SunTrust 2010 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

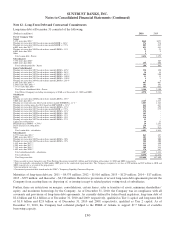

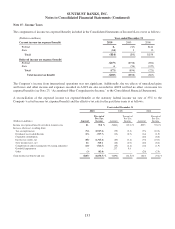

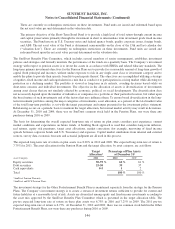

accounts. Compensation expense related to this plan for the years ended December 31, 2010, 2009 and 2008 totaled $74

million, $76 million and $80 million, respectively.

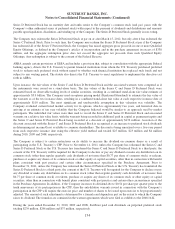

SunTrust also maintains the SunTrust Banks, Inc. Deferred Compensation Plan in which key executives of the Company are

eligible. Prior to January 1, 2010, in addition to the Deferred Compensation Plan, SunTrust maintained the SunTrust Banks,

Inc. 401(k) Excess Plan. In accordance with the terms of the plan, effective January 1, 2008, the matching contribution to the

401(k) Excess Plan increased to be the same percentage of match as provided in the qualified 401(k) Plan, which is 100% of

the first 5% of eligible pay that a participant, including an SEO, elects to defer to the applicable plan, subject to such

limitations as may be imposed by the plans’ provisions and applicable laws and regulations. Effective January 1, 2010, the

401(k) Excess Plan was merged into the Deferred Compensation Plan. All future nonqualified plan deferrals and associated

matching contributions will be made to the SunTrust Deferred Compensation Plan. Effective January 1, 2011, employees

hired on or after January 1, 2011 will become vested in the Company’s 401(k) matching contributions and matching

contributions under the Deferred Compensation Plan upon completion of two years of vesting service.

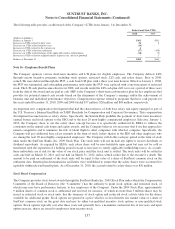

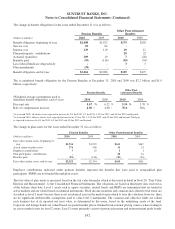

Noncontributory Pension Plans

SunTrust maintains a funded, noncontributory qualified retirement plan covering employees meeting certain service

requirements. The plan provides benefits based on salary and years of service. Effective January 1, 2008, retirement plan

participants who were Company employees as of December 31, 2007 (“Affected Participants”) ceased to accrue additional

benefits under the existing pension benefit formula after that date and all their accrued benefits were frozen. Beginning

January 1, 2008, Affected Participants who have fewer than 20 years of service and future participants accrue future pension

benefits under a cash balance formula that provides compensation and interest credits to a Personal Pension Account. The

interest crediting rate applied to each Personal Pension Account was an annual effective rate of 4.49% for 2010. Affected

Participants with 20 or more years of service as of December 31, 2007 were given the opportunity to choose between

continuing a traditional pension benefit accrual under a reduced formula or participating in the new Personal Pension

Account. Effective January 1, 2008, the vesting schedule was changed from a 5-year cliff to a 3-year cliff for participants

employed by the Company on and after that date. SunTrust monitors the funded status of the plan closely and due to the

current funded status, SunTrust did not make a contribution for the 2010 plan year.

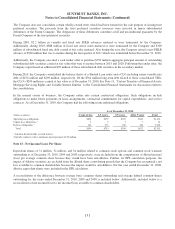

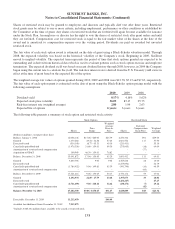

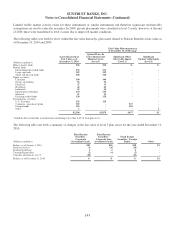

On October 1, 2004, SunTrust acquired NCF. Prior to the acquisition, NCF sponsored a funded qualified retirement plan, an

unfunded nonqualified retirement plan for some of its participants, and certain other postretirement health benefits for its

employees. Effective December 31, 2004, participants no longer earned future service in the NCF Retirement Plan (the

qualified plan), and participants’ benefits were frozen with the exception of adjustments for pay increases after 2004. All

former NCF employees who met the service requirements began to earn benefits in the SunTrust Retirement Plan effective

January 1, 2005. On February 13, 2007, the NCF Retirement Plan was amended to completely freeze benefits for those

Affected Participants who do not elect, or are not eligible to elect, the traditional pension benefit formula in the SunTrust

Retirement Plan. The effective date for changes impacting the NCF Retirement Plan was January 1, 2008. Similar to the

SunTrust Retirement Plan, due to the current funded status of the NCF Retirement Plan, SunTrust did not make a

contribution for the 2010 plan year.

SunTrust also maintains unfunded, noncontributory nonqualified supplemental defined benefit pension plans that cover key

executives of the Company. The plans provide defined benefits based on years of service and final average salary. SunTrust’s

obligations for these nonqualified supplemental defined benefit pension plans are included within the qualified Pension Plans

in the tables presented in this section under “Pension Benefits”.

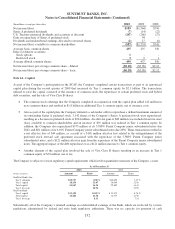

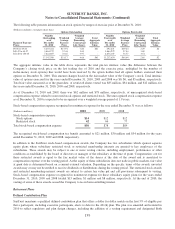

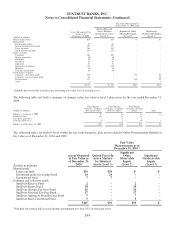

On February 13, 2007, the SERP was amended to reduce the benefit formula for future service accruals. Current participants

in the SunTrust SERP will continue to earn future accruals under a reduced final average earnings formula. All future

participants and ERISA Excess Plan participants will accrue benefits under benefit formulas that mirror the revised benefit

formulas in the SunTrust Retirement Plan. The effective date for changes impacting the SERP was January 1, 2008. After

January 1, 2008, a new SERP cash balance formula was implemented for existing participants with no limit on pay for SERP

Tier 2 participants and a minimum preserved benefit for SERP participants at December 31, 2007. On December 31, 2007,

SunTrust also adopted an additional written amendment to the SunTrust Banks, Inc. ERISA Excess Plan. This amendment

implemented changes to mirror the cash balance changes in the qualified Pension Plan, but with an earnings limit of two

times the qualified plan’s eligible earnings.

140