SunTrust 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

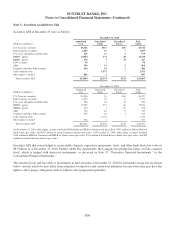

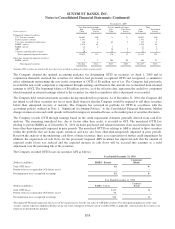

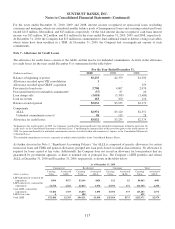

indicator. The Company assigns credit ratings to commercial borrowers in a manner generally consistent with NRSRO

guidelines, except that the Company’s credit ratings also consider proprietary loss severity expectations in addition to

borrower creditworthiness to derive a dual rating approach to risk of loss. An independent credit rating agency will rate a

borrower with an elevated risk of default as noninvestment grade. There will be instances, however, where the Company

rates the risk of loss for a loan to this type of borrower as investment grade due to a lower expected loss severity, which is

influenced by collateral and other structural factors. Ratings are updated at least annually or more frequently if there is a

material change in creditworthiness. For consumer and residential loans, the Company believes that consumer credit risk, as

assessed by the FICO scoring method, is a relevant credit quality indicator. FICO scores are obtained at origination as part of

the Company’s formal underwriting process, and refreshed FICO scores are obtained by the Company at least quarterly.

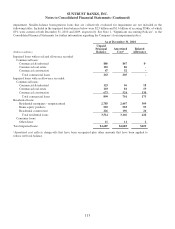

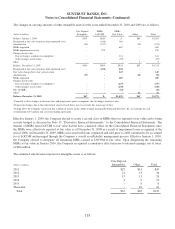

LHFI by credit quality indicator are shown in the tables below:

Commercial & industrial Commercial real estate Commercial construction

(Dollars in millions) 2010 2009 2010 2009 2010 2009

Credit rating:

Investment grade $23,163 $22,879 $1,230 $2,017 $144 $199

Non-investment grade 21,590 21,129 4,937 4,677 2,424 4,785

Total $44,753 $44,008 $6,167 $6,694 $2,568 $4,984

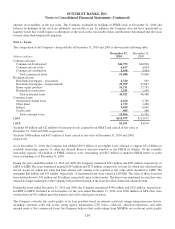

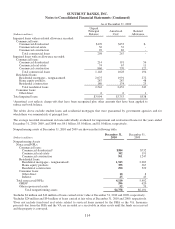

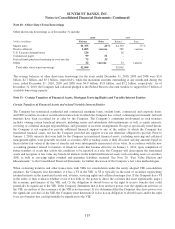

Residential mortgages -

nonguaranteed Home equity products Residential construction

2010 2009 2010 2009 2010 2009

Current FICO score range:

700 and above $15,920 $16,086 $11,673 $12,342 $828 $1,128

620 - 699 4,457 4,644 2,897 3,128 258 355

Below 62013,582 5,117 2,181 2,313 205 426

Total $23,959 $25,847 $16,751 $17,783 $1,291 $1,909

Consumer - other direct2Consumer - indirect Consumer - credit cards

2010 2009 2010 2009 2010 2009

Current FICO score range:

700 and above $973 $799 $6,780 $4,160 $258 $277

620 - 699 231 219 1,799 1,551 149 182

Below 6201105 111 920 954 78 107

Total $1,309 $1,129 $9,499 $6,665 $485 $566

1For substantially all loans with refreshed FICO scores below 620, the borrower’s FICO score at the time of origination

exceeded 620 but has since deteriorated as the loan has seasoned.

2Excludes $413 million and $355 million as of December 31, 2010 and 2009, respectively, of private-label student loans with

third-party insurance.

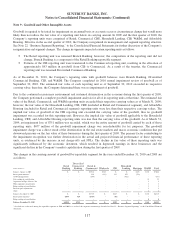

The tables above exclude student loans and residential mortgages that were guaranteed by government agencies and for

which there was nominal risk of principal loss.

111