SunTrust 2010 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

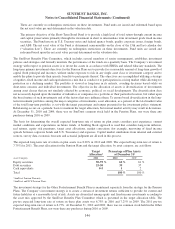

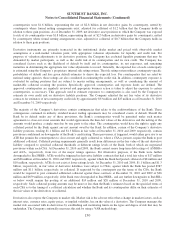

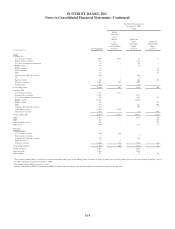

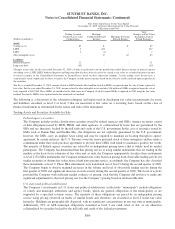

basis, and generally accomplish the Company’s goal of mitigating the targeted risk. To the extent that specific derivatives are

associated with specific hedged items, the notional amounts, fair values, and gains/(losses) on the derivatives are illustrated

in the tables in this footnote.

•The Company utilizes interest rate derivatives to mitigate exposures from various instruments.

OThe Company is subject to interest rate risk on its fixed rate debt. As market interest rates move, a portion

of the fair value of the Company’s debt is affected. To protect against this risk on certain debt issuances

that the Company has elected to carry at fair value, the Company has entered into pay variable-receive

fixed interest rate swaps (in addition to entering into certain non-derivative instruments on a macro basis)

that decrease in value in a rising rate environment and increase in value in a declining rate environment.

OThe Company is exposed to risk on the returns of certain of its brokered deposits that are carried at fair

value. To hedge against this risk, the Company has entered into interest rate derivatives that mirror the risk

profile of the returns on these instruments.

OThe Company is exposed to interest rate risk associated with MSRs, which the Company hedges with a

combination of mortgage and interest rate derivatives, including forward and option contracts, futures, and

forward rate agreements. At January 1, 2010, the Company elected fair value for MSRs previously

accounted for at LOCOM which resulted in an increase in associated hedging activity during the current

year.

OThe Company enters into mortgage and interest rate derivatives, including forward contracts, futures, and

option contracts to mitigate interest rate risk associated with IRLCs, mortgage LHFS, and mortgage LHFI

reported at fair value.

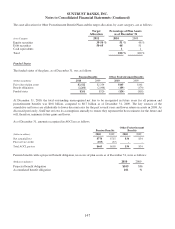

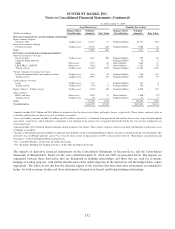

•The Company is exposed to foreign exchange rate risk associated with certain senior notes denominated in euros

and pound sterling. This risk is economically hedged with cross currency swaps, which receive either euros or

pound sterling and pay U.S. dollars. Interest expense on the Consolidated Statements of Income/(Loss) reflects only

the contractual interest rate on the debt based on the average spot exchange rate during the applicable period, while

fair value changes on the derivatives and valuation adjustments on the debt are both recorded within trading account

profits/(losses) and commissions.

•The Company enters into CDS to hedge credit risk associated with certain loans held within its CIB line of business.

•Trading activity, in the tables in this footnote, primarily includes interest rate swaps, equity derivatives, CDS,

futures, options and foreign currency contracts. These derivatives are entered into in a dealer capacity to facilitate

client transactions or are utilized as a risk management tool by the Company as an end user in certain macro-

hedging strategies. The macro-hedging strategies are focused on managing the Company’s overall interest rate risk

exposure that is not otherwise hedged by derivatives or in connection with specific hedges and, therefore, the

Company does not specifically associate individual derivatives with specific assets or liabilities.

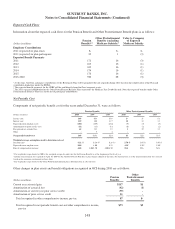

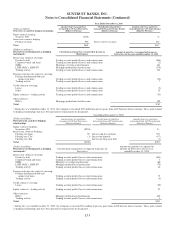

Note 18 – Reinsurance Arrangements and Guarantees

Reinsurance

The Company provides mortgage reinsurance on certain mortgage loans through contracts with several primary mortgage

insurance companies. Under these contracts, the Company provides aggregate excess loss coverage in a mezzanine layer in

exchange for a portion of the pool’s mortgage insurance premium. As of December 31, 2010, approximately $11.9 billion of

mortgage loans were covered by such mortgage reinsurance contracts. The reinsurance contracts are intended to place limits

on the Company’s maximum exposure to losses by defining the loss amounts ceded to the Company as well as by

establishing trust accounts for each contract. The trust accounts, which are comprised of funds contributed by the Company

plus premiums earned under the reinsurance contracts, are maintained to fund claims made under the reinsurance contracts. If

claims exceed funds held in the trust accounts, the Company does not intend to make additional contributions beyond future

premiums earned under the existing contracts.

156