Wells Fargo 2011 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

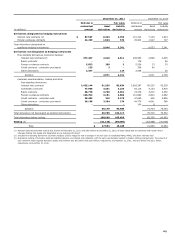

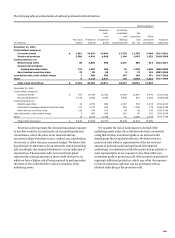

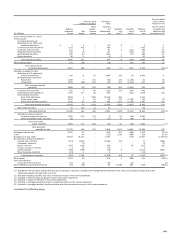

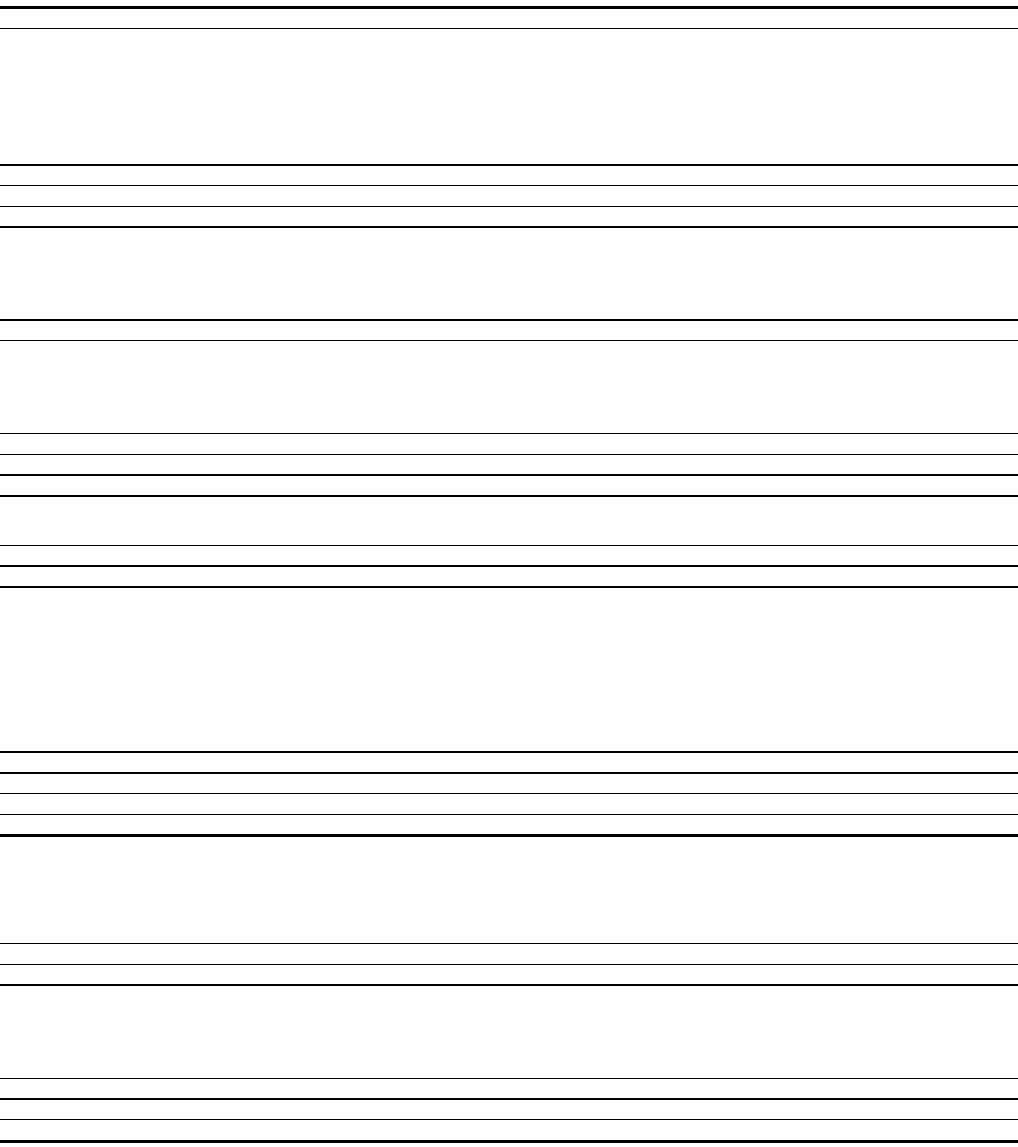

Assets and Liabilities Recorded at Fair Value on a

Recurring Basis

The tables below present the balances of assets and liabilities

measured at fair value on a recurring basis.

