SunTrust 2010 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

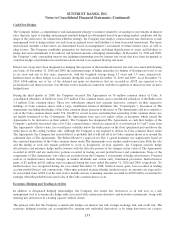

Note 20 - Fair Value Election and Measurement

The Company carries certain assets and liabilities at fair value on a recurring basis and appropriately classifies them as level

1, level 2 or level 3 within the fair value hierarchy. The Company’s recurring fair value measurements are based on a

requirement to carry such assets and liabilities at fair value or the Company’s election to carry certain financial assets and

financial liabilities at fair value. Assets and liabilities that are required to be carried at fair value on a recurring basis include

trading securities, securities AFS, and derivative financial instruments. Assets and liabilities that the Company has elected to

carry at fair value on a recurring basis include certain LHFI and LHFS, MSRs, certain brokered deposits, and certain

issuances of fixed rate debt.

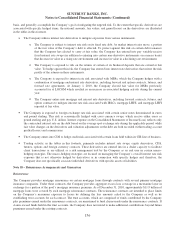

In certain circumstances, fair value enables a company to more accurately align its financial performance with the economic

value of actively traded or hedged assets or liabilities. Fair value also enables a company to mitigate the non-economic

earnings volatility caused from financial assets and financial liabilities being carried at different bases of accounting, as well

as to more accurately portray the active and dynamic management of a company’s balance sheet. In cases where the

Company believed that fair value was more representative of the results of its activities, the Company elected to carry certain

financial instruments at fair value, as discussed further herein.

The classification of an instrument as level 3 versus level 2 involves judgment and is based on a variety of subjective factors.

A market is considered “inactive” if significant decreases in the volume and level of activity for the asset or liability have

been observed. In determining whether a market is inactive, the Company evaluates such factors as the number of recent

transactions in either the primary or secondary markets, whether price quotations are current, the nature of the market

participants, the variability of price quotations, the significance of bid/ask spreads, declines in (or the absence of) new

issuances, and the availability of public information. Inactive markets necessitate the use of additional judgment when

valuing financial instruments, such as pricing matrices, cash flow modeling, and the selection of an appropriate discount rate.

The assumptions used to estimate the value of an instrument where the market was inactive were based on the Company’s

assessment of the assumptions a market participant would use to value the instrument in an orderly transaction and included

considerations of illiquidity in the current market environment. Where the Company determined that a significant decrease in

the volume and level of activity had occurred, the Company was then required to evaluate whether significant adjustments

were required to market data to arrive at an exit price.

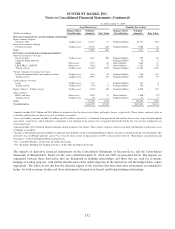

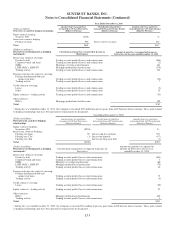

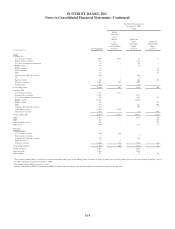

The following tables present certain information regarding assets and liabilities measured at fair value on a recurring basis and

the changes in fair value for those specific financial instruments in which fair value has been elected. The tables do not reflect

the change in fair value attributable to the related economic hedges the Company used to mitigate the market-related risks

associated with the financial instruments. The changes in the fair value of economic hedges were also recorded in trading

account profits/(losses) and commissions, mortgage production related income, or mortgage servicing related income/(loss), as

appropriate, and are designed to partially offset the change in fair value of the financial instruments referenced in the tables

below. The Company’s economic hedging activities are deployed at both the instrument and portfolio level.

162