Wells Fargo 2011 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

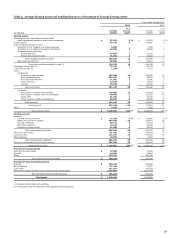

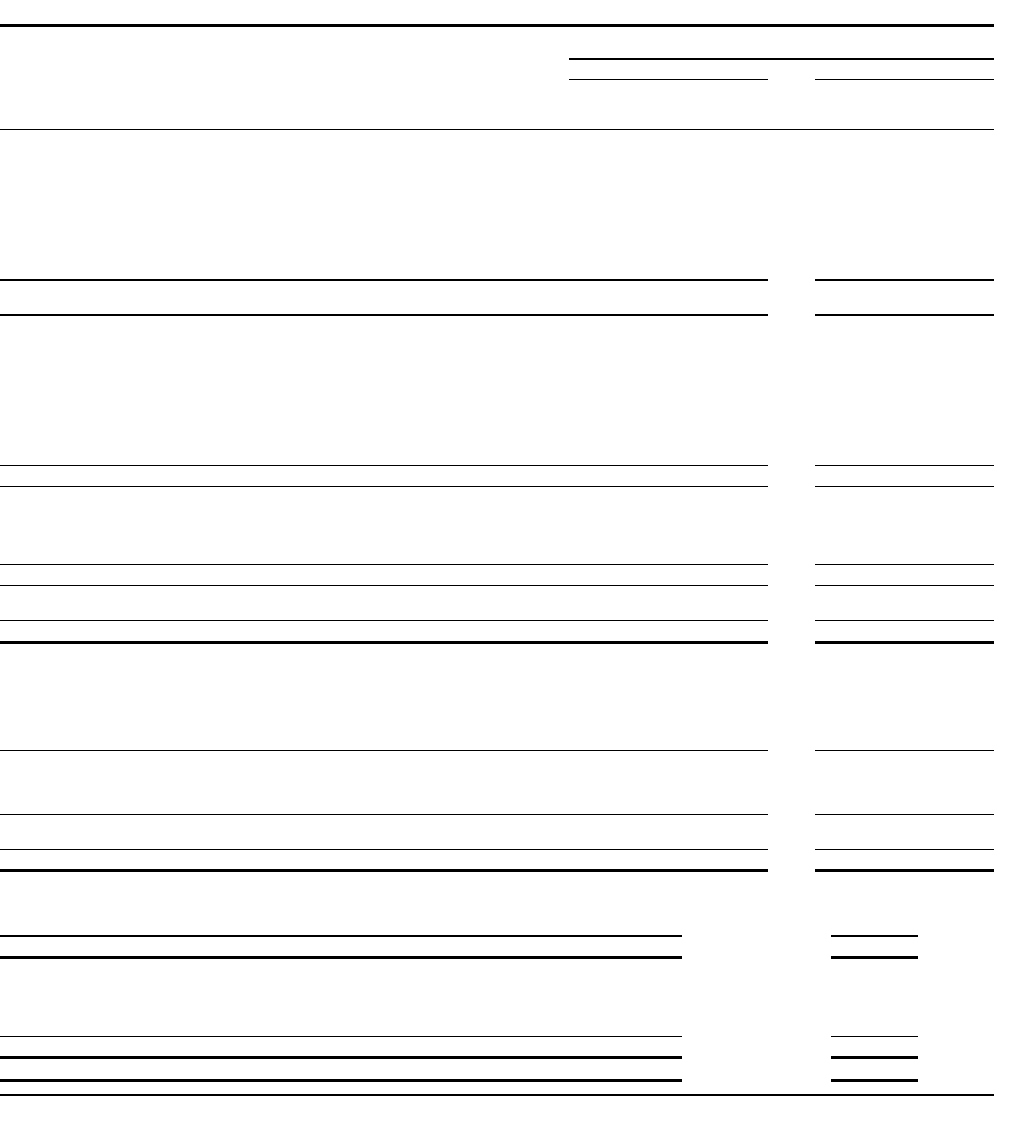

Table 4: Average Earning Assets and Funding Sources as a Percentage of Average Earning Assets

Year ended December 31,

2011

2010

% of

% of

Average

earning

Average

earning

(in millions)

balance

assets

balance

assets

Earning assets

Federal funds sold, securities purchased under

resale agreements and other short-term investments

$

87,186

8

%

$

62,961

6

%

Trading assets

39,737

4

29,920

3

Debt securities available for sale:

Securities of U.S. Treasury and federal agencies

5,503

-

1,870

-

Securities of U.S. states and political subdivisions

24,035

2

16,089

2

Mortgage-backed securities:

Federal agencies

74,665

7

71,953

7

Residential and commercial

31,902

3

31,815

3

Total mortgage-backed securities

106,567

10

103,768

10

Other debt securities (1)

38,625

4

32,611

3

Total debt securities available for sale (1)

174,730

16

154,338

15

Mortgages held for sale (2)

37,232

3

36,716

3

Loans held for sale (2)

1,104

-

3,773

-

Loans:

Commercial:

Commercial and industrial

157,608

15

149,576

14

Real estate mortgage

102,236

9

98,497

9

Real estate construction

21,592

2

31,286

3

Lease financing

12,944

1

13,451

1

Foreign

36,768

3

29,726

3

Total commercial

331,148

30

322,536

30

Consumer:

Real estate 1-4 family first mortgage

226,980

21

235,568

22

Real estate 1-4 family junior lien mortgage

90,705

8

101,537

10

Credit card

21,463

2

22,375

2

Other revolving credit and installment

86,848

8

88,585

8

Total consumer

425,996

39

448,065

42

Total loans (2)

757,144

69

770,601

72

Other

4,929

-

5,849

1

Total earning assets

$

1,102,062

100

%

$

1,064,158

100

%

Funding sources

Deposits:

Interest-bearing checking

$

47,705

4

%

$

60,941

6

%

Market rate and other savings

464,450

42

416,877

39

Savings certificates

69,711

6

87,133

8

Other time deposits

13,126

1

14,654

1

Deposits in foreign offices

61,566

6

55,097

5

Total interest-bearing deposits

656,558

59

634,702

59

Short-term borrowings

51,781

5

46,824

4

Long-term debt

141,079

13

185,426

18

Other liabilities

10,955

1

6,863

1

Total interest-bearing liabilities

860,373

78

873,815

82

Portion of noninterest-bearing funding sources

241,689

22

190,343

18

Total funding sources

$

1,102,062

100

%

$

1,064,158

100

%

Noninterest-earning assets

Cash and due from banks

$

17,388

17,618

Goodwill

24,904

24,824

Other

125,911

120,338

Total noninterest-earning assets

$

168,203

162,780

Noninterest-bearing funding sources

Deposits

$

215,242

183,008

Other liabilities

57,399

47,877

Total equity

137,251

122,238

Noninterest-bearing funding sources used to fund earning assets

(241,689)

(190,343)

Net noninterest-bearing funding sources

$

168,203

162,780

Total assets

$

1,270,265

1,226,938

(1)

Includes certain preferred securities.

(2)

Nonaccrual loans are included in their respective loan categories.

33