SunTrust 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BUSINESS SEGMENTS

See Note 22, “Business Segment Reporting,” to the Consolidated Financial Statements for discussion of our segment

structure, basis of presentation and internal management reporting methodologies.

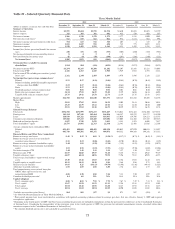

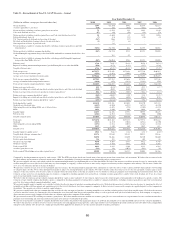

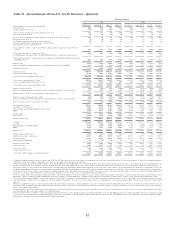

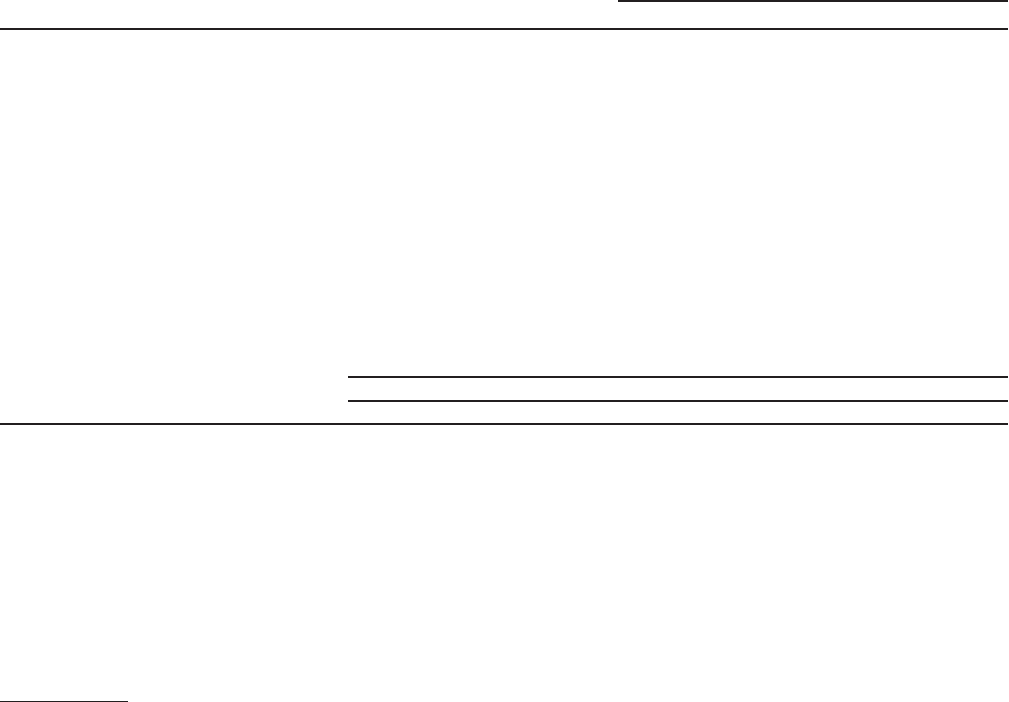

The following table for our reportable business segments compares net income/(loss) for the year ended December 31, 2010

to the same period in 2009 and 2008:

Table 30 – Net Income/(Loss) by Segment

Year Ended December 31

(Dollars in millions) 2010 2009 2008

Retail Banking $156 ($165) $227

Diversified Commercial Banking 197 149 200

CRE (330) (584) 28

CIB 322 116 142

Mortgage (821) (995) (546)

W&IM 180 132 182

Corporate Other and Treasury 444 397 854

Reconciling Items 41 (614) (291)

The following table for our reportable business segments compares average loans and average deposits for the year ended

December 31, 2010 to the same period in 2009 and 2008:

Table 31 – Average Loans and Deposits by Segment

Year Ended December 31

Average Loans Average Consumer and Commercial Deposits

(Dollars in millions) 2010 2009 2008 2010 2009 2008

Retail Banking $33,220 $33,152 $33,777 $74,756 $72,757 $68,088

Diversified Commercial Banking 22,371 24,399 25,064 18,501 17,644 13,497

CRE 9,757 12,507 13,464 1,561 1,888 1,622

CIB 11,225 12,842 13,357 6,617 5,855 5,714

Mortgage 29,043 29,599 31,342 3,135 3,134 2,238

W&IM 8,106 8,351 8,174 11,832 11,184 9,504

Corporate Other and Treasury 251 203 274 848 772 761

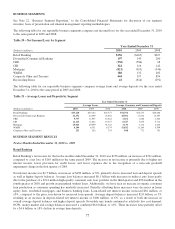

BUSINESS SEGMENT RESULTS

Twelve Months Ended December 31, 2010 vs. 2009

Retail Banking

Retail Banking’s net income for the twelve months ended December 31, 2010 was $156 million, an increase of $321 million,

compared to a net loss of $165 million in the same period 2009. The increase in net income is primarily due to higher net

interest income, lower provision for credit losses, and lower expenses due to the recognition of a non-cash goodwill

impairment charge in the first quarter of 2009.

Net interest income was $2.5 billion, an increase of $189 million, or 8%, primarily due to increased loan and deposit spreads

as well as higher deposit balances. Average loan balances increased $0.1 billion with increases in indirect auto loans partly

due to the purchase of a $741 million high-quality consumer auto loan portfolio in the third quarter and $934 million in the

fourth quarter of 2010 and growth in guaranteed student loans. Additionally, we have seen an increase in organic consumer

loan production as consumer spending has modestly increased. Partially offsetting those increases were decreases in home

equity lines, residential mortgages, and business banking loans. Loan-related net interest income increased $82 million, or

10%, compared to the prior year driven by increased loan spreads. Average deposit balances increased $2.0 billion, or 3%

resulting in an increase in deposit-related net interest income of $100 million, or 6%, as a result of both the increase in

overall average deposit balances and higher deposit spreads. Favorable mix trends continued as relatively low cost demand,

NOW, money market and savings balances increased a combined $6.6 billion, or 14%. These increases were partially offset

by a $4.6 billion, or 18% decline in average time deposits.

77