SunTrust 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

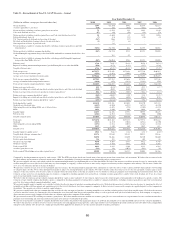

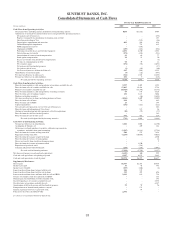

SUNTRUST BANKS, INC.

Consolidated Statements of Cash Flows

For the Year Ended December 31

(Dollars in millions) 2010 2009 2008

Cash Flows from Operating Activities:

Net income/(loss) including income attributable to noncontrolling interest $206 ($1,552) $807

Adjustments to reconcile net income/(loss) to net cash provided by operating activities:

Net gain on sale of businesses -- (198)

Expense recognized on contribution of common stock of Coke -- 183

Gain from ownership in Visa -(112) (86)

Depreciation, amortization and accretion 803 966 824

Goodwill/intangibles impairment -751 415

MSRs impairment recovery -(199) -

Origination of MSRs (289) (682) (486)

Provisions for credit losses and foreclosed property 2,831 4,270 2,552

Deferred income tax benefit (171) (894) (221)

Amortization of restricted stock compensation 42 66 77

Stock option compensation 24 11 20

Excess tax benefits from stock-based compensation -- (5)

Net loss on extinguishment of debt 70 39 12

Net securities gains (191) (98) (1,073)

Net gain on sale/leaseback of premises -- (37)

Net gain on sale of assets (9) (66) (60)

Net decrease/(increase) in loans held for sale 415 (964) 4,192

Contributions to retirement plans (8) (26) (387)

Net (increase)/decrease in other assets (341) 1,523 (2,695)

Net increase/(decrease) in other liabilities 836 9 (218)

Net cash provided by operating activities 4,218 3,042 3,616

Cash Flows from Investing Activities:

Proceeds from maturities, calls and paydowns of securities available for sale 5,597 3,407 1,292

Proceeds from sales of securities available for sale 17,465 19,488 5,738

Purchases of securities available for sale (20,920) (33,793) (8,171)

Proceeds from maturities, calls and paydowns of trading securities 99 148 4,329

Proceeds from sales of trading securities 132 2,113 3,046

Purchases of trading securities -(86) (3,688)

Net (increase)/decrease in loans, including purchases of loans (4,566) 8,609 (5,807)

Proceeds from sales of loans 936 756 882

Proceeds from sale of MSRs 23 - 148

Capital expenditures (252) (212) (222)

Net cash and cash equivalents received for sale of businesses -- 302

Proceeds from sale/redemption of Visa shares -112 86

Contingent consideration and other payments related to acquisitions (10) (25) (27)

Proceeds from the sale/leaseback of premises -- 289

Proceeds from the sale of other assets 777 567 319

Net cash (used in)/provided by investing activities (719) 1,084 (1,484)

Cash Flows from Financing Activities:

Net increase/(decrease) in total deposits 1,182 8,085 (6,150)

Assumption of deposits, net -449 161

Net decrease in funds purchased, securities sold under agreements to

repurchase, and other short-term borrowings (1,295) (4,114) (2,796)

Proceeds from the issuance of long-term debt 500 575 7,834

Repayment of long-term debt (5,246) (10,034) (4,025)

Proceeds from the issuance of preferred stock -- 4,850

Proceeds from the exercise of stock options --26

Excess tax benefits from stock-based compensation --5

Proceeds from the issuance of common stock -1,830 -

Repurchase of preferred stock -(228) -

Common and preferred dividends paid (259) (329) (1,042)

Net cash used in financing activities (5,118) (3,766) (1,137)

Net (decrease)/increase in cash and cash equivalents (1,619) 360 995

Cash and cash equivalents at beginning of period 6,997 6,637 5,642

Cash and cash equivalents at end of period $5,378 $6,997 $6,637

Supplemental Disclosures:

Interest paid $1,537 $2,367 $3,868

Income taxes paid 33 45 341

Income taxes refunded (435) (106) (4)

Loans transferred from loans to loans held for sale 346 125 -

Loans transferred from loans held for sale to loans 213 307 656

Loans transferred from loans and loans held for sale to OREO 1,063 812 754

Issuance of common stock for acquisition of GB&T -- 155

Noncash gain on contribution of Coke common stock -- 183

Unsettled purchases of securities available for sale -- 8,898

Unsettled sales of securities available for sale -- 6,387

Amortization of deferred gain on sale/leaseback of premises 59 59 56

Extinguishment of forward stock purchase contract -174 -

Gain on repurchase of Series A preferred stock -94 -

Total assets of newly consolidated VIEs 2,541 --

See Notes to Consolidated Financial Statements.

93