SunTrust 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

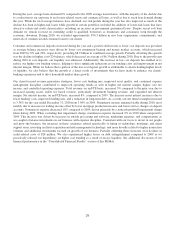

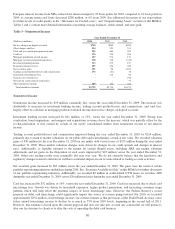

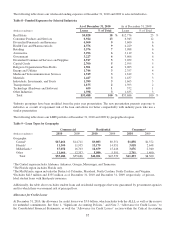

CONSOLIDATED FINANCIAL RESULTS

Table 1- Consolidated Daily Average Balances, Income/Expense And Average Yields Earned And Rates Paid

2010 2009 2008

(Dollars in millions; yields on taxable-equivalent basis)

Average

Balances

Income/

Expense

Yields/

Rates

Average

Balances

Income/

Expense

Yields/

Rates

Average

Balances

Income/

Expense

Yields/

Rates

Assets

Loans:1,6

Real estate residential mortgage 1-4 family $29,058 $1,553 5.35 % $29,588 $1,723 5.82 % $31,859 $2,005 6.29 %

Real estate construction 3,402 126 3.69 5,991 198 3.31 10,828 576 5.32

Real estate home equity lines 14,912 503 3.37 15,685 523 3.34 15,205 797 5.24

Real estate commercial 14,578 593 4.07 15,573 639 4.11 13,969 790 5.65

Commercial - FTE232,788 1,828 5.57 36,458 1,820 4.99 38,132 2,090 5.48

Credit card 1,058 89 8.39 984 74 7.47 863 34 4.00

Consumer - direct 5,812 251 4.32 5,101 207 4.06 4,542 254 5.60

Consumer - indirect 7,530 423 5.62 6,594 418 6.34 7,262 460 6.33

Nonaccrual34,787 39 0.81 5,067 36 0.72 2,773 25 0.92

Total loans 113,925 5,405 4.74 121,041 5,638 4.66 125,433 7,031 5.61

Securities available for sale:

Taxable 24,994 785 3.14 18,960 790 4.17 12,220 731 5.98

Tax-exempt - FTE2783 42 5.34 1,003 55 5.46 1,038 63 6.07

Total securities available for sale - FTE 25,777 827 3.21 19,963 845 4.23 13,258 794 5.99

Funds sold and securities purchased under agreements to

resell 969 1 0.08 794 2 0.27 1,318 25 1.91

Loans held for sale 3,295 136 4.14 5,228 233 4.45 5,106 290 5.68

Interest-bearing deposits 26 0.17 25 - 0.91 25 1 3.18

Interest earning trading assets 3,195 90 2.79 3,857 115 2.99 7,609 304 4.00

Total earning assets 147,187 6,459 4.39 150,908 6,833 4.53 152,749 8,445 5.53

Allowance for loan and lease losses (3,045) (2,706) (1,815)

Cash and due from banks 4,821 4,844 3,093

Other assets 18,268 17,355 17,270

Noninterest earning trading assets 2,913 3,429 2,642

Unrealized gains on securities available for sale, net 2,231 1,612 1,909

Total assets $172,375 $175,442 $175,848

Liabilities and Shareholders’ Equity

Interest-bearing deposits:

NOW accounts $24,668 $58 0.24 % $23,601 $99 0.42 % $21,081 $253 1.20 %

Money market accounts 38,893 227 0.58 31,864 315 0.99 26,565 520 1.96

Savings 4,028 9 0.22 3,664 10 0.27 3,771 16 0.43

Consumer time 14,232 267 1.87 16,718 479 2.87 16,770 639 3.81

Other time 9,205 189 2.05 13,068 382 2.92 12,197 479 3.92

Total interest-bearing consumer and commercial

deposits 91,026 750 0.82 88,915 1,285 1.45 80,384 1,907 2.37

Brokered deposits 2,561 110 4.29 5,648 154 2.69 10,493 392 3.73

Foreign deposits 355 0.13 434 1 0.12 4,250 79 1.85

Total interest-bearing deposits 93,942 860 0.92 94,997 1,440 1.52 95,127 2,378 2.50

Funds purchased 1,226 2 0.19 1,670 3 0.19 2,622 52 1.96

Securities sold under agreements to repurchase 2,416 4 0.15 2,483 5 0.18 4,961 79 1.59

Interest-bearing trading liabilities 833 30 3.58 487 20 4.14 786 27 3.46

Other short-term borrowings 3,014 13 0.43 2,704 15 0.54 3,057 55 1.80

Long-term debt 16,096 580 3.60 20,119 761 3.78 22,893 1,117 4.88

Total interest-bearing liabilities 117,527 1,489 1.27 122,460 2,244 1.83 129,446 3,708 2.86

Noninterest-bearing deposits 26,103 24,249 20,949

Other liabilities 4,097 4,387 5,061

Noninterest-bearing trading liabilities 1,814 2,060 1,796

Shareholders’ equity 22,834 22,286 18,596

Total liabilities and shareholders’ equity $172,375 $175,442 $175,848

Interest Rate Spread 3.12 % 2.70 % 2.67 %

Net Interest Income - FTE4$4,970 $4,589 $4,737

Net Interest Margin53.38 % 3.04 % 3.10 %

1Interest income includes loan fees of $146 million, $148 million, and $142 million for the three years ended December 31, 2010, 2009, and 2008, respectively. Nonaccrual loans

are included in average balances and income on such loans, if recognized, is recorded on a cash basis.

2Interest income includes the effects of taxable-equivalent adjustments using a federal income tax rate of 35% and, where applicable, state income taxes to increase tax-exempt

interest income to a taxable-equivalent basis. The net taxable-equivalent adjustment amounts included in the above table aggregated $116 million, $123 million, and $117 million

for the three years ended December 31, respectively.

3Accruing TDRs were classified in nonaccruals during prior periods. Due to sustained performance, accruing TDRs have been reclassified to the applicable loans category where

the related interest income is being classified in all periods presented.

4The Company obtained derivative instruments to manage the Company’s interest-sensitivity position that increased net interest income $617 million, $488 million and $181

million in the periods ended December 31, 2010, 2009 and 2008, respectively.

5The net interest margin is calculated by dividing net interest income – FTE by average total earning assets.

6Loan categories in this table are presented using pre-adoption classifications due to an inability to produce average balances using post-adoption classifications.

27