Wells Fargo 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

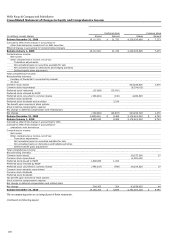

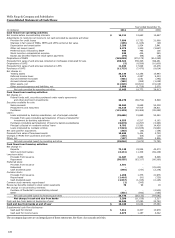

Wells Fargo & Company and Subsidiaries

Consolidated Statement of Changes in Equity and Comprehensive Income

Preferred stock

Common stock

(in millions, except shares)

Shares

Amount

Shares

Amount

Balance December 31, 2008

10,111,821

$

31,332

4,228,630,889

$

7,273

Cumulative effect from change in accounting for

other-than-temporary impairment on debt securities

Effect of change in accounting for noncontrolling interests

Balance January 1, 2009

10,111,821

31,332

4,228,630,889

7,273

Comprehensive income:

Net income

Other comprehensive income, net of tax:

Translation adjustments

Net unrealized gains on securities available for sale

Net unrealized losses on derivatives and hedging activities

Defined benefit plans adjustment

Total comprehensive income

Noncontrolling interests:

Purchase of Prudential’s noncontrolling interest

All other

Common stock issued

953,285,636

1,470

Common stock repurchased

(8,274,015)

Preferred stock redeemed

(25,000)

(25,000)

Preferred stock released by ESOP

Preferred stock converted to common shares

(105,881)

(106)

4,982,083

Common stock dividends

Preferred stock dividends and accretion

2,259

Tax benefit upon exercise of stock options

Stock incentive compensation expense

Net change in deferred compensation and related plans

Net change

(130,881)

(22,847)

949,993,704

1,470

Balance December 31, 2009

9,980,940

$

8,485

5,178,624,593

$

8,743

Balance January 1, 2010

9,980,940

8,485

5,178,624,593

8,743

Cumulative effect from change in accounting for VIEs

Cumulative effect from change in accounting for

embedded credit derivatives

Comprehensive income:

Net income

Other comprehensive income, net of tax:

Translation adjustments

Net unrealized gains on securities available for sale

Net unrealized gains on derivatives and hedging activities

Defined benefit plans adjustment

Total comprehensive income

Noncontrolling interests

Common stock issued

58,375,566

27

Common stock repurchased

(3,010,451)

Preferred stock issued to ESOP

1,000,000

1,000

Preferred stock released by ESOP

Preferred stock converted to common shares

(795,637)

(796)

28,293,520

17

Common stock warrants repurchased

Common stock dividends

Preferred stock dividends

Tax benefit upon exercise of stock options

Stock incentive compensation expense

Net change in deferred compensation and related plans

Net change

204,363

204

83,658,635

44

Balance December 31, 2010

10,185,303

$

8,689

5,262,283,228

$

8,787

The accompanying notes are an integral part of these statements.

(continued on following pages)

116