SunTrust 2010 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

dividends to the Parent Company under these regulations at December 31, 2010 and 2009. The Company also has cash

reserves required by the Federal Reserve. As of December 31, 2010 and 2009, these reserve requirements totaled $1.4 billion

and $1.1 billion, respectively and were fulfilled with a combination of cash on hand and deposits at the Federal Reserve.

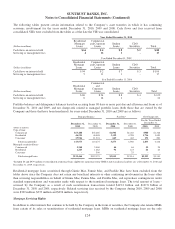

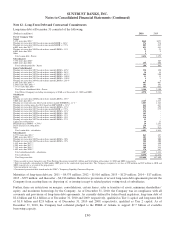

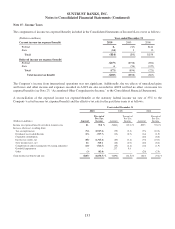

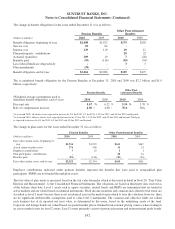

Preferred Stock

As of December 31

(Dollars in millions) 2010 2009

Series A (1,725 shares outstanding) $172 $172

Series C (35,000 shares outstanding) 3,442 3,424

Series D (13,500 shares outstanding) 1,328 1,321

$4,942 $4,917

On September 12, 2006, the Company issued depositary shares representing ownership interests in 5,000 shares of Perpetual

Preferred Stock, Series A, no par value and $100,000 liquidation preference per share (the “Series A Preferred Stock”). The

Company is authorized to issue 50,000 shares. The Series A Preferred Stock has no stated maturity and will not be subject to

any sinking fund or other obligation of the Company. Dividends on the Series A Preferred Stock, if declared, will accrue and be

payable quarterly at a rate per annum equal to the greater of three-month LIBOR plus 0.53%, or 4.00%. Dividends on the shares

are non-cumulative. Shares of the Series A Preferred Stock have priority over the Company’s common stock with regard to the

payment of dividends. As such, the Company may not pay dividends on or repurchase, redeem, or otherwise acquire for

consideration shares of its common stock unless dividends for the Series A Preferred Stock have been declared for that period,

and sufficient funds have been set aside to make payment. On or after September 15, 2011, the Series A Preferred Stock will be

redeemable at the Company’s option at a redemption price equal to $100,000 per share, plus any declared and unpaid dividends.

Except in certain limited circumstances, the Series A Preferred Stock does not have any voting rights.

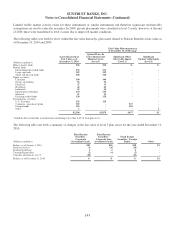

On November 14, 2008, as part of the CPP established by the U.S. Treasury under the EESA, the Company entered into a

Purchase Agreement with the U.S. Treasury pursuant to which the Company issued and sold to the U.S. Treasury 35,000

shares of the Company’s Fixed Rate Cumulative Perpetual Preferred Stock, Series C, having a liquidation preference of

$100,000 per share (the “Series C Preferred Stock”), and a ten-year warrant to purchase up to 11,891,280 shares of the

Company’s common stock, par value $1.00 per share, at an initial exercise price of $44.15 per share, for an aggregate

purchase price of $3.5 billion in cash.

Cumulative dividends on the Series C Preferred Stock will accrue on the liquidation preference at a rate of 5% per annum for the

first five years, and at a rate of 9% per annum thereafter, but will be paid only if, as, and when declared by the Board. The Series

C Preferred Stock has no maturity date and ranks senior to the Company’s common stock (and pari passu with the Company’s

other authorized series of preferred stock) with respect to the payment of dividends and distributions and amounts payable upon

liquidation, dissolution, and winding up of the Company. The Series C Preferred Stock generally is non-voting.

The Company may redeem the Series C Preferred Stock at par on or after December 15, 2011. Prior to this date, the

Company may redeem the Series C Preferred Stock at par if the Company has raised aggregate gross proceeds in one or more

Qualified Equity Offerings, as defined in the Company’s articles of incorporation and in the purchase agreement, in excess of

$875 million, and the aggregate redemption price does not exceed the aggregate net proceeds from such Qualified Equity

Offerings. Any redemption is subject to the consent of the Federal Reserve.

On December 31, 2008, as part of the CPP established by the U.S. Treasury under the EESA, the Company entered into a

Purchase Agreement with the U.S. Treasury dated December 31, 2008 pursuant to which the Company issued and sold to the

U.S. Treasury 13,500 shares of the Company’s Fixed Rate Cumulative Perpetual Preferred Stock, Series D, having a

liquidation preference of $100,000 per share (the “Series D Preferred Stock”), and a ten-year warrant to purchase up to

6,008,902 shares of the Company’s common stock, par value $1.00 per share, at an initial exercise price of $33.70 per share,

for an aggregate purchase price of $1.4 billion in cash.

Cumulative dividends on the Series D Preferred Stock will accrue on the liquidation preference at a rate of 5% per annum for

the first five years, and at a rate of 9% per annum thereafter, but will be paid only if, as, and when declared by the Board. The

133