SunTrust 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

nonconforming loans. The Company estimates this liability based on the likelihood of receiving a repurchase request, the

nature of any such requests, and current and estimated future defaults, among other factors. The Company did not

repurchase a significant amount of these previously transferred loans during the years ended December 31, 2010, 2009, or

2008.

The transfer of loans to investors, whether through a whole loan sale or securitization transaction, exposes the Company

to losses related to potential defects in the securitization process and breaches of representations and warranties made by

the Company related to its compliance with underwriting and servicing guidelines and standards. As noted above, the

Company normally retains servicing rights when loans are transferred. As servicer, the Company makes representations

and warranties that it will service the loans in accordance with investor servicing guidelines and standards. These

guidelines and standards cover all aspects of servicing including collection and remittance of principal and interest,

administration of escrow for taxes and insurance, advancing principal, interest, taxes, insurance and collection expenses

on delinquent accounts, loss mitigation strategies including loan modifications, and foreclosures. Defects in the

securitization process or breaches of underwriting and servicing representations and warranties can result in loan

repurchases, as well as adversely affect the valuation of MSRs, servicing advances or other mortgage loan related

exposures, such as OREO. Beyond the repurchase loss contingencies discussed above and in Note 18, “Reinsurance

Arrangements and Guarantees,” to the Consolidated Financial Statements, the Company is not aware any defects or

breaches that have resulted in such contingent losses.

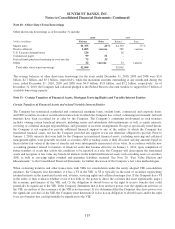

Commercial and Corporate Loans

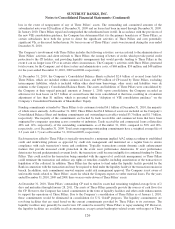

In 2007, the Company completed a $1.9 billion structured sale of corporate loans to multi-seller CP conduits, which are

VIEs administered by unrelated third parties, from which it retained a 3% residual interest in the pool of loans

transferred, which does not constitute a VI in the third party conduits as it relates to the unparticipated portion of the

loans. During the year ended December 31, 2009, the Company wrote this residual interest and related accrued interest

to zero, resulting in a loss of $17 million. This write-off was the result of the deterioration in the performance of the loan

pool to such an extent that the Company expected that it would no longer receive cash flows on the interest until the

senior participation interest had been repaid in full. At December 31, 2009, the carrying value of the Company’s

investment in the residual interest was zero; however, during 2010, the Company observed an improvement in the credit

quality of the underlying loans as well as a continued build up of over collateralization in the transaction as all cash

flows have been directed to repay the senior participation interest. As a result, during the year ended December 31, 2010,

the Company marked up the value of the residual interest to its estimated market value of $13 million at December 31,

2010. The key assumptions and inputs used by the Company in valuing this retained interest at December 31, 2010,

include the expected credit losses of 5%, prepayment speed of 20% and annual discount rate of 25%. Analyses of the

impact on the fair values of two adverse changes from the key assumptions were performed as of December 31, 2010

and the resulting amounts were insignificant for each key assumption and in the aggregate.

In conjunction with the transfer of the loans, the Company provided commitments in the form of liquidity facilities to these

conduits; the sum of these commitments, which represents the Company’s maximum exposure to loss under the facilities,

totaled $322 million at December 31, 2009. Due to deterioration in the loans that collateralize these facilities, the Company

recorded a contingent loss reserve of $16 million on the facilities during the year ended December 31, 2009. In January

2010, the administrator of the conduits drew on these commitments in full, resulting in a funded loan to the conduits that is

recorded on the Company’s Consolidated Balance Sheets. Upon funding the loan, the related contingent loss reserve was

reclassified and prospectively evaluated as part of the ALLL. This event did not modify the Company’s sale accounting

treatment or conclusion that it is not the primary beneficiary of these VIEs. In addition, no other events have occurred

during the year ended December 31, 2010 that would call into question either the Company’s sale accounting or the

Company’s conclusions that it is not the primary beneficiary of these VIEs. In February 2011, the Company exercised its

clean up call rights on the structured participation and repurchased the remaining corporate loans. In conjunction with the

clean up call, the outstanding amount of the liquidity facilities and the residual interest were paid off. The exercise of the

clean up call was not material to the Company’s financial condition, results of operations, or cash flows.

The Company has involvement with CLO entities that own commercial leveraged loans and bonds, certain of which

were transferred by the Company to the CLOs. In addition to retaining certain securities issued by the CLOs, the

121