SunTrust 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Short-term borrowings increased $455 million, or 8%, from December 31, 2009 to $5.8 billion as of December 31, 2010. The

increase was primarily attributable to an incremental $309 million of securities sold under agreement to repurchase and $300

million of dealer collateral held by the Company as of December 31, 2010. Additionally, the $99 million of CP issued during

2010 contributed to the rise in short-term borrowings. These increases were slightly offset by a decrease of $482 million in

Fed funds purchased overnight to $951 million as of December 31, 2010.

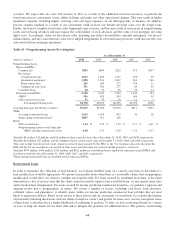

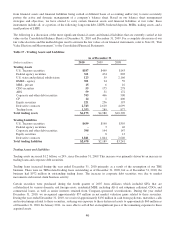

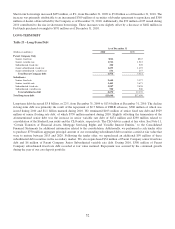

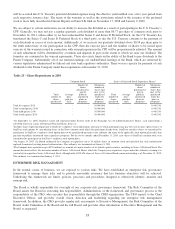

LONG-TERM DEBT

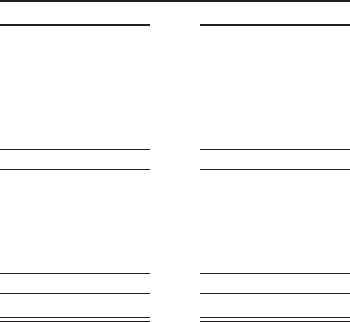

Table 23 – Long-Term Debt

As of December 31

(Dollars in millions) 2010 2009

Parent Company Only

Senior, fixed rate $922 $947

Senior, variable rate 1,512 1,512

Subordinated, fixed rate 200 505

Junior subordinated, fixed rate 1,693 1,693

Junior subordinated, variable rate 651 657

Total Parent Company debt 4,978 5,314

Subsidiaries

Senior, fixed rate 2,640 5,177

Senior, variable rate 3,443 3,671

Subordinated, fixed rate 2,087 2,828

Subordinated, variable rate 500 500

Total subsidiaries debt 8,670 12,176

Total long-term debt $13,648 $17,490

Long-term debt decreased $3.8 billion, or 22%, from December 31, 2009 to $13.6 billion at December 31, 2010. The decline

in long-term debt was primarily the result of the repayment of $2.7 billion of FHLB advances, $500 million of which was

issued during 2010 and $1.1 billion matured during 2010. We terminated $103 million of senior fixed rate debt and $929

million of senior floating rate debt, of which $750 million matured during 2010. Slightly offsetting the termination of the

aforementioned senior debt was the increase in senior variable rate debt of $474 million and $290 million related to

consolidation of the Student Loan entity and the CLO entity, respectively. The CLO debt is carried at fair value. See Note 11,

“Certain Transfers of Financial Assets, Mortgage Servicing Rights and Variable Interest Entities,” to the Consolidated

Financial Statements for additional information related to the consolidation. Additionally, we performed a cash tender offer

to purchase $750 million aggregate principal amount of our outstanding subordinated debt securities carried at fair value that

were to mature between 2015 and 2020. Following the tender offer, we repurchased an additional $99 million of these

subordinated debt securities in the secondary market. We also repurchased $34 million of Parent Company senior fixed rate

debt and $6 million of Parent Company Junior Subordinated variable rate debt. During 2010, $300 million of Parent

Company subordinated fixed rate debt recorded at fair value matured. Repayment was assisted by the continued growth

during the year of our core deposit portfolio.

52