SunTrust 2010 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

Pillars. Draws on the facilities are subject to the purchase price (or borrowing base) formula that, in many cases,

excludes defaulted assets to the extent that they exceed available over-collateralization in the form of non-defaulted

assets, and may also provide the liquidity banks with loss protection equal to a portion of the loss protection provided for

in the related securitization agreement. Additionally, there are transaction specific covenants and triggers that are tied to

the performance of the assets of the relevant seller/servicer that may result in a transaction termination event, which, if

continuing, would require funding through the related liquidity facility. Finally, in a termination event of Three Pillars,

such as if its tangible net worth falls below $5,000 for a period in excess of 15 days, Three Pillars would be unable to

issue CP, which would likely result in funding through the liquidity facilities. Draws under the credit enhancement are

also available in all circumstances, but are generally used to the extent required to make payment on any maturing CP if

there are insufficient funds from collections of receivables or the use of liquidity facilities. The required amount of credit

enhancement at Three Pillars will vary from time to time as new receivable pools are purchased or removed from its

asset portfolio, but is generally equal to 10% of the aggregate commitments of Three Pillars.

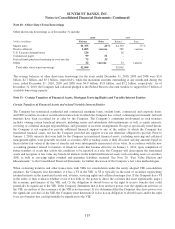

Due to the consolidation of Three Pillars, the Company’s maximum exposure to potential loss was $4.2 billion as of

December 31, 2010, which represents the Company’s exposure to the lines of credit that Three Pillars had extended to its

clients. Prior to consolidation, the Company had $3.8 billion and $371 million, respectively, of liquidity facilities and

other credit enhancements outstanding as of December 31, 2009. The Company did not recognize any liability on its

Consolidated Balance Sheets related to these liquidity facilities and other credit enhancements as of December 31, 2010

or December 31, 2009, as no amounts had been drawn, nor were any draws probable to occur, such that a loss should

have been accrued. In addition, no losses were recognized by the Company in connection with these commitments

during the years ended December 31, 2010, 2009 and 2008.

Total Return Swaps

The Company has had involvement with various VIEs related to its TRS business. The Company had unwound prior

transactions during 2009, such that no such transactions were outstanding at December 31, 2009. However, during 2010,

the Company began to execute new TRS transactions.

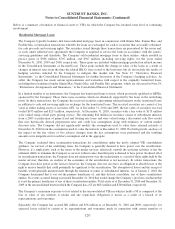

Under the matched book TRS business model, the VIEs purchase assets (typically loans) from the market, which are

identified by third party clients, that serve as the underlying reference assets for a TRS between the VIE and the

Company and a mirror TRS between the Company and its third party clients. The TRS contracts between the VIEs and

the Company hedge the Company’s exposure to the TRS contracts with its third party clients. These third parties are not

related parties to the Company, nor are they and the Company de facto agents of each other. In order for the VIEs to

purchase the reference assets, the Company provides senior financing, in the form of demand notes, to these VIEs. The

TRS contracts pass through interest and other cash flows on the assets owned by the VIEs to the third parties, along with

exposing the third parties to depreciation on the assets and providing them with the rights to appreciation on the assets.

The terms of the TRS contracts require the third parties to post initial collateral, in addition to ongoing margin as the fair

values of the underlying assets change. Although the Company has always caused the VIEs to purchase a reference asset

in response to the addition of a reference asset by its third party clients, there is no legal obligation between the

Company and its third party clients for the Company to cause the VIEs to purchase the assets.

The Company considered the new VIE consolidation guidance, which requires an evaluation of the substantive

contractual and non-contractual aspects of transactions involving VIEs, for VIEs established subsequent to January 1,

2010. The Company and its third party clients are the only VI holders. As such, the Company evaluated the nature of all

VIs and other interests and involvement with the VIEs, in addition to the purpose and design of the VIEs, relative to the

risks they were designed to create. The purpose and design of a VIE are key components of a consolidation analysis and

any power should be analyzed based on the substance of that power relative to the purpose and design of the VIE. The

VIEs were designed for the benefit of the third parties and would not exist if the Company did not enter into the TRS

contracts with the third parties. The activities of the VIEs are restricted to buying and selling reference assets with

respect to the TRS contracts entered into between the Company and its third party clients and the risks/benefits of any

such assets owned by the VIEs are passed to the third party clients via the TRS contracts. The TRS contracts between the

Company and its third party clients have a substantive effect on the design of the overall transaction and the VIEs. Based

on its evaluation, the Company has determined that it is not the primary beneficiary of the VIEs, as the design of the

TRS business results in the Company having no substantive power to direct the significant activities of the VIEs.

127