SunTrust 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our ALCO measures liquidity risks, sets policies to manage these risks, and reviews adherence to those policies at its

monthly meetings. For example, we manage the use of short-term unsecured borrowings as well as total wholesale funding

through policies established and reviewed by ALCO. In addition, the Risk Committee of our Board sets liquidity limits and

reviews current and forecasted liquidity positions at each of its regularly scheduled meetings.

Uses of Funds. Our primary uses of funds include the extension of loans and credit, the purchase of investment securities,

working capital, and debt and capital service. In addition, contingent uses of funds may arise from events such as financial

market disruptions or credit rating downgrades. Factors that affect our credit ratings include, but are not limited to, the credit

risk profile of our assets, the adequacy of our ALLL, earnings, the liquidity profile of both the Bank and the Parent

Company, the economic environment, and the adequacy of our capital base. During 2010, SunTrust received one-notch credit

ratings downgrades from each of the four primary NRSROs (Moody’s, Standard & Poor’s, Fitch and DBRS). The

incremental impact of these downgrades to our daily business operations was immaterial given that our credit ratings

remained investment grade, many peer banks received similar downgrades, our capital ratios remained well above regulatory

standards for being “well-capitalized,” and most of our fundamental credit metrics improved during the course of the year.

As of December 31, 2010, all of the primary NRSROs maintained a “Stable” outlook on our credit ratings. Given the

“Stable” outlooks, additional downgrades are possible although not anticipated; see Part I, Item 1A, “Risk Factors,” for

additional information.

The Bank and the Parent Company borrow in the money markets using instruments such as Fed funds, Eurodollars, and CP.

As of December 31, 2010, the Parent Company had no CP outstanding and the Bank retained a material cash position in the

form of excess reserves in its Federal Reserve account. In the absence of robust loan demand, we have chosen to deploy

some of this excess liquidity to purchase and retire certain high-cost debt securities or other borrowings. During 2010, we

repurchased $2.8 billion of Bank and Parent Company debt securities, including senior and subordinated notes, senior notes

guaranteed under the FDIC’s DGP, and FHLB advances. As of December 31, 2010, the Bank had just $34 million of

outstanding FHLB advances.

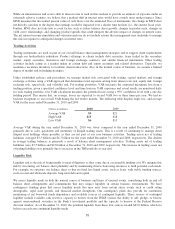

Sources of Funds. Our primary source of funds is a large, stable retail deposit base. Core deposits, primarily gathered from

our retail branch network, are our largest and most cost-effective source of funding. Core deposits totaled $120.0 billion as of

December 31, 2010, up from $116.3 billion as of December 31, 2009. The Bank used core deposit growth to replace some of

the $4.1 billion of term wholesale funding, which matured during the year ended December 31, 2010, bolstering the quality

and depth of the Bank’s already strong liquidity position.

We also maintain access to a diversified collection of wholesale funding sources. These uncommitted sources include Fed

funds purchased from other banks, securities sold under agreements to repurchase, negotiable CDs, offshore deposits, FHLB

advances, Global Bank Notes, and CP. Aggregate wholesale funding totaled $22.9 billion as of December 31, 2010, down

from $28.2 billion as of December 31, 2009. Net short-term unsecured borrowings, which includes wholesale domestic and

foreign deposits and Fed funds purchased, totaled $7.1 billion as of December 31, 2010, down from $8.9 billion as of

December 31, 2009.

We also have access to wholesale liquidity via the capital markets. The Parent Company maintains an SEC shelf registration

statement from which it may issue senior or subordinated notes and various capital securities such as common or preferred

stock. Our Board has authorized the issuance of up to $5.0 billion of such securities. The Bank maintains a Global Bank Note

program under which it may issue senior or subordinated debt with various terms. As of December 31, 2010, the Bank had

capacity to issue $32.1 billion of notes under the Global Bank Note program. Borrowings under these programs are designed

to appeal primarily to domestic and international institutional investors. Institutional investor demand for these securities is

dependent upon numerous factors, including but not limited to our credit ratings and investor perception of financial market

conditions and the health of the banking sector. Our capacity under these programs refers to authorization granted by our

Board, and does not refer to a commitment to purchase by any investor.

Parent Company Liquidity. Our primary measure of Parent Company liquidity is the length of time the Parent Company can

meet its existing obligations using its present cash balance without the support of dividends from the Bank or new debt

issuance. In accordance with risk limits established by ALCO and the Board, we manage the Parent Company’s liquidity by

structuring its maturity schedule to minimize the amount of debt maturing within a short period of time. Approximately $300

million of Parent Company debt matured during the year ended December, 2010 and none is scheduled to mature during

2011. Much of the Parent Company’s liabilities are long-term in nature, coming from the proceeds of our capital securities

and long-term senior and subordinated notes.

60