Wells Fargo 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

all customers segments, with most lending areas experiencing

double-digit rates of growth in loans outstandings, including in

Asset Backed Finance, Capital Finance, Commercial Banking,

Commercial Real Estate, Government and Institutional Banking,

International, and Real Estate Capital Markets.

Wealth, Brokerage and Retirement provides a full range of

financial advisory services to clients using a planning approach

to meet each client's needs. Wealth Management provides

affluent and high net worth clients with a complete range of

wealth management solutions, including financial planning,

private banking, credit, investment management and trust.

Family Wealth (which will be rebranded as Abbot Downing, a

Wells Fargo Business, in April 2012) meets the unique needs of

ultra high net worth customers. Brokerage serves customers'

advisory, brokerage and financial needs as part of one of the

largest full-service brokerage firms in the United States.

Retirement is a national leader in providing institutional

retirement and trust services (including 401(k) and pension plan

record keeping) for businesses, retail retirement solutions for

individuals, and reinsurance services for the life insurance

industry.

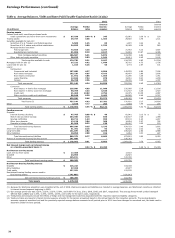

Wealth, Brokerage and Retirement reported net income of

$1.3 billion in 2011, up $283 million, or 28%, from 2010.

Revenue increased $458 million, or 4%, from 2010, as net

interest income increased $148 million, or 5%, and noninterest

income increased $310 million, or 3%, from 2010. Net interest

income increased due to higher investment income and the

impact of deposit balance growth. Average core deposits of

$130.4 billion in 2011 increased 8% from 2010. Noninterest

income increased as higher asset-based fees and a gain on the

sale of the H.D. Vest Financial Services business exceeded losses

on deferred compensation plan investments (offset in expense)

and lower brokerage transaction revenue. Noninterest expense

increased $167 million, or 2%, from 2010, primarily due to

growth in personnel cost largely due to higher broker

commissions driven by increased production levels, as well as

increases in other incentive compensation, offset by lower

deferred compensation. The provision for credit losses

decreased $164 million, or 49%, from 2010, due to lower net

charge-offs.

Balance Sheet Analysis

During 2011, our total assets grew 4%, funded by core deposit

growth of 9% and internal capital generation, partially offset by a

reduction in our long-term borrowings. Our total loans and core

deposits at December 31, 2011, were up from the previous year.

At December 31, 2011, core deposits totaled 113% of the loan

portfolio, and we have the capacity to add higher yielding

earning assets to generate future revenue and earnings growth.

The strength of our business model produced record earnings

and high rates of internal capital generation as reflected in our

improved capital ratios. Tier 1 capital increased to 11.33% as a

percentage of total risk-weighted assets, and Tier 1 common

equity to 9.46% at December 31, 2011, up from 11.16% and

8.30%, respectively, at December 31, 2010. Total capital was

14.76% and Tier 1 leverage was 9.03%, compared with 15.01%

and 9.19%, respectively, at December 2010. For additional

information about our capital requirements, see Note 26

(Regulatory and Agency Capital Requirements) to Financial

Statements in this Report.

The following discussion provides additional information

about the major components of our balance sheet. Information

about changes in our asset mix and about our capital is included

in the “Earnings Performance – Net Interest Income” and

“Capital Management” sections of this Report.

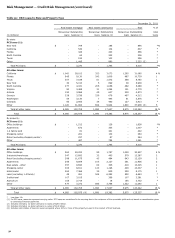

Securities Available for Sale

Table 10: Securities Available for Sale – Summary

December 31,

2011

2010

Net

Net

unrealized

Fair

unrealized

Fair

(in millions)

Cost

gain

value

Cost

gain

value

Debt securities available for sale

$

212,642

6,554

219,196

160,071

7,394

167,465

Marketable equity securities

2,929

488

3,417

4,258

931

5,189

Total securities available for sale

$

215,571

7,042

222,613

164,329

8,325

172,654

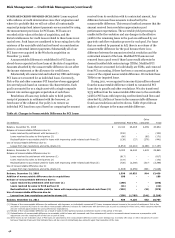

Table 10 presents a summary of our securities available-for-

sale portfolio. Securities available for sale consist of both debt

and marketable equity securities. We hold debt securities

available for sale primarily for liquidity, interest rate risk

management and long-term yield enhancement. Accordingly,

this portfolio consists primarily of liquid, high-quality federal

agency debt and privately issued mortgage-backed securities

(MBS). The total net unrealized gains on securities available for

sale were $7.0 billion at December 31, 2011, down from net

unrealized gains of $8.3 billion at December 31, 2010, primarily

due to gains realized from sales partially offset by slight

widening of credit spreads in some asset classes.

We analyze securities for OTTI quarterly, or more often if a

potential loss-triggering event occurs. Of the $711 million OTTI

write-downs recognized in 2011, $423 million related to debt

securities. There were $118 million in OTTI write-downs for

41