SunTrust 2010 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

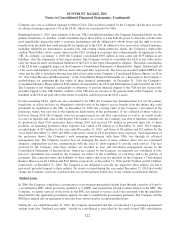

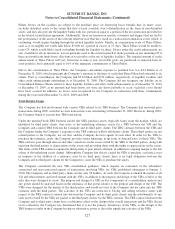

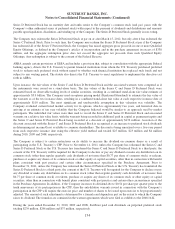

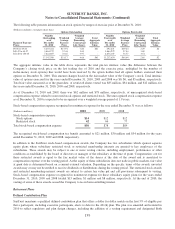

(In millions, except per share data) 2010 2009 2008

Net income/(loss) $189 ($1,564) $796

Series A preferred dividends (7) (14) (22)

U.S. Treasury preferred dividends and accretion of discount (267) (266) (27)

Gain on repurchase of Series A preferred stock -94 -

Dividends and undistributed earnings allocated to unvested shares (2) 17 (6)

Net income/(loss) available to common shareholders ($87) ($1,733) $741

Average basic common shares 495 435 349

Effect of dilutive securities:

Stock options 1--

Restricted stock 321

Average diluted common shares 499 437 350

Net income/(loss) per average common share – diluted ($0.18) ($3.98) $2.12

Net income/(loss) per average common share – basic ($0.18) ($3.98) $2.12

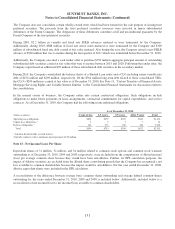

Note 14 - Capital

As part of the Company’s participation in the SCAP, the Company completed certain transactions as part of an announced

capital plan during the second quarter of 2009 that increased its Tier 1 common equity by $2.1 billion. The transactions

utilized to raise the capital consisted of the issuance of common stock, the repurchase of certain preferred stock and hybrid

debt securities, and the sale of Visa Class B shares.

•The common stock offerings that the Company completed in conjunction with the capital plan added 142 million in

new common shares and resulted in $1.8 billion in additional Tier 1 common equity, net of issuance costs.

•Also as part of the capital plan, the Company initiated a cash tender offer to repurchase a defined maximum amount of

its outstanding Series A preferred stock. 3,142 shares of the Company’s Series A preferred stock were repurchased,

resulting in a decrease in preferred stock of $314 million. An after-tax gain of $89 million was included in net income/

(loss) available to common shareholders and an increase of $91 million was realized in Tier 1 common equity. In

addition, the Company also repurchased $375 million of its 5.588% Parent Company junior subordinated notes due

2042, and $61 million of its 6.10% Parent Company junior subordinated notes due 2036. These transactions resulted in

a net after-tax loss of $44 million, as a result of a $165 million after-tax loss related to the extinguishment of the

preferred stock forward sale agreement associated with the repurchase of the 5.588% Parent Company junior

subordinated notes, and a $121 million after-tax gain from the repurchase of the Parent Company junior subordinated

notes. The aggregate impact of the debt repurchases was a $121 million increase to Tier 1 common equity.

•Another element of the capital plan involved the sale of Visa Class B shares resulting in an increase in Tier 1

common equity of $70 million, net of tax.

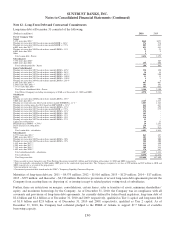

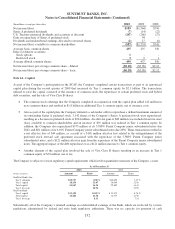

The Company is subject to various regulatory capital requirements which involve quantitative measures of the Company’s assets.

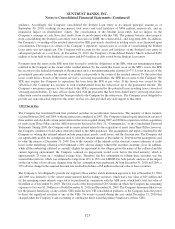

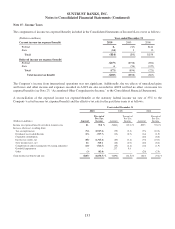

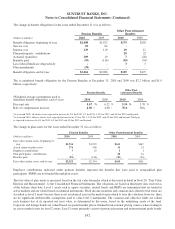

As of December 31

2010 2009

(Dollars in millions) Amount Ratio Amount Ratio

SunTrust Banks, Inc.

Tier 1 common $10,737 8.08 % $10,692 7.67 %

Tier 1 capital 18,156 13.67 18,069 12.96

Total capital 21,967 16.54 22,895 16.43

Tier 1 leverage 10.94 10.90

SunTrust Bank

Tier 1 capital $13,120 10.05 % $ 11,973 8.76 %

Total capital 16,424 12.58 16,377 11.98

Tier 1 leverage 8.33 7.51

Substantially all of the Company’s retained earnings are undistributed earnings of the Bank, which are restricted by various

regulations administered by federal and state bank regulatory authorities. There was no capacity for payment of cash

132