Wells Fargo 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

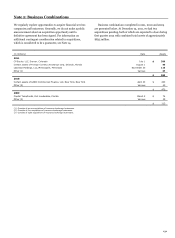

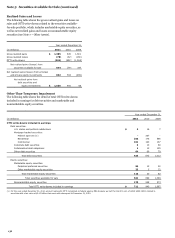

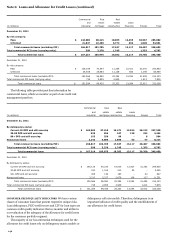

Note 6: Loans and Allowance for Credit Losses

The following table presents total loans outstanding by portfolio

segment and class of financing receivable. Outstanding balances

include a total net reduction of $9.3 billion and $11.3 billion at

December 31, 2011 and 2010, respectively, for unearned income,

net deferred loan fees, and unamortized discounts and

premiums. Outstanding balances also include PCI loans net of

any remaining purchase accounting adjustments. Information

about PCI loans is presented separately in the “Purchased

Credit-Impaired Loans” section of this Note.

December 31,

(in millions)

2011

2010

2009

2008

2007

Commercial:

Commercial and industrial

$

167,216

151,284

158,352

202,469

90,468

Real estate mortgage

105,975

99,435

97,527

94,923

36,747

Real estate construction

19,382

25,333

36,978

42,861

18,854

Lease financing

13,117

13,094

14,210

15,829

6,772

Foreign (1)

39,760

32,912

29,398

33,882

7,441

Total commercial

345,450

322,058

336,465

389,964

160,282

Consumer:

Real estate 1-4 family first mortgage

228,894

230,235

229,536

247,894

71,415

Real estate 1-4 family junior lien mortgage

85,991

96,149

103,708

110,164

75,565

Credit card

22,836

22,260

24,003

23,555

18,762

Other revolving credit and installment

86,460

86,565

89,058

93,253

56,171

Total consumer

424,181

435,209

446,305

474,866

221,913

Total loans

$

769,631

757,267

782,770

864,830

382,195

(1) Substantially all of our foreign loan portfolio is commercial loans. Loans are classified as foreign if the borrower’s primary address is outside of the United States.

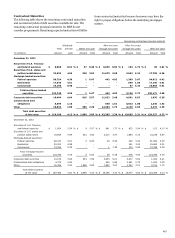

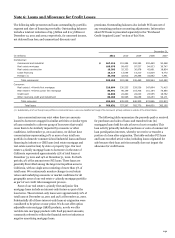

Loan concentrations may exist when there are amounts

loaned to borrowers engaged in similar activities or similar types

of loans extended to a diverse group of borrowers that would

cause them to be similarly impacted by economic or other

conditions. At December 31, 2011 and 2010, we did not have

concentrations representing 10% or more of our total loan

portfolio in domestic commercial and industrial loans and lease

financing by industry or CRE loans (real estate mortgage and

real estate construction) by state or property type. Our real

estate 1-4 family mortgage loans to borrowers in the state of

California represented approximately 13% of total loans at

December 31, 2011 and 14% at December 31, 2010. For both

periods, 3% of the amount were PCI loans. These loans are

generally diversified among the larger metropolitan areas in

California, with no single area consisting of more than 3% of

total loans. We continuously monitor changes in real estate

values and underlying economic or market conditions for all

geographic areas of our real estate 1-4 family mortgage portfolio

as part of our credit risk management process.

Some of our real estate 1-4 family first and junior lien

mortgage loans include an interest-only feature as part of the

loan terms. These interest-only loans were approximately 21% of

total loans at December 31, 2011 and 25% at December 31, 2010.

Substantially all of these interest-only loans at origination were

considered to be prime or near prime. We do not offer option

adjustable-rate mortgage (ARM) products, nor do we offer

variable-rate mortgage products with fixed payment amounts,

commonly referred to within the financial services industry as

negative amortizing mortgage loans.

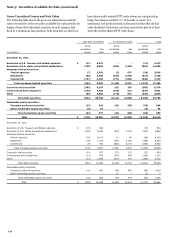

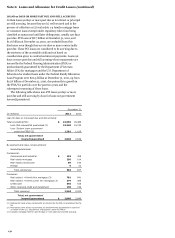

The following table summarizes the proceeds paid or received

for purchases and sales of loans and transfers from (to)

mortgages/loans held for sale at lower of cost or market. This

loan activity primarily includes purchases or sales of commercial

loan participation interests, whereby we receive or transfer a

portion of a loan after origination. The table excludes PCI loans

and loans recorded at fair value, including loans originated for

sale because their loan activity normally does not impact the

allowance for credit losses.

141