SunTrust 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

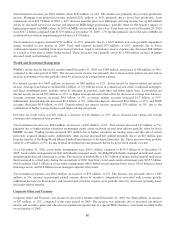

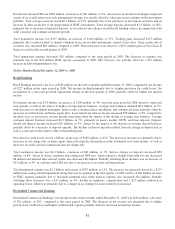

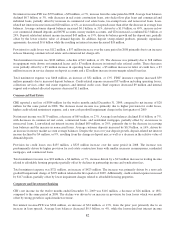

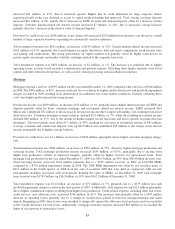

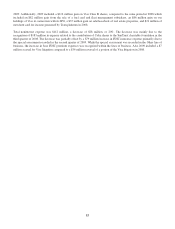

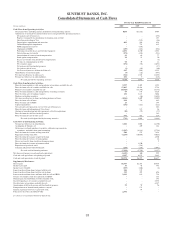

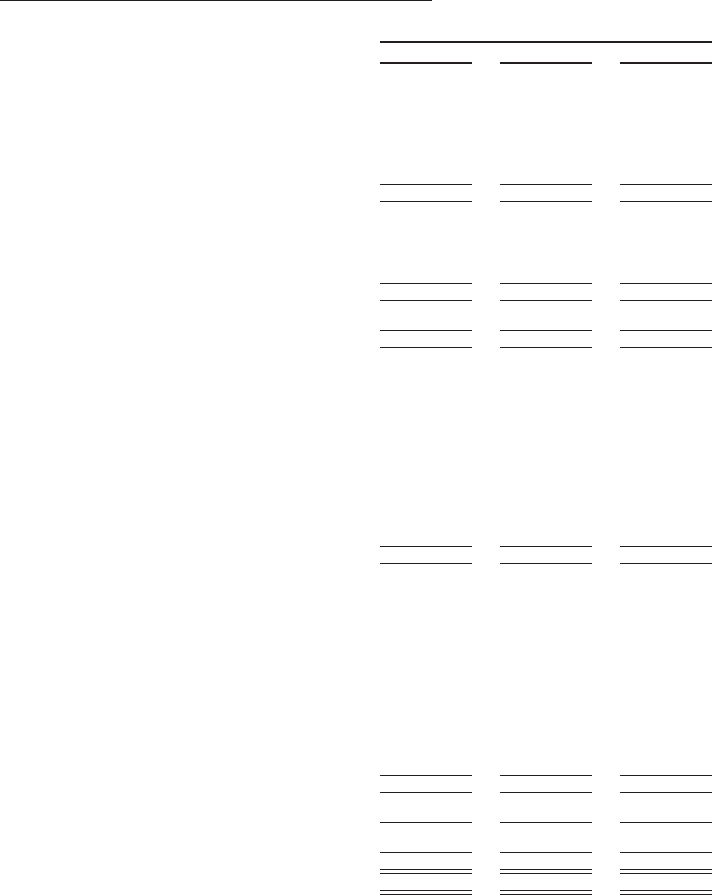

SUNTRUST BANKS, INC.

Consolidated Statements of Income/(Loss)

For the Year Ended December 31

(Dollars and shares in millions, except per share data) 2010 2009 2008

Interest Income

Interest and fees on loans $5,300 $5,530 $6,934

Interest and fees on loans held for sale 137 233 290

Interest and dividends on securities available for sale

Taxable interest 709 717 628

Tax-exempt interest 31 40 44

Dividends176 73 103

Trading account interest 89 115 303

Other interest income 12 26

Total interest income 6,343 6,710 8,328

Interest Expense

Interest on deposits 860 1,440 2,378

Interest on funds purchased and securities sold under agreements to repurchase 68 131

Interest on trading liabilities 30 20 27

Interest on other short-term borrowings 13 15 55

Interest on long-term debt 580 761 1,117

Total interest expense 1,489 2,244 3,708

Net interest income 4,854 4,466 4,620

Provision for credit losses 2,651 4,064 2,474

Net interest income after provision for credit losses 2,203 402 2,146

Noninterest Income

Service charges on deposit accounts 760 848 904

Other charges and fees 534 523 511

Trust and investment management income 503 486 592

Card fees 376 324 308

Mortgage production related income 127 376 171

Mortgage servicing related income/(loss) 358 330 (212)

Investment banking income 313 272 237

Retail investment services 205 218 289

Net securities gains2191 98 1,073

Trading account profits/(losses) and commissions 173 (41) 38

Gain from ownership in Visa -112 86

Net gain on sale of businesses -- 198

Net gain on sale/leaseback of premises --37

Other noninterest income 189 164 241

Total noninterest income 3,729 3,710 4,473

Noninterest Expense

Employee compensation 2,364 2,258 2,327

Employee benefits 457 542 434

Outside processing and software 638 579 493

Net occupancy expense 361 357 347

Other real estate expense 300 244 105

Credit and collection services 279 259 156

Regulatory assessments 265 302 55

Marketing and customer development 177 152 372

Equipment expense 174 172 203

Operating losses 83 99 446

Net loss on debt extinguishment 70 39 12

Amortization/impairment of goodwill/intangible assets 51 807 121

Mortgage reinsurance 27 115 180

Visa litigation -7 (33)

Other noninterest expense 665 630 661

Total noninterest expense 5,911 6,562 5,879

Income/(loss) before provision/(benefit) for income taxes 21 (2,450) 740

Provision/(benefit) for income taxes (185) (898) (67)

Net income/(loss) including income attributable to noncontrolling interest 206 (1,552) 807

Net income attributable to noncontrolling interest 17 12 11

Net income/(loss) $189 ($1,564) $796

Net income/(loss) available to common shareholders ($87) ($1,733) $741

Net income/(loss) per average common share

Diluted3($0.18) ($3.98) $2.12

Basic (0.18) (3.98) 2.12

Dividends declared per common share 0.04 0.22 2.85

Average common shares - diluted 499 437 350

Average common shares - basic 495 435 349

1Includes dividends on common stock of The Coca-Cola Company. $53 $49 $56

2Includes other-than-temporary impairment losses of $2 million and $20 million, consisting of $2 million and $113 million of total unrealized losses, net of $0 and $93 million of non-credit

related unrealized losses recorded in other comprehensive income, before taxes, for the years ended December 31, 2010 and 2009, respectively. Includes other-than-temporary impairment loss

of $84 million for the year ended December 31, 2008.

3For earnings per share calculation purposes, the impact of dilutive securities are excluded from the diluted share count during periods that the Company has recognized a net loss available to

common shareholders because the impact would be anti-dilutive.

See Notes to Consolidated Financial Statements.

90