SunTrust 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consumer loans increased by $4.5 billion, or 39%, during the year ended December 31, 2010. The increase was primarily

attributable to a $1.5 billion increase in guaranteed student loans, which included the $0.5 billion impact of consolidating a

student loan trust during the year, and a $2.8 billion increase in indirect consumer loans, which included purchases of $1.7

billion in automobile loans during the year. We have been opportunistic with consumer loan purchases completed to date, as

we have found them to have attractive returns and credit characteristics.

Loans Held for Sale

LHFS decreased by $1.2 billion, or 25%, during year ended December 31, 2010. The decline is attributable to recently

enacted legislation that prohibits us from originating federally-guaranteed student loans and to lower levels of mortgage loan

originations, partially offset by the addition of LHFS related to a CLO entity that was consolidated as of January 1, 2010.

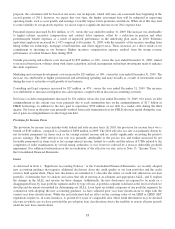

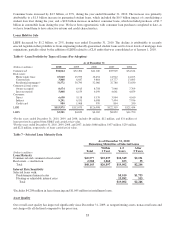

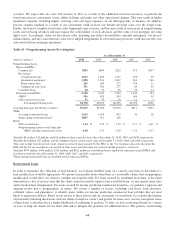

Table 6 - Loan Portfolio by Types of Loans (Pre-Adoption)

As of December 31

(Dollars in millions) 2010 2009 2008 2007 2006

Commercial1$34,064 $32,494 $41,040 $35,929 $34,614

Real estate:

Home equity lines 15,040 15,953 16,454 14,912 14,103

Construction 3,848 6,647 9,864 13,777 13,893

Residential mortgages231,572 30,790 32,066 32,780 33,830

Commercial real estate:

Owner occupied 8,674 8,915 8,758 7,948 7,709

Investor owned 5,868 6,159 6,199 4,661 4,859

Consumer:

Direct 6,638 5,118 5,139 3,964 4,160

Indirect 9,291 6,531 6,508 7,494 7,936

Credit card 980 1,068 970 854 350

LHFI $115,975 $113,675 $126,998 $122,319 $121,454

LHFS $3,501 $4,670 $4,032 $8,852 $11,790

1For the years ended December 31, 2010, 2009, and 2008, includes $4 million, $12 million, and $31 million of

loans previously acquired from GB&T and carried at fair value.

2For the years ended December 31, 2010, 2009, 2008, and 2007, includes $488 million, $437 million, $239 million,

and $221 million, respectively, of loans carried at fair value.

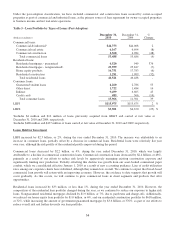

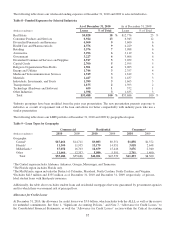

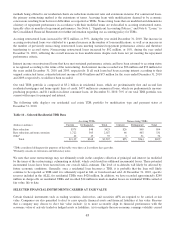

Table 7 – Selected Loan Maturity Data

As of December 31, 2010

Remaining Maturities of Selected Loans

Total

Within

1 Year

1-5

Years

After

5 Years

(Dollars in millions)

Loan Maturity

Commercial and commercial real estate1$45,577 $25,037 $18,349 $2,191

Real estate - construction 2,568 1,860 653 55

Total $48,145 $26,897 $19,002 $2,246

Interest Rate Sensitivity

Selected loans with:

Predetermined interest rates $5,010 $1,733

Floating or adjustable interest rates 13,992 513

Total $19,002 $2,246

1Excludes $4,298 million in lease financing and $1,045 million in installment loans.

Asset Quality

Our overall asset quality has improved significantly since December 31, 2009, as nonperforming assets, nonaccrual loans and

net charge-offs all declined compared to the prior year.

35