SunTrust 2010 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

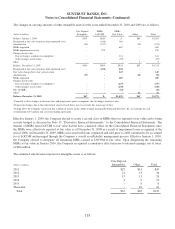

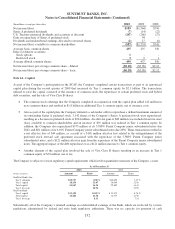

guidance. Accordingly, the Company consolidated the Student Loan entity at its unpaid principal amount as of

September 30, 2010, resulting in incremental total assets and total liabilities of $486 million, respectively, and an

immaterial impact on shareholders’ equity. The consolidation of the Student Loan entity had no impact on the

Company’s earnings or cash flows that results from its involvement with this VIE. The primary balance sheet impacts

from consolidating the Student Loan entity were increases in LHFI, the related ALLL, and long-term debt. In addition,

the Company’s ownership of the residual interest in the SPE, previously classified in trading assets, was eliminated upon

consolidation. The impact on certain of the Company’s regulatory capital ratios as a result of consolidating the Student

Loan entity was not significant. The Company will account for the assets and liabilities of the Student Loan entity in

subsequent periods on a cost basis. At December 31, 2010, the Company’s Consolidated Balance Sheets reflected $458

million of loans held by the Student Loan entity and $474 million of debt issued by the Student Loan entity.

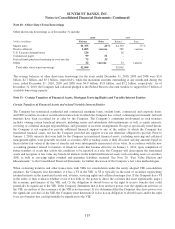

Payments from the assets in the SPE must first be used to settle the obligations of the SPE, with any remaining payments

remitted to the Company as the owner of the residual interest. To the extent that losses occur on the SPE’s assets, the SPE

has recourse to the federal government as the guarantor up to a maximum guarantee amount of 97%. Losses in excess of the

government guarantee reduce the amount of available cash payable to the owner of the residual interest. To the extent that

losses result from a breach of the master servicer’s servicing responsibilities, the SPE has recourse to the Company; the

SPE may require the Company to repurchase the loan from the SPE at par value. If the breach was caused by the

subservicer, the Company has recourse to seek reimbursement from the subservicer up to the guaranteed amount. The

Company’s maximum exposure to loss related to the SPE is represented by the potential losses resulting from a breach of

servicing responsibilities. To date, all loss claims filed with the guarantor that have been denied due to servicing errors have

either been cured or reimbursement has been provided to the Company by the subservicer. The Company is not obligated to

provide any noncontractual support to this entity, nor has it to date provided any such support to this entity.

CDO Securities

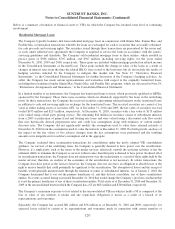

The Company has transferred bank trust preferred securities in securitization transactions. The majority of these transfers

occurred between 2002 and 2005, with one transaction completed in 2007. The Company retained equity interests in certain of

these entities and also holds certain senior interests that were acquired during 2007 and 2008 in conjunction with its acquisition

of assets from Three Pillars and the ARS transactions discussed in Note 21, “Contingencies,” to the Consolidated Financial

Statements. During 2009, the Company sold its senior interest related to the acquisition of assets from Three Pillars; however,

the Company continues to hold senior interests related to the ARS purchases. The assumptions and inputs considered by the

Company in valuing this retained interest include prepayment speeds, credit losses, and the discount rate. The Company did

not significantly modify the assumptions used to value the retained interest at December 31, 2010 from the assumptions used

to value the interest at December 31, 2009. Due to the seniority of the interests in the structure, current estimates of credit

losses in the underlying collateral could withstand a 20% adverse change without the securities incurring a loss. In addition,

while all the underlying collateral is currently eligible for repayment by the obligor, given the nature of the collateral and the

current repricing environment, the Company assumed no prepayment would occur before the final maturity, which is

approximately 23 years on a weighted average basis. Therefore, the key assumption in valuing these securities was the

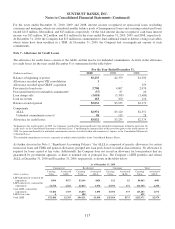

assumed discount rate, which was estimated to range from 14% to 16% over LIBOR. For both periods, analyses of the impact

on the fair values of two adverse changes from the key assumption were performed. At both December 31, 2010 and 2009, a

20% adverse change in the assumed discount rate resulted in declines of $5 million in the fair value of these securities.

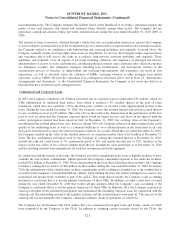

The Company is not obligated to provide any support to these entities and its maximum exposure to loss at December 31, 2010

and 2009 was limited to (i) the current senior interests held in trading securities, which had a fair value of $25 million and

(ii) the remaining senior interests expected to be purchased in conjunction with the ARS issue, which had a total fair value of

$4 million as of December 31, 2010. The total assets of the trust preferred CDO entities in which the Company has remaining

exposure to loss was $1.3 billion as of both December 31, 2010 and December 31, 2009. The Company determined that it was

not the primary beneficiary of any of these VIEs under the new VIE consolidation guidance, as the Company lacks the power

to direct the significant activities of any of the VIEs. No events occurred during the year ended December 31, 2010 that

changed either the Company’s sale accounting or conclusions that it is not the primary beneficiary of these VIEs.

123