SunTrust 2010 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

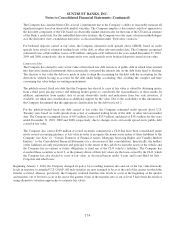

have been considered level 3 securities from the time that these auctions began failing in 2008, causing a significant

decrease in the volume and level of activity in these markets; this decrease in volume and activity required the use of

significant unobservable inputs into the Company’s valuations. Student loan ABS held by the Company are

generally collateralized by FFELP student loans, the majority of which benefit from a 97% (or higher) government

guarantee of principal and interest. As a result of an increase in observable market trades and bids for similar senior

securities, the Company determined that these securities were now level 2 instruments. For subordinate securities in

the same structure, the Company adjusts valuations on the senior securities based on the likelihood that the issuer

will refinance in the near term, a security’s level of subordination in the structure, and/or the perceived risk of the

issuer as determined by credit ratings or total leverage of the trust. These adjustments may be significant, and, as

such, the subordinate student loan ARS continue to be classified as level 3.

Other level 3 AFS ABS includes interests in third party securitizations of auto loans and home equity lines of credit

that are vintage 2003-2004. Level 3 trading ABS includes ARS collateralized by student loans. The Company’s

retained interest in a student loan securitization was eliminated upon consolidation of the student loan trust, resulting

in a decrease in level 3 ABS during the year ended December 31, 2010. See Note 11, “Certain Transfers of Financial

Assets, Mortgage Servicing Rights, and Variable Interest Entities,” to the Consolidated Financial Statements for

further discussion.

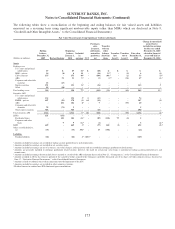

Generally, the Company attempts to obtain pricing for these level 3 securities from an independent pricing service or

third party brokers who have experience in valuing certain investments. This pricing may be used as either direct

support for the valuations or used to validate outputs from the Company’s own proprietary models. The Company

evaluates third party pricing to determine the reasonableness of the information relative to changes in market data,

such as any recent trades, market information received from outside market participants and analysts, and/or changes

in the underlying collateral performance. When actual trades are not available to corroborate pricing information, the

Company uses industry-standard or proprietary models to estimate fair value and considers assumptions that are

generally not observable in the current markets for the specific securities, such as relevant market indices that

correlate to the underlying collateral, prepayment speeds, default rates, loss severity rates and discount rates. During

the year ended December 31, 2010, the Company began to observe a return of liquidity to the markets, resulting in

the availability of more pricing information from third parties and a reduction in the need to use internal pricing

models to estimate fair value. Even though limited third party pricing has been available, the Company continues to

classify certain ABS as level 3, as the Company believes that pricing relies on a significant amount of unobservable

assumptions.

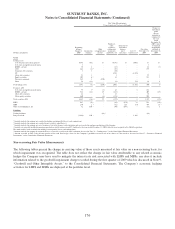

Corporate and other debt securities

Corporate debt securities are predominantly comprised of senior and subordinate debt obligations of domestic

corporations. These securities are valued by an independent pricing service that is widely used by market

participants. The Company has determined that this pricing service is using similar instruments, or in some cases the

same instruments, that are trading in the markets as the basis for its estimates of fair value. Because the Company

does not have direct access to the pricing service’s valuation sources, the Company has determined that

classification of these instruments as level 2 is appropriate. Other debt securities in level 3 include bonds that are

redeemable with the issuer at par and cannot be traded in the market; as such, no significant observable market data

for these instruments is available.

Commercial paper

From time to time, the Company trades third party CP that is generally short-term in nature (less than 30 days) and

highly rated (A-1/P-1). The Company estimates the fair value of the CP that it trades based on observable pricing

from executed trades of similar instruments.

Equity securities

Level 2 equity securities, both trading and AFS, consist primarily of MMMFs that trade at a $1 net asset value,

which is considered the fair market value of those fund shares.

Level 3 equity securities classified as trading include nonmarketable preferred shares in municipal funds issued as

ARS that the Company has purchased since the auction rate market began failing in February 2008. These ARS have

169