(in millions)

Level 1

Level 2

Level 3

Netting

Total

December 31, 2011

Trading assets (excluding derivatives)

Securities of U.S. Treasury and federal agencies

$

3,342

3,638

-

-

6,980

Securities of U.S. states and political subdivisions

-

2,438

53

-

2,491

Collateralized debt obligations(1)

-

-

1,582

-

1,582

Corporate debt securities

-

6,479

97

-

6,576

Mortgage-backed securities

-

34,959

108

-

35,067

Asset-backed securities

-

1,093

190

-

1,283

Equity securities

1,682

172

4

-

1,858

Total trading securities

5,024

48,779

2,034

-

55,837

Other trading assets

1,847

68

115

-

2,030

Total trading assets (excluding derivatives)

6,871

48,847

2,149

-

57,867

Securities of U.S. Treasury and federal agencies

869

6,099

-

-

6,968

Securities of U.S. states and political subdivisions

-

21,077

11,516

-

32,593

Mortgage-backed securities:

Federal agencies

-

96,754

-

-

96,754

Residential

-

17,775

61

-

17,836

Commercial

-

17,918

232

-

18,150

Total mortgage-backed securities

-

132,447

293

-

132,740

Corporate debt securities

317

17,792

295

-

18,404

Collateralized debt obligations(2)

-

-

8,599

-

8,599

Asset-backed securities:

Auto loans and leases

-

86

6,641

-

6,727

Home equity loans

-

650

282

-

932

Other asset-backed securities

-

8,326

2,863

-

11,189

Total asset-backed securities

-

9,062

9,786

-

18,848

Other debt securities

-

1,044

-

-

1,044

Total debt securities

1,186

187,521

30,489

-

219,196

Marketable equity securities:

Perpetual preferred securities (3)

552

631

1,344

-

2,527

Other marketable equity securities

814

53

23

-

890

Total marketable equity securities

1,366

684

1,367

-

3,417

Total securities available for sale

2,552

188,205

31,856

-

222,613

Mortgages held for sale

-

41,381

3,410

-

44,791

Loans held for sale

-

1,176

-

-

1,176

Loans

-

5,893

23

-

5,916

Mortgage servicing rights (residential)

-

-

12,603

-

12,603

Derivative assets:

Interest rate contracts

-

91,022

1,055

-

92,077

Commodity contracts

-

4,351

-

-

4,351

Equity contracts

471

2,737

560

-

3,768

Foreign exchange contracts

35

4,873

16

-

4,924

Credit contracts

-

2,219

1,357

-

3,576

Other derivative contracts

-

-

-

-

-

Netting

-

-

-

(81,143)

(4)

(81,143)

Total derivative assets (5)

506

105,202

2,988

(81,143)

27,553

Other assets

88

135

244

-

467

Total assets recorded at fair value

$

10,017

390,839

53,273

(81,143)

372,986

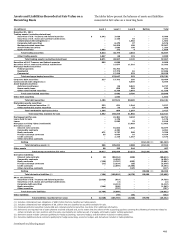

Derivative liabilities:

Interest rate contracts

$

(4)

(88,164)

(446)

-

(88,614)

Commodity contracts

-

(4,234)

-

-

(4,234)

Equity contracts

(229)

(2,797)

(635)

-

(3,661)

Foreign exchange contracts

(31)

(3,324)

(23)

-

(3,378)

Credit contracts

-

(2,099)

(3,355)

-

(5,454)

Other derivative contracts

-

-

(117)

-

(117)

Netting

-

-

-

89,990

(4)

89,990

Total derivative liabilities (6)

(264)

(100,618)

(4,576)

89,990

(15,468)

Short sale liabilities:

Securities of U.S. Treasury and federal agencies

(3,820)

(919)

-

-

(4,739)

Securities of U.S. states and political subdivisions

-

(2)

-

-

(2)

Corporate debt securities

-

(4,112)

-

-

(4,112)

Equity securities

(944)

(298)

-

-

(1,242)

Other securities

-

(737)

-

-

(737)

Total short sale liabilities

(4,764)

(6,068)

-

-

(10,832)

Other liabilities

-

(98)

(44)

-

(142)

Total liabilities recorded at fair value

$

(5,028)

(106,784)

(4,620)

89,990

(26,442)

(1) Includes collateralized loan obligations of $583 million that are classified as trading assets.

(2) Includes collateralized loan obligations of $8.1 billion that are classified as securities available for sale.

(3) Perpetual preferred securities include ARS and corporate preferred securities. See Note 8 for additional information.

(4) Derivatives are reported net of cash collateral received and paid and, to the extent that the criteria of the accounting guidance covering the offsetting of amounts related to

certain contracts are met, positions with the same counterparty are netted as part of a legally enforceable master netting agreement.

(5) Derivative assets include contracts qualifying for hedge accounting, economic hedges, and derivatives included in trading assets.

(6) Derivative liabilities include contracts qualifying for hedge accounting, economic hedges, and derivatives included in trading liabilities.

(continued on following page)

195