Wells Fargo 2011 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

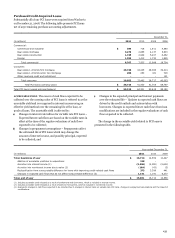

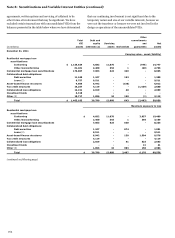

Note 7: Premises, Equipment, Lease Commitments and Other Assets

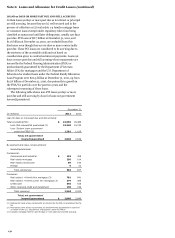

December 31,

(in millions)

2011

2010

Land

$

1,825

1,825

Buildings

7,441

7,440

Furniture and equipment

7,195

6,689

Leasehold improvements

1,725

1,683

Premises and equipment leased

under capital leases

147

148

Total premises and equipment

18,333

17,785

Less: Accumulated depreciation

and amortization

8,802

8,141

Net book value,

premises and equipment

$

9,531

9,644

Depreciation and amortization expense for premises and

equipment was $1.4 billion, $1.5 billion and $1.3 billion in 2011,

2010 and 2009, respectively.

Dispositions of premises and equipment, included in

noninterest expense, resulted in net losses of $17 million,

$115 million and $22 million in 2011, 2010 and 2009,

respectively.

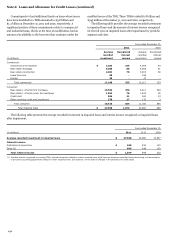

We have obligations under a number of noncancelable

operating leases for premises and equipment. The terms of these

leases are predominantly up to 15 years, with the longest up to

94 years, and many provide for periodic adjustment of rentals

based on changes in various economic indicators. Some leases

also include a renewal option. The following table provides the

future minimum payments under capital leases and

noncancelable operating leases, net of sublease rentals, with

terms greater than one year as of December 31, 2011.

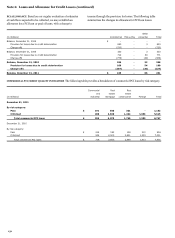

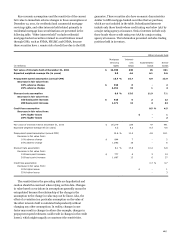

Operating

Capital

(in millions)

leases

leases

Year ended December 31,

2012

$

1,319

54

2013

1,216

55

2014

1,075

3

2015

872

3

2016

717

3

Thereafter

3,239

17

Total minimum lease payments

$

8,438

135

Executory costs

$

(9)

Amounts representing interest

(10)

Present value of net minimum

lease payments

$

116

Operating lease rental expense (predominantly for premises),

net of rental income, was $1.2 billion, $1.3 billion and

$1.4 billion in 2011, 2010 and 2009, respectively.

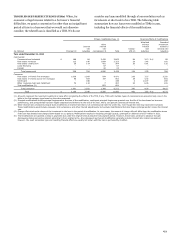

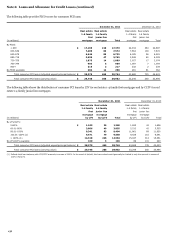

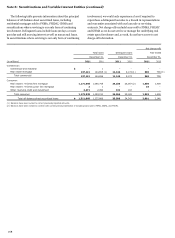

The components of other assets were:

December 31,

(in millions)

2011

2010

Nonmarketable equity investments:

Cost method:

Private equity investments

$

3,444

3,240

Federal bank stock

4,617

5,254

Total cost method

8,061

8,494

LIHTC investments - equity method (1)

4,077

3,611

All other equity method

4,434

4,013

Principal investments (2)

236

305

Total nonmarketable

equity investments

16,808

16,423

Corporate/bank-owned life insurance

20,146

19,845

Accounts receivable

25,939

23,763

Interest receivable

5,296

4,895

Core deposit intangibles

7,311

8,904

Customer relationship and

other amortized intangibles

1,639

1,847

Foreclosed assets:

GNMA (3)

1,319

1,479

Other

3,342

4,530

Operating lease assets

1,825

1,873

Due from customers on acceptances

225

229

Other

17,172

15,993

Total other assets

$

101,022

99,781

(1)

Represents low income housing tax credit investments.

(2) Principal investments are recorded at fair value with realized and unrealized

gains (losses) included in net gains (losses) from equity investments in the

income statement.

(3) These are foreclosed real estate securing FHA insured and VA guaranteed loans.

Both principal and interest for these loans secured by the foreclosed real estate

are collectible because they are insured/guaranteed.

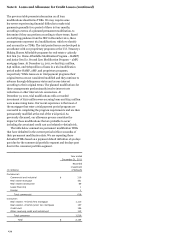

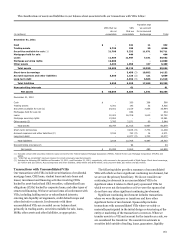

Income related to nonmarketable equity investments was:

Year ended December 31,

(in millions)

2011

2010

2009

Net gains (losses) from:

Private equity investments

$

813

492

(368)

Principal investments

29

42

79

All other nonmarketable

equity investments

(298)

(188)

(234)

Total

$

544

346

(523)

159