortgage banking noninterest income were:

Year ended December 31,

(in millions)

2011

2010

2009

Servicing income, net:

Servicing fees:

Contractually specified servicing fees

$

4,611

4,566

4,473

Late charges

298

360

330

Ancillary fees

354

434

287

Unreimbursed direct servicing costs (1)

(1,119)

(763)

(914)

Net servicing fees

4,144

4,597

4,176

Changes in fair value of MSRs carried at fair value:

Due to changes in valuation model inputs or assumptions (2)

(3,680)

(2,957)

(1,534)

Other changes in fair value (3)

(2,141)

(2,554)

(3,436)

Total changes in fair value of MSRs carried at fair value

(5,821)

(5,511)

(4,970)

Amortization

(264)

(228)

(264)

Provision for MSRs in excess of fair value

(34)

(3)

-

Net derivative gains from economic hedges (4)

5,241

4,485

6,849

Total servicing income, net

3,266

3,340

5,791

Net gains on mortgage loan origination/sales activities

4,566

6,397

6,237

Total mortgage banking noninterest income

$

7,832

9,737

12,028

Market-related valuation changes to MSRs, net of hedge results (2) + (4)

$

1,561

1,528

5,315

(1) Primarily associated with foreclosure expenses and other interest costs.

(2) Principally reflects changes in discount rates and prepayment speed assumptions, mostly due to changes in interest rates and costs to service, including delinquency and

foreclosure costs.

(3) Represents changes due to collection/realization of expected cash flows over time.

(4) Represents results from free-standing derivatives (economic hedges) used to hedge the risk of changes in fair value of MSRs. See Note 16 – Free-Standing Derivatives for

additional discussion and detail.

172