Wells Fargo 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

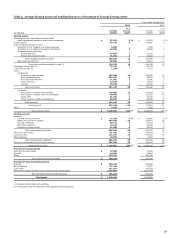

Loan Portfolio

Total loans were $769.6 billion at December 31, 2011, up

$12.4 billion from December 31, 2010. Table 12 provides a

summarized breakdown by loan portfolio. Increased balances in

many commercial loan portfolios more than offset the continued

reduction in the non-strategic and liquidating loan portfolios,

which have declined $21.0 billion since December 31, 2010, as

well as the soft demand in consumer loans in response to

economic conditions. Additional information on the non-

strategic and liquidating loan portfolios is included in Table 17 in

the “Credit Risk Management” section of this Report.

Many loan portfolios had double-digit year-over-year loan

growth in average balances, including government and

institutional banking, asset-backed finance, capital finance,

commercial banking, commercial real estate, international and

real estate capital markets. Included in the growth of loans from

year end 2010 were loan purchases in 2011 with a period end

balance of $3.6 billion of U.S.-based commercial real estate.

Consumer loans include the consolidation of $5.6 billion of

reverse mortgage loans previously sold.

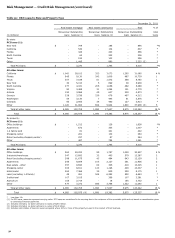

Table 12: Loan Portfolios

December 31,

(in millions)

2011

2010

2009

2008

2007

Commercial

$

345,450

322,058

336,465

389,964

160,282

Consumer

424,181

435,209

446,305

474,866

221,913

Total loans

$

769,631

757,267

782,770

864,830

382,195

A discussion of average loan balances and a comparative

detail of average loan balances is included in Table 5 under

“Earnings Performance – Net Interest Income” earlier in this

Report. Year-end balances and other loan related information

are in Note 6 (Loans and Allowance for Credit Losses) to

Financial Statements in this Report.

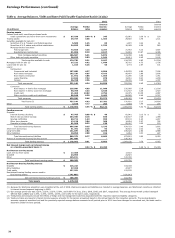

Table 13 shows contractual loan maturities for selected loan

categories and sensitivities of those loans to changes in interest

rates.

Table 13: Maturities for Selected Loan Categories

December 31,

2011

2010

After

After

Within

one year

After

Within

one year

After

one

through

five

one

through

five

(in millions)

year

five years

years

Total

year

five years

years

Total

Selected loan maturities:

Commercial and industrial

$

44,258

101,273

21,685

167,216

39,576

90,497

21,211

151,284

Real estate mortgage

22,537

54,201

29,237

105,975

27,544

44,627

27,264

99,435

Real estate construction

10,059

8,178

1,145

19,382

15,009

9,189

1,135

25,333

Foreign

35,258

3,142

1,360

39,760

25,087

5,508

2,317

32,912

Total selected loans

$

112,112

166,794

53,427

332,333

107,216

149,821

51,927

308,964

Distribution of loans due

after one year to

changes in interest rates:

Loans at fixed

interest rates

$

19,319

13,712

29,886

14,543

Loans at floating/variable

interest rates

147,475

39,715

119,935

37,384

Total selected loans

$

166,794

53,427

149,821

51,927

43