SunTrust 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

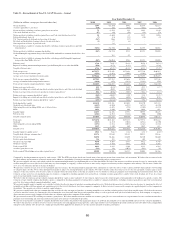

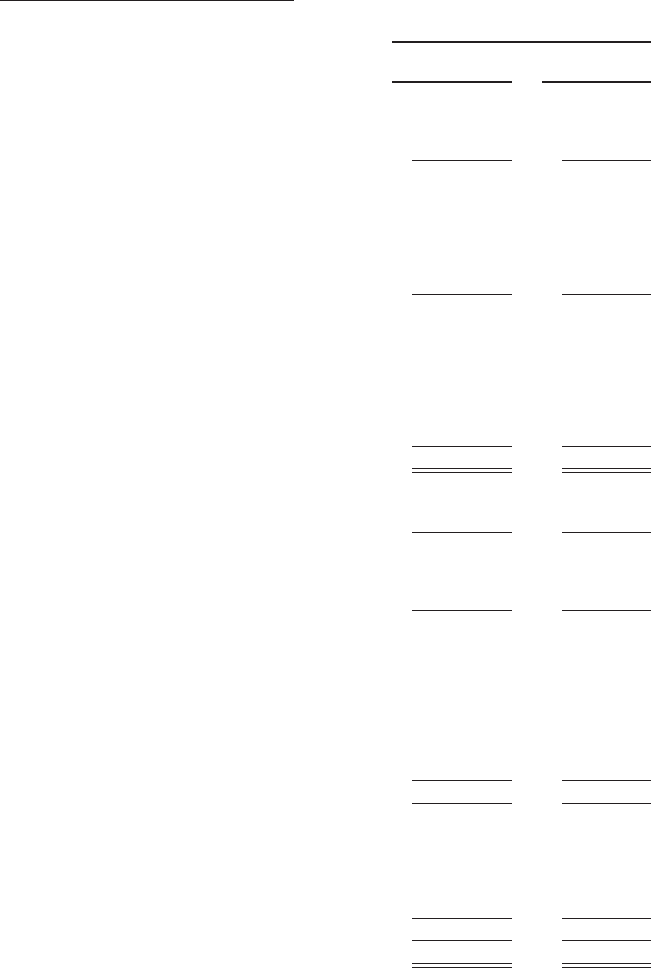

SUNTRUST BANKS, INC.

Consolidated Balance Sheets

As of

(Dollars in millions and shares in thousands)

December 31

2010

December 31

2009

Assets

Cash and due from banks $4,296 $6,456

Interest-bearing deposits in other banks 24 24

Funds sold and securities purchased under agreements to resell 1,058 517

Cash and cash equivalents 5,378 6,997

Trading assets 6,175 4,980

Securities available for sale 26,895 28,477

Loans held for sale 1(loans at fair value: $3,168 as of December 31, 2010; $2,923 as of

December 31, 2009) 3,501 4,670

Loans 2(loans at fair value: $492 as of December 31, 2010; $449 as of December 31, 2009) 115,975 113,675

Allowance for loan and lease losses (2,974) (3,120)

Net loans 113,001 110,555

Premises and equipment 1,620 1,552

Goodwill 6,323 6,319

Other intangible assets (MSRs at fair value: $1,439 as of December 31, 2010; $936 as of

December 31, 2009) 1,571 1,711

Customers’ acceptance liability 86

Other real estate owned 596 620

Other assets 7,806 8,278

Total assets $172,874 $174,165

Liabilities and Shareholders’ Equity

Noninterest-bearing consumer and commercial deposits $27,290 $24,244

Interest-bearing consumer and commercial deposits 92,735 92,059

Total consumer and commercial deposits 120,025 116,303

Brokered deposits (CDs at fair value: $1,213 as of December 31, 2010; $1,261 as of

December 31, 2009) 2,365 4,231

Foreign deposits 654 1,329

Total deposits 123,044 121,863

Funds purchased 951 1,433

Securities sold under agreements to repurchase 2,180 1,871

Other short-term borrowings 2,690 2,062

Long-term debt 3(debt at fair value: $2,837 as of December 31, 2010; $3,586 as of

December 31, 2009) 13,648 17,490

Acceptances outstanding 86

Trading liabilities 2,678 2,189

Other liabilities 4,545 4,720

Total liabilities 149,744 151,634

Preferred stock 4,942 4,917

Common stock, $1.00 par value 515 515

Additional paid in capital 8,403 8,521

Retained earnings 8,542 8,563

Treasury stock, at cost, and other (888) (1,055)

Accumulated other comprehensive income 1,616 1,070

Total shareholders’ equity 23,130 22,531

Total liabilities and shareholders’ equity $172,874 $174,165

Common shares outstanding 500,436 499,157

Common shares authorized 750,000 750,000

Preferred shares outstanding 50 50

Preferred shares authorized 50,000 50,000

Treasury shares of common stock 14,231 15,510

1Includes loans held for sale, at fair value, of consolidated VIEs $316 $-

2Includes loans of consolidated VIEs 2,869 -

3Includes debt of consolidated VIEs 764 -

See Notes to Consolidated Financial Statements.

91