SunTrust 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

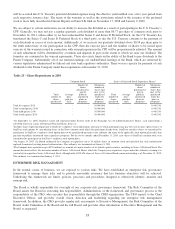

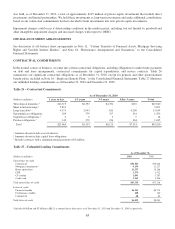

Our determination of the ALLL for commercial loans is sensitive to the assigned internal risk ratings and inherent loss rates

at December 31, 2010. In the event that 10 percent of loans within this portfolio segment experienced downgrades of two

internal risk ratings, the ALLL for the commercial portfolio would increase by approximately $150 million at December 31,

2010. In the event that estimated loss severity rates for the entire commercial loan portfolio increased by 10 percent, the

ALLL for the commercial portfolio would increase by approximately $129 million at December 31, 2010. Our determination

of the allowance for residential and consumer loans is also sensitive to changes in estimated loss severity rates. In the event

that estimated loss severity rates for the residential and consumer loan portfolio increased by 10 percent, the ALLL for the

residential and consumer portfolios would increase, in total, by approximately $154 million at December 31, 2010. Because

several quantitative and qualitative factors are considered in determining the ALLL, these sensitivity analyses do not

necessarily reflect the nature and extent of future changes in the ALLL. They are intended to provide insights into the impact

of adverse changes in risk rating and estimated loss severity rates and do not imply any expectation of future deterioration in

the risk ratings or loss rates. Given current processes employed, management believes the risk ratings and inherent loss rates

currently assigned are appropriate. It is possible that others, given the same information, may at any point in time reach

different reasonable conclusions that could be significant to our financial statements.

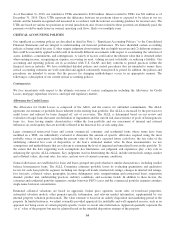

In addition to the ALLL, we also estimate probable losses related to unfunded lending commitments, such as letters of credit

and binding unfunded loan commitments. Unfunded lending commitments are analyzed and segregated by risk similar to

funded loans based on our internal risk rating scale. These risk classifications, in combination with an analysis of historical

loss experience, probability of commitment usage, and any other pertinent information, result in the estimation of the reserve

for unfunded lending commitments.

Our financial results are affected by the changes in and the absolute level of the Allowance for Credit Losses. This process

involves our analysis of complex internal and external variables, and it requires that we exercise judgment to estimate an

appropriate Allowance for Credit Losses. As a result of the uncertainty associated with this subjectivity, we cannot assure the

precision of the amount reserved should we experience sizeable loan or lease losses in any particular period. For example,

changes in the financial condition of individual borrowers, economic conditions, or the condition of various markets in which

collateral may be sold could require us to significantly decrease or increase the level of the Allowance for Credit Losses.

Such an adjustment could materially affect net income as a result of the change in provision for credit losses. During 2009

and 2010, we experienced elevated delinquencies and net charge-offs in residential real estate loans due to the deterioration

of the housing market. These market conditions were considered in deriving the estimated Allowance for Credit Losses;

however, given the continued economic challenges and uncertainties, the ultimate amount of loss could vary from that

estimate. For additional discussion of the ALLL see the “Allowance for Credit Losses” and “Nonperforming Assets” sections

in this MD&A as well as Note 6, “Loans,” and Note 7, “Allowance for Credit Losses,” to the Consolidated Financial

Statements.

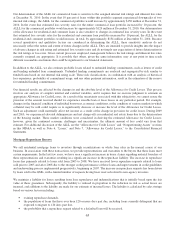

Mortgage Repurchase Reserve

We sell residential mortgage loans to investors through securitizations or whole loan sales in the normal course of our

business. In association with these transactions, we provide representations and warranties to the buyers that these loans meet

certain requirements. In the last few years, we have seen a significant increase in buyer claims regarding material breaches of

these representations and warranties resulting in a significant increase in the repurchase liability. The increase in repurchase

losses has primarily related to loans sold from 2005 to 2008. We have received fewer repurchase requests related to loans

sold prior to 2005 and after 2008 due to the stronger credit performance of these loans and improvements in credit guidelines

and underwriting process implemented progressively, beginning in 2007. The increase in repurchase requests has been driven

by loans sold to the GSEs, with a limited number of requests having been received related to non-agency investors.

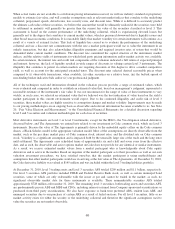

We maintain a liability for losses resulting from loan repurchases and indemnifications that is initially based upon the fair

value of these guarantees. Subsequently, the liability is reduced in proportion to the reduction in risk as actual losses are

incurred, and additions to the liability are made for our estimate of incurred losses. The liability is calculated by sales vintage

based on various factors including:

•existing repurchase demands,

•the population of loans that have ever been 120 or more days past due, including loans currently delinquent that are

expected to migrate to 120 days past due,

•the probability that a repurchase request related to a defaulted loan will be received,

65