Wells Fargo 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

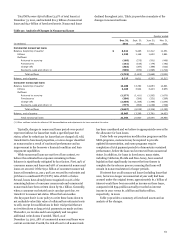

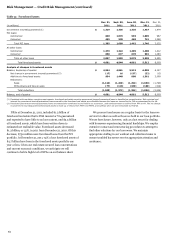

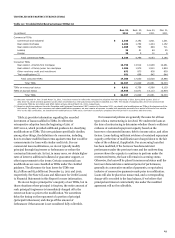

Risk Management — Credit Risk Management (continued)

LIABILITY FOR MORTGAGE LOAN REPURCHASE LOSSES

We

sell residential mortgage loans to various parties, including (1)

government-sponsored entities Freddie Mac and Fannie Mae

(GSEs) who include the mortgage loans in GSE-guaranteed

mortgage securitizations, (2) SPEs that issue private label MBS,

and (3) other financial institutions that purchase mortgage loans

for investment or private label securitization. In addition, we

pool FHA-insured and VA-guaranteed mortgage loans that back

securities guaranteed by GNMA. We may be required to

repurchase these mortgage loans, indemnify the securitization

trust, investor or insurer, or reimburse the securitization trust,

investor or insurer for credit losses incurred on loans

(collectively “repurchase”) in the event of a breach of contractual

representations or warranties that is not remedied within a

period (usually 90 days or less) after we receive notice of the

breach.

We have established a mortgage repurchase liability related

to various representations and warranties that reflect

management’s estimate of losses for loans for which we have a

repurchase obligation, whether or not we currently service those

loans, based on a combination of factors. Our mortgage

repurchase liability estimation process also incorporates a

forecast for repurchase demands associated with mortgage

insurance rescission activity. Currently, repurchase demands

primarily relate to 2006 through 2008 vintages and to GSE-

guaranteed MBS.

During 2011, we continued to experience elevated levels of

repurchase activity measured by the number of investor

repurchase demands and our level of repurchases. We

repurchased or reimbursed investors for incurred losses on

mortgage loans with original balances of $2.8 billion in 2011,

compared with $2.6 billion in 2010. Additionally, we negotiated

settlements on pools of mortgage loans with original sold

balances of $341 million in 2011, compared with $675 million in

2010, to eliminate the risk of repurchase on these loans. We

incurred net losses on repurchased loans, investor

reimbursements and loan pool global settlements totaling

$1.2 billion in 2011, compared with $1.4 billion in 2010.

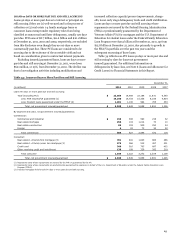

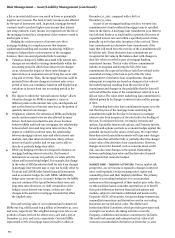

Table 37 provides the number of unresolved repurchase

demands and mortgage insurance rescissions. We do not

typically receive repurchase requests from GNMA, FHA/HUD or

VA. As an originator of an FHA insured or VA guaranteed loan,

we are responsible for obtaining the insurance with FHA or the

guarantee with the VA. To the extent we are not able to obtain

the insurance or the guarantee we must request to repurchase

the loan from the GNMA pool. Such repurchases from GNMA

pools typically represent a self-initiated process upon discovery

of the uninsurable loan (usually within 180 days from funding of

the loan). Alternatively, in lieu of repurchasing loans from

GNMA pools, we may be asked by the FHA/HUD or the VA to

indemnify them (as applicable) for defects found in the Post

Endorsement Technical Review process or audits performed by

FHA/HUD or the VA. Our liability for mortgage loan repurchase

losses incorporates probable losses associated with such

indemnification.

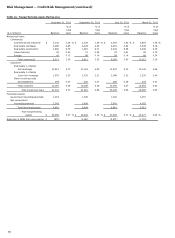

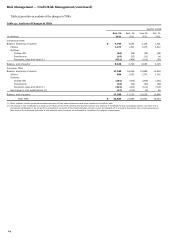

Table 37: Unresolved Repurchase Demands and Mortgage Insurance Rescissions

Government

Mortgage insurance

sponsored entities (1)

Private

rescissions with no demand (2)

Total

Number of

Original loan

Number of

Original loan

Number of

Original loan

Number of

Original loan

($ in millions)

loans

balance (3)

loans

balance (3)

loans

balance (3)

loans

balance (3)

2011

December 31,

7,066

$

1,575

470

$

167

1,178

$

268

8,714

$

2,010

September 30,

6,577

1,500

582

208

1,508

314

8,667

2,022

June 30,

6,876

1,565

695

230

2,019

444

9,590

2,239

March 31,

6,210

1,395

1,973

424

2,885

674

11,068

2,493

2010

December 31,

6,501

1,467

2,899

680

3,248

801

12,648

2,948

September 30,

9,887

2,212

3,605

882

3,035

748

16,527

3,842

June 30,

12,536

2,840

3,160

707

2,979

760

18,675

4,307

March 31,

10,804

2,499

2,320

519

2,843

737

15,967

3,755

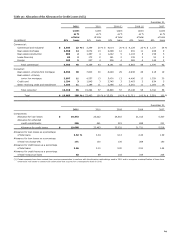

(1)

Includes repurchase demands of 861 and $161 million, 878 and $173 million, 892 and $179 million, 685 and $132 million, 1,495 and $291 million, 2,263 and $437 million,

2,141 and $417 million, and 1,824 and $372 million for December 31, September 30, June 30 and March 31, 2011 and 2010, respec

tively, received from investors on

mortgage servicing rights acquired from other originators. We generally have the right of recourse against the seller and may

be able to recover losses related to such

repurchase demands subject to counterparty risk associated with the seller.

(2)

As part of our representations and warranties in our loan sales contracts, we typically represent to GSEs and private investors that certain loans have mortgage insurance to

the extent there are loans that have loan to value ratios in excess of 80

% that require mortgage insurance. To the extent the mortgage insurance is rescinded by the

mortgage insurer due to a claim of breach of a contractual representation or warranty, the lack of insurance may result in a

repurchase demand from an investor. Sim

ilar to

repurchase demands, we evaluate mortgage insurance rescission notices for validity and appeal for reinstatement if the rescis

sion was not based on a contractual breach.

When investor demands are received due to lack of mortgage insurance, they are reported as unresolved repurchase demands based on the applicable investor category for

the loan (GSE or private). Over the last year, approximately 20% of our repurchase demands from GSEs had mortgage insurance r

escission as one of the reasons for the

rep

urchase demand. Of all the mortgage insurance rescissions notices received in 2010, approximately 70% have resulted in repurc

hase demands through December 2011.

Not all mortgage insurance rescissions received in 2010 have been completed through the appeals

process with the mortgage insurer and upon successful appeal, we work

with the investor to rescind the repurchase demand.

(3)

While the original loan balances related to these demands are presented above, the establishment of the repurchase liability is based on a combination of factors, such as

our appeals success rates, reimbursement by correspondent and other third

-party originators, and projected loss severity, which is driven by the difference between the

current loan balance and the estimated collateral value less costs to sell the property.

70