SunTrust 2010 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

Note 9 - Goodwill and Other Intangible Assets

Goodwill is required to be tested for impairment on an annual basis or as events occur or circumstances change that would more

likely than not reduce the fair value of a reporting unit below its carrying amount. In 2009 and the first quarter of 2010, the

Company’s reporting units were comprised of Retail, Commercial, CRE, Household Lending, CIB, W&IM, and Affordable

Housing. Effective in the second quarter of 2010, the Company reorganized its management and segment reporting structure.

See Note 22, “Business Segment Reporting,” to the Consolidated Financial Statements for further discussion of the Company’s

reorganization and segment changes. The change in segments impacted certain reporting units as follows:

•The Retail reporting unit was renamed Branch Banking; however, the composition of the reporting unit did not

change. Branch Banking is a component of the Retail Banking reportable segment.

•Portions of the CIB reporting unit were transferred to the Commercial reporting unit, resulting in the allocation of

approximately $43 million in goodwill from CIB to Commercial. As a result of the transfer, the Commercial

reporting unit was renamed Diversified Commercial Banking.

As of December 31, 2010, the Company’s reporting units with goodwill balances were Branch Banking, Diversified

Commercial Banking, CIB, and W&IM. The Company completed its 2010 annual impairment review of goodwill as of

September 30, 2010. The estimated fair value of each reporting unit as of September 30, 2010 exceeded its respective

carrying value; therefore, the Company determined there was no impairment of goodwill.

Due to the continued recessionary environment and sustained deterioration in the economy during the first quarter of 2009,

the Company performed a complete goodwill impairment analysis for all of its reporting units at that time. The estimated fair

value of the Retail, Commercial, and W&IM reporting units exceeded their respective carrying values as of March 31, 2009;

however, the fair value of the Household Lending, CIB, CRE (included in Retail and Commercial segment), and Affordable

Housing (included in Retail and Commercial segment) reporting units were less than their respective carrying values. The

implied fair value of goodwill of the CIB reporting unit exceeded the carrying value of the goodwill, thus no goodwill

impairment was recorded for this reporting unit. However, the implied fair value of goodwill applicable to the Household

Lending, CRE, and Affordable Housing reporting units was less than the carrying value of the goodwill. As of March 31,

2009, an impairment loss of $751 million was recorded, which was the entire amount of goodwill carried by each of those

reporting units. $677 million of the goodwill impairment charge was non-deductible for tax purposes. The goodwill

impairment charge was a direct result of the deterioration in the real estate markets and macro economic conditions that put

downward pressure on the fair value of these businesses during the first quarter of 2009. The primary factor contributing to

the impairment recognition was further deterioration in the actual and projected financial performance of these reporting

units, as evidenced by the increase in net charge-offs and NPLs. The decline in fair value of these reporting units was

significantly influenced by the economic downturn, which resulted in depressed earnings in these businesses and the

significant decline in the Company’s market capitalization during the first quarter of 2009.

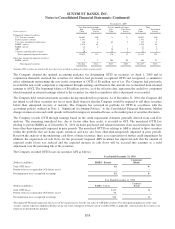

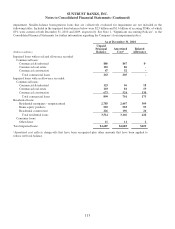

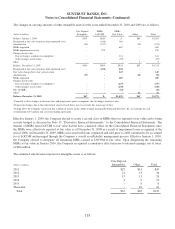

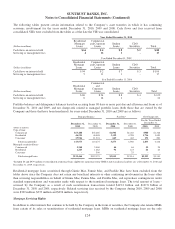

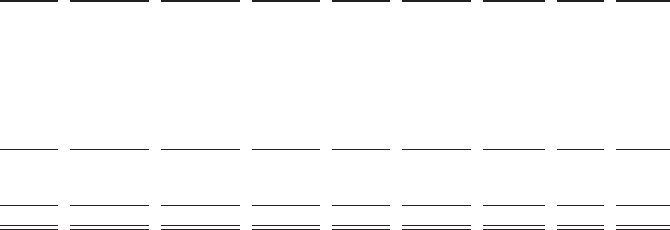

The changes in the carrying amount of goodwill by reportable segment for the years ended December 31, 2010 and 2009 are

as follows:

(Dollars in millions)

Retail

Banking

Diversified

Commercial

Banking

Retail &

Commercial Wholesale CIB

Household

Lending Mortgage W&IM Total

Balance, January 1, 2009 $- $- $5,912 $523 $- $- $278 $331 $7,044

Intersegment transfers 1- - 126 (523) 223 452 (278) - -

Goodwill impairment - - (299) - - (452) - - (751)

Seix contingent consideration - - - - - - - 13 13

Acquisition of Epic Advisors, Inc. - - - - - - - 5 5

TBK contingent consideration - - - - - - - 3 3

Inlign contingent consideration - - - - - - - 2 2

Purchase price adjustments - - - - - - - 1 1

Other - - - - - - - 2 2

Balance, December 31, 2009 $- $- $5,739 $- $223 $- $- $357 $6,319

Intersegment transfers 14,854 928 (5,739) - (43) - - - -

Inlign contingent consideration - - - --- -44

Balance, December 31, 2010 $4,854 $928 $- $- $180 $- $- $361 $6,323

1Goodwill was reallocated among the reportable segments in 2010 and 2009 as a result of the corporate restructurings described in Note 22, “Business Segment Reporting,” to the Consolidated Financial

Statements.

117