SunTrust 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

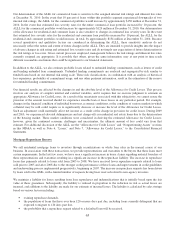

The size of the implied goodwill is significantly affected by the estimated fair value of loans. The estimated fair value of a

loan portfolio is based on an exit price, and the assumptions used are intended to approximate those that a market participant

would use in valuing the loans in an orderly transaction, including a market liquidity discount. Future changes in the fair

value of a reporting unit’s net assets could result in future goodwill impairment. For example, to the extent there are

significant market risk premiums and the fair value of the individual assets of a reporting unit increases at a faster rate than

the fair value of the reporting unit as a whole, that may cause the implied goodwill of a reporting unit to be lower than the

carrying value of goodwill, resulting in goodwill impairment.

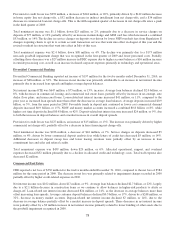

Income Taxes

We are subject to the income tax laws of the various jurisdictions where we conduct business and estimate income tax

expense based on amounts expected to be owed to these various tax jurisdictions. The estimated income tax expense/(benefit)

is reported in the Consolidated Statements of Income/(Loss). The evaluation pertaining to the tax expense and related tax

asset and liability balances involves a high degree of judgment and subjectivity around the ultimate measurement and

resolution of these matters.

Accrued taxes represent the net estimated amount due to or to be received from tax jurisdictions either currently or in the

future and are reported in other liabilities on the Consolidated Balance Sheets. We assess the appropriate tax treatment of

transactions and filing positions after considering statutes, regulations, judicial precedent and other pertinent information and

maintain tax accruals consistent with our evaluation. Changes in the estimate of accrued taxes occur periodically due to

changes in tax rates, interpretations of tax laws, the status of examinations by the tax authorities and newly enacted statutory,

judicial and regulatory guidance that could impact the relative merits of tax positions. These changes, when they occur,

impact accrued taxes and can materially affect our operating results. We regularly evaluate our uncertain tax positions and

estimate the appropriate level of UTBs related to each of these positions.

We regularly evaluate the realizability of deferred tax asset positions. In determining whether a valuation allowance is

necessary, we consider the level of taxable income in prior years to the extent that carrybacks are permitted under current tax

laws, as well as estimates of future pre-tax and taxable income and tax planning strategies that would, if necessary, be

implemented. We currently maintain a valuation allowance associated with deferred tax assets for certain state carryforwards

generated by our subsidiaries. We expect to realize our remaining deferred tax assets over the allowable carryback and/or

carryforward periods. Therefore, no valuation allowance is deemed necessary against our federal or remaining state deferred

tax assets as of December 31, 2010. For additional information, refer to Note 15, “Income Taxes,” to the Consolidated

Financial Statements.

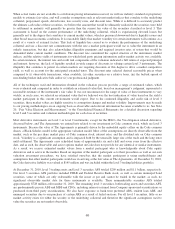

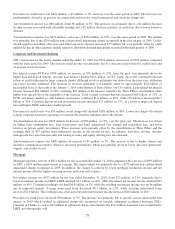

Pension Accounting

Several variables affect the annual variability of cost for our retirement programs. The main variables are: (1) size and

characteristics of the employee population, (2) discount rate, (3) expected long-term rate of return on plan assets,

(4) recognition of actual asset returns, (5) other actuarial assumptions and (6) healthcare cost. Below is a brief description of

these variables and the effect they have on our pension costs.

Size and Characteristics of the Employee Population

Pension cost is directly related to the number of employees covered by the plans, and other factors including salary, age,

years of employment, and benefit terms. Effective January 1, 2008, retirement plan participants who were employed as of

December 31, 2007 ceased to accrue additional benefits under the existing pension benefit formula and their accrued benefits

were frozen. Beginning January 1, 2008, participants who had fewer than 20 years of service and future participants accrue

future pension benefits under a cash balance formula that provides compensation and interest credits to a Personal Pension

Account. Participants with 20 or more years of service as of December 31, 2007 were given the opportunity to choose

between continuing a traditional pension benefit accrual under a reduced formula or participating in the new Personal

Pension Account. See Note 16, “Employee Benefit Plans,” to the Consolidated Financial Statements for plan changes

effective January 1, 2011 that will impact plan assumptions during 2011.

73