SunTrust 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

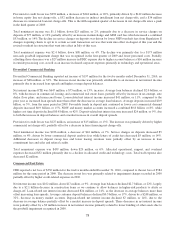

Total noninterest income was $521 million, down $165 million, or 24%. The decline was primarily due to lower production

income. Mortgage loan production income declined $251 million, or 69%, primarily due to lower loan production. Loan

originations were $29.3 billion in 2010, a 42% decrease from the prior year. Mortgage servicing income was up $66 million

driven by increased service fee income and improved MSR hedge performance, partially offset by the negative impact of

higher prepayments on MSR values. In 2010 all MSRs are recorded at fair value. Total loans serviced at December 31, 2010

were $167.2 billion compared with $178.9 billion at December 31, 2009, a 7% decline primarily due to the sale of MSRs on

residential loans with an unpaid principal balance of $7.0 billion.

Total noninterest expense declined $329 million, or 23%, primarily due to a $279 million non-cash goodwill impairment

charge recorded in first quarter of 2009. Total staff expense declined $75 million, or 16%, primarily due to lower

commission expense resulting from lower loan production. Captive reinsurance reserve expense also decreased $88 million

as a result of trust reserve limits being reached. These decreases were partially offset by a $46 million increase in higher

allocated credit and technology costs.

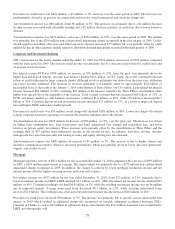

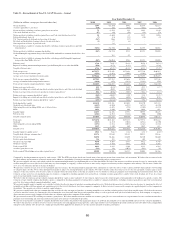

Wealth and Investment Management

W&IM’s net income for the twelve months ended December 31, 2010 was $180 million, an increase of $48 million, or 36%,

compared to the same period in 2009. The increase in net income was primarily due to increased net interest income and an

increase in noninterest income partially offset by an increase in compensation expense.

Net interest income was $447 million, an increase of $48 million, or 12%, driven mostly by deposit-related net interest

income. Average loan balances declined $0.2 billion, or 3% with decreases in commercial real estate, residential mortgages,

and direct installment loans, partially offset by increases in personal credit lines and home equity lines. Loan-related net

interest income increased $15 million, or 11%, as higher loan spreads more than offset the decrease in average loan balances.

Average customer deposits increased $0.6 billion, or 6%, as money market accounts increased $1.5 billion, or 55%.

Additionally, demand deposits increased $0.2 billion, or 9%, while time deposits decreased $0.6 billion, or 31%, and NOW

accounts decreased $0.4 billion, or 10%. Deposit-related net interest income increased $24 million, or 9%, due to the

combination of higher average balances and improved deposit spreads.

Provision for credit losses was $61 million, a decrease of $18 million, or 23%, due to decreased net charge-offs in both

consumer and commercial loan products.

Total noninterest income was $822 million, an increase of $69 million, or 9%. Trust income increased $17 million, or 3%,

primarily due to higher market valuations on managed equity assets and fixed income asset inflows partially offset by lower

MMMF revenue. Trading income increased $29 million due to higher valuations on trading assets and the sale of certain

previously acquired illiquid assets. Additionally, other income increased $25 million primarily due to an $18 million gain

from the transfer of the RidgeWorth Money Market Fund business to Federated Investors, Inc. These increases were partially

offset by a $9 million, or 5%, decline in retail investment income primarily driven by lower fixed annuity revenue.

As of December 31, 2010, assets under management were $105.1 billion compared to $119.5 billion as of December 31,

2009. Assets under management include individually managed assets, the RidgeWorth Funds, managed institutional assets,

and participant-directed retirement accounts. The decrease is attributable to $14.1 billion of money market mutual fund assets

that transferred to a third party during the second half of 2010. SunTrust’s total assets under advisement were $195.5 billion,

which includes $105.1 billion in assets under management, $46.0 billion in non-managed trust assets, $34.6 billion in retail

brokerage assets, and $9.8 billion in non-managed corporate trust assets.

Total noninterest expense was $916 million, an increase of $55 million, or 6%. The increase was primarily due to a $25

million, or 5%, increase in personnel related expense driven by incentive compensation associated with revenue growth.

Additional increases in discretionary and transactional structural expense were partially offset by decreased operating losses

and credit-related expense.

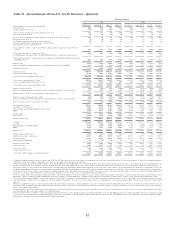

Corporate Other and Treasury

Corporate Other and Treasury’s net income for the twelve months ended December 31, 2010 was $444 million, an increase

of $47 million, or 12%, compared to the same period in 2009. The increase was primarily due to increased net interest

income and securities gains and a decrease in noninterest expense due to a special FDIC insurance assessment recorded in the

second quarter of 2009.

80