Wells Fargo 2011 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

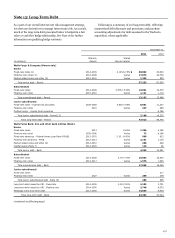

Note 9: Mortgage Banking Activities

Mortgage banking activities, included in the Community

Banking and Wholesale Banking operating segments, consist of

residential and commercial mortgage loan origination, sale

activity and servicing.

We apply fair value method to substantially all of our

residential MSRs and apply the amortization method to all

commercial and some residential MSRs. The changes in MSRs

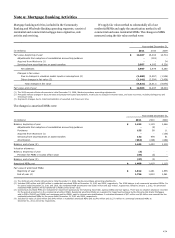

measured using the fair value method were:

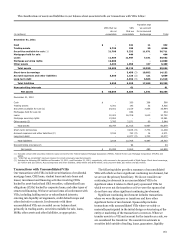

Year ended December 31,

(in millions)

2011

2010

2009

Fair value, beginning of year

$

14,467

16,004

14,714

Adjustments from adoption of consolidation accounting guidance

-

(118)

-

Acquired from Wachovia (1)

-

-

34

Servicing from securitizations or asset transfers

3,957

4,092

6,226

Net additions

3,957

3,974

6,260

Changes in fair value:

Due to changes in valuation model inputs or assumptions (2)

(3,680)

(2,957)

(1,534)

Other changes in fair value (3)

(2,141)

(2,554)

(3,436)

Total changes in fair value

(5,821)

(5,511)

(4,970)

Fair value, end of year

$

12,603

14,467

16,004

(1) The 2009 amount reflects refinements to initial December 31, 2008, Wachovia purchase accounting adjustments.

(2) Principally reflects changes in discount rates and prepayment speed assumptions, mostly due to changes in interest rates, and costs to service, including delinquency and

foreclosure costs.

(3) Represents changes due to collection/realization of expected cash flows over time.

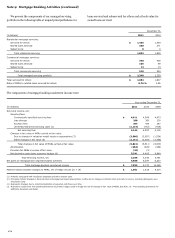

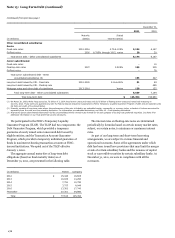

The changes in amortized MSRs were:

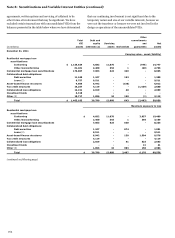

Year ended December 31,

(in millions)

2011

2010

2009

Balance, beginning of year

$

1,422

1,119

1,446

Adjustments from adoption of consolidation accounting guidance

-

(5)

-

Purchases

155

58

11

Acquired from Wachovia (1)

-

-

(135)

Servicing from securitizations or asset transfers

132

478

61

Amortization

(264)

(228)

(264)

Balance, end of year (2)

1,445

1,422

1,119

Valuation allowance:

Balance, beginning of year

(3)

-

-

Provision for MSRs in excess of fair value

(34)

(3)

-

Balance, end of year (3)

(37)

(3)

-

Amortized MSRs, net

$

1,408

1,419

1,119

Fair value of amortized MSRs:

Beginning of year

$

1,812

1,261

1,555

End of year (4)

1,756

1,812

1,261

(1) The 2009 amount reflects refinements to initial December 31, 2008, Wachovia purchase accounting adjustments.

(2) Includes $350 million and $400 million in residential amortized MSRs at December 31, 2011 and 2010, respectively. The 2009 balance is all commercial amortized MSRs. For

the years ended December 31, 2011 and 2010, the residential MSR amortization was $(50) million and $(5) million, respectively. Effective January 1, 2012, the amortized

residential MSR portfolio will be transferred to MSRs carried at fair value.

(3) Commercial amortized MSRs are evaluated for impairment purposes by the following risk strata: agency (GSEs) and non-agency. There was no valuation allowance recorded

for the periods presented on the commercial amortized MSRs. Residential amortized MSRs are evaluated for impairment purposes by the following risk strata: Mortgages

sold to GSEs (FHLMC and FNMA) and mortgages sold to GNMA, each by interest rate stratifications. A valuation allowance of $37 million and $3 million was recorded on the

residential amortized MSRs for the years ended December 31, 2011 and 2010, respectively.

(4) Includes fair value of $316 million and $441 million in residential amortized MSRs and $1,440 million and $1,371 million in commercial amortized MSRs at

December 31, 2011 and 2010, respectively.

171