SunTrust 2010 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

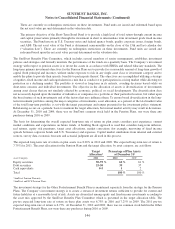

Cash Flow Hedges

The Company utilizes a comprehensive risk management strategy to monitor sensitivity of earnings to movements in interest

rates. Specific types of funding and principal amounts hedged are determined based on prevailing market conditions and the

shape of the yield curve. In conjunction with this strategy, the Company may employ various interest rate derivatives as risk

management tools to hedge interest rate risk from recognized assets and liabilities or from forecasted transactions. The terms

and notional amounts of derivatives are determined based on management’s assessment of future interest rates, as well as

other factors. The Company establishes parameters for derivative usage, including identification of assets and liabilities to

hedge, derivative instruments to be utilized, and notional amounts of hedging relationships. At December 31, 2010 and 2009,

the Company’s only outstanding interest rate hedging relationships involve interest rate swaps that have been designated as

cash flow hedges of probable forecasted transactions related to recognized floating rate loans.

Interest rate swaps have been designated as hedging the exposure to the benchmark interest rate risk associated with floating

rate loans. At December 31, 2010 and 2009, the maximum range of hedge maturities for hedges of floating rate loans is one

to six years and one to five years, respectively, with the weighted average being 3.5 years and 3.3 years, respectively.

Ineffectiveness on these hedges was de minimis during the years ended December 31, 2010 and 2009. As of December 31,

2010, $368 million, net of tax, of the deferred net gains on derivatives that are recorded in AOCI are expected to be

reclassified to net interest income over the next twelve months in connection with the recognition of interest income on these

hedged items.

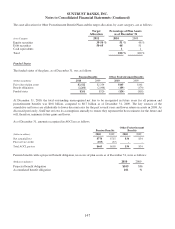

During the third quarter of 2008, the Company executed The Agreements on 30 million common shares of Coke. A

consolidated subsidiary of SunTrust owns 22.9 million Coke common shares and a consolidated subsidiary of the Bank owns

7.1 million Coke common shares. These two subsidiaries entered into separate derivative contracts on their respective

holdings of Coke common shares with a large, unaffiliated financial institution (the “Counterparty”). Execution of The

Agreements (including the pledges of the Coke common shares pursuant to the terms of The Agreements) did not constitute a

sale of the Coke common shares under U.S. GAAP for several reasons, including that ownership of the common shares was

not legally transferred to the Counterparty. The Agreements were zero-cost equity collars at inception, which caused the

Agreements to be derivatives in their entirety. The Company has designated The Agreements as cash flow hedges of the

Company’s probable forecasted sales of its Coke common shares, which are expected to occur between 6.5 and 7 years from

The Agreements’ effective date, for overall price volatility below the strike prices on the floor (purchased put) and above the

strike prices on the ceiling (written call). Although the Company is not required to deliver its Coke common shares under

The Agreements, the Company has asserted that it is probable that it will sell all of its Coke common shares at or around the

settlement date of The Agreements. The Federal Reserve’s approval for Tier 1 capital treatment was significantly based on

this expected disposition of the Coke common shares under The Agreements or in another market transaction. Both the sale

and the timing of such sale remain probable to occur as designated. At least quarterly, the Company assesses hedge

effectiveness and measures hedge ineffectiveness with the effective portion of the changes in fair value of The Agreements

recorded in AOCI and any ineffective portions recorded in trading account profits/(losses) and commissions. None of the

components of The Agreements’ fair values are excluded from the Company’s assessments of hedge effectiveness. Potential

sources of ineffectiveness include changes in market dividends and certain early termination provisions. Ineffectiveness

gains of $2 million and $1 million were recognized during the years ended December 31, 2010 and 2009, respectively. No

ineffectiveness was recognized during the year ended December 31, 2008. Ineffectiveness gains were recorded in trading

account profits/(losses) and commissions.Other than potential measured hedge ineffectiveness, no amounts are expected to

be reclassified from AOCI over the next twelve months and any remaining amounts recorded in AOCI will be reclassified to

earnings when the probable forecasted sales of the Coke common shares occur.

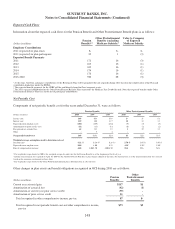

Economic Hedging and Trading Activities

In addition to designated hedging relationships, the Company also enters into derivatives as an end user as a risk

management tool to economically hedge risks associated with certain non-derivative and derivative instruments, along with

entering into derivatives in a trading capacity with its clients.

The primary risks that the Company economically hedges are interest rate risk, foreign exchange risk, and credit risk. The

economic hedging activities are accomplished by entering into individual derivatives or by using derivatives on a macro

155