Wells Fargo 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

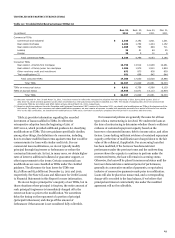

Risk Management — Credit Risk Management (continued)

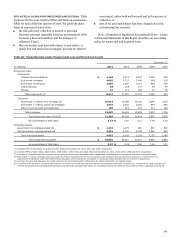

were PCI loans from Wachovia) at December 31, 2011, mostly

within the larger metropolitan areas, with no single California

metropolitan area consisting of more than 3% of total loans. We

continuously monitor changes in real estate values and

underlying economic or market conditions for all geographic

areas of our real estate 1-4 family mortgage portfolio as part of

our credit risk management process.

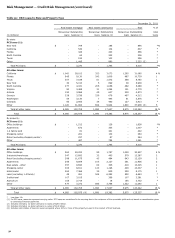

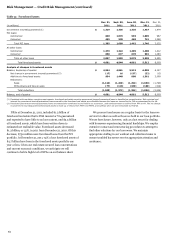

Part of our credit monitoring includes tracking delinquency,

FICO scores and collateral values (LTV/CLTV) on the entire real

estate 1-4 family mortgage loan portfolio. These metrics

experienced improvement throughout 2011, on the non-PCI

mortgage portfolio, with the majority of the improvement

occurring in the first half of 2011. Loans 30 days or more

delinquent at December 31, 2011, totaled $18.4 billion, or 6%, of

total non-PCI mortgages, compared with $20.3 billion, or 7%, at

December 31, 2010. Loans with FICO scores lower than 640

totaled $44.1 billion at December 31, 2011, or 15% of all non-PCI

mortgages, compared with $50.7 billion, or 17%, at

December 31, 2010. Mortgages with a LTV/CLTV greater than

100% totaled $74.2 billion at December 31, 2011, or 26% of total

non-PCI mortgages, compared with $84.9 billion, or 29%, at

December 31, 2010. Information regarding credit risk trends can

be found in Note 6 (Loans and Allowance for Credit Losses) to

Financial Statements in this Report.

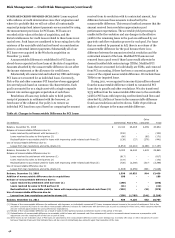

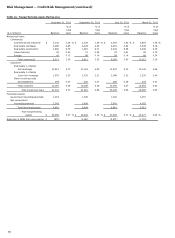

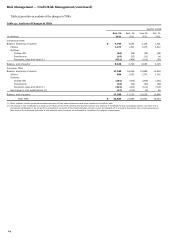

Table 23: Real Estate 1-4 Family Mortgage Loans by State

December 31, 2011

Real estate

Real estate

Total real

1-4 family

1-4 family

estate 1-4

% of

first

junior lien

family

total

(in millions)

mortgage

mortgage

mortgage

loans

PCI loans:

California

$

19,336

42

19,378

3

%

Florida

2,700

38

2,738

*

New Jersey

1,285

25

1,310

*

Other (1)

6,425

101

6,526

*

Total PCI loans

$

29,746

206

29,952

4

%

All other loans:

California

$

54,312

23,934

78,246

10

%

Florida

16,001

7,664

23,665

3

New Jersey

9,007

6,240

15,247

2

New York

9,045

3,597

12,642

2

Virginia

5,874

4,431

10,305

1

Pennsylvania

5,978

3,929

9,907

1

North Carolina

5,642

3,582

9,224

1

Georgia

4,583

3,369

7,952

1

Texas

6,444

1,335

7,779

1

Other (2)

55,707

27,704

83,411

12

Government insured/

guaranteed loans (3)

26,555

-

26,555

3

Total all

other loans

$

199,148

85,785

284,933

37

%

Total

$

228,894

85,991

314,885

41

%

* Less than 1%.

(1) Consists of 45 states; no state had loans in excess of $729 million.

(2) Consists of 41 states; no state had loans in excess of $6.6 billion.

(3) Represents loans whose repayments are insured by the FHA or guaranteed by

the VA. In 2011, we consolidated $5.6 billion of previously sold FHA insured real

estate 1-4 family reverse mortgages.

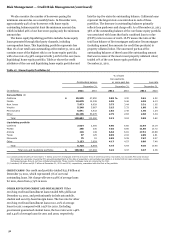

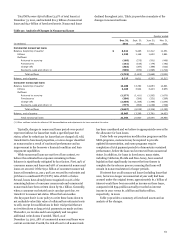

PICK-A-PAY PORTFOLIO

The Pick-a-Pay portfolio was one of the

consumer residential first mortgage portfolios we acquired from

Wachovia and a majority of the portfolio was identified as PCI

loans. The Pick-a-Pay portfolio is a liquidating portfolio, as

Wachovia ceased originating new Pick-a-Pay loans in 2008.

The Pick-a-Pay portfolio includes loans that offer payment

options (Pick-a-Pay option payment loans), and also includes

loans that were originated without the option payment feature,

loans that no longer offer the option feature as a result of our

modification efforts since the acquisition, and loans where the

customer voluntarily converted to a fixed-rate product. The Pick-

a-Pay portfolio is included in the consumer real estate 1-4 family

first mortgage class of loans throughout this Report. Real estate

1-4 family junior lien mortgages and lines of credit associated

with Pick-a-Pay loans are reported in the home equity portfolio.

Table 24 provides balances over time related to the types of

loans included in the portfolio since acquisition.

54