SunTrust 2010 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2010 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

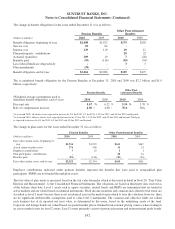

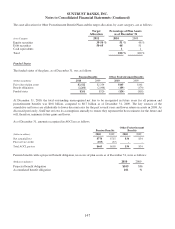

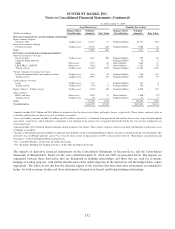

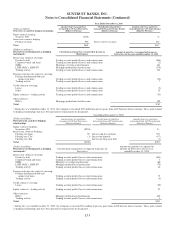

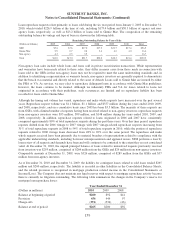

The tables below present the Company’s derivative positions at December 31, 2010 and 2009. The notional amounts in the

tables are presented on a gross basis and have been classified within Asset Derivatives or Liability Derivatives based on the

estimated fair value of the individual contract at December 31, 2010 and 2009. On the Consolidated Balance Sheets, the fair

values of derivatives with counterparties with master netting agreements are recorded on a net basis. However, for purposes

of the table below, the gross positive and gross negative fair value amounts associated with the respective notional amounts

are presented without consideration of any netting agreements. For contracts constituting a combination of options that

contain a written option and a purchased option (such as a collar), the notional amount of each option is presented separately,

with the purchased notional amount being presented as an Asset Derivative and the written notional amount being presented

as a Liability Derivative. The fair value of a combination of options is presented as a single value with the purchased notional

amount if the combined fair value is positive, and with the written notional amount, if the combined fair value is negative.

(Dollars in millions)

As of December 31, 2010

Asset Derivatives Liability Derivatives

Balance Sheet

Classification

Notional

Amounts Fair Value

Balance Sheet

Classification

Notional

Amounts Fair Value

Derivatives designated in cash flow hedging relationships 5

Equity contracts hedging:

Securities AFS Trading assets $1,547 $- Trading liabilities $1,547 $145

Interest rate contracts hedging:

Floating rate loans Trading assets 15,350 947 Trading liabilities 500 10

Total 16,897 947 2,047 155

Derivatives not designated as hedging instruments 6

Interest rate contracts covering:

Fixed rate debt Trading assets 1,273 41 Trading liabilities 60 4

Corporate bonds and loans - - Trading liabilities 5 -

MSRs Other assets 20,474 152 Other liabilities 6,480 73

LHFS, IRLCs, LHFI-FV Other assets 7,269 392 Other liabilities 2,383 20

Trading activity Trading assets 132,286 14,211 Trading liabilities 105,926 3,884

Foreign exchange rate contracts covering:

Foreign-denominated debt and commercial loans Trading assets 1,083 17 Trading liabilities 495 128

Trading activity Trading assets 2,691 92 Trading liabilities 2,818 91

Credit contracts covering:

Loans Trading assets 15 - Trading liabilities 227 2

Trading activity Trading assets 1,094 239 Trading liabilities 1,039 234

Equity contracts - Trading activity Trading assets 5,010 1583 Trading liabilities 8,012 730

Other contracts:

IRLCs and other Other assets 2,169 18 Other liabilities 2,196 442 4

Trading activity Trading assets 111 11 Trading liabilities 111 11

Total 173,475 5,256 129,752 5,019

Total derivatives $190,372 $6,203 $131,799 $5,174

1Amounts include $25.0 billion and $0.5 billion of notional related to interest rate futures and equity futures, respectively. These futures contracts settle in

cash daily and therefore no derivative asset or liability is recorded.

2Asset and liability amounts include $1 million and $8 million, respectively, of notional from purchased and written interest rate swap risk participation

agreements, respectively, which notional is calculated as the notional of the interest rate swap participated adjusted by the relevant risk weighted assets

conversion factor.

3Amount includes $1.4 billion of notional amounts related to interest rate futures. These futures contracts settle in cash daily and therefore no derivative

asset or liability is recorded.

4Includes a $23 million derivative liability recorded in other liabilities in the Consolidated Balance Sheets, related to a notional amount of $134 million. This

derivative was established upon the sale of Visa Class B shares in the second quarter of 2009 as discussed in Note 18, “Reinsurance Arrangements and

Guarantees,” to the Consolidated Financial Statements.

5See “Cash Flow Hedges” in this Note for further discussion.

6See “Economic Hedging and Trading Activities” in this Note for further discussion.

